IFR ASIA: Good afternoon and welcome to the IFR Green and Sustainable Financing Roundtable. I’ll start with Sean for an overview, where is ESG bond issuance coming from in Asia Pacific?

Sean Henderson, HSBC: Thank you. The Asian green bond market probably started a little slower than everyone expected. It was talked about in very excited terms a few years ago when everybody thought that it would explode into a brand new market all on its own very, very quickly. I think what we have found is what you need for this market to really take off is for the investor behaviour to change.

I think that took a little bit longer than expected. There have been a few investors like Amundi here, for example, who have been leading lights, but a vast amount of Asian investors two or three years ago probably didn’t really fully appreciate what it meant to buy a green loan or a green bond.

When we did the first green bond for the Republic of Indonesia, most people were asking what it meant and how is it priced. There were a huge amount of questions around it.

What we’ve seen in the last year or so is as that awareness has grown exponentially. A significant amount of issuance has resulted, because issuers are actually finding that it makes a difference to the quality of the order book and the differentiation of their investor base.

The easiest sectors to issue green bonds are those with a clear and measurable environmental impact, like the renewable energy companies. You’ve got the likes of Renew Power, Azure and Greenko out of India, for example, and AC Energy from the Philippines. Then you’ve also got a wide range of banks with clear ESG policies and portfolios of green loans to finance, hence the banking sector has been a very big source of issuance, with the likes of Westpac, MUFG, KDB, ICBC, etc, all issuing in green or sustainability format.

Another obvious area of growth has been the property sector. It’s quite easy to identify the green impact of a building because many new buildings are independently rated by organisations such as BCA’s Green Mark rating in Singapore, or LEED or Green Star in Australia. As a sector it tends to be quite heavily covered in terms of the quality and the environmental impact of each building. So the property sector has been quite busy, with Modern Land, New World and others issuing bonds, and a bunch of loans have recently been issued from the property sector in Singapore as well.

Then of course from the government issuance side, that’s been quite key as governments typically have very clear policy objectives that align with improving their citizens’ quality of life and ESG factors. You’ve had the Hong Kong government, the Republic of Indonesia and then you’ve also had transport companies like MTR and the like.

So actually it’s broadened quite quickly across Asia and certainly we’re very encouraged by that because I think it shows a greater awareness across a much wider range of industries than we saw three or four years ago and obviously opens a scope for very significant amount of issuance going forward.

IFR ASIA: Cedric, are you encouraged as well by what you’ve seen in ASEAN in terms of ESG bonds recently?

Cedric Rimaud, CBI: Yes, definitely. I mean we see a lot of initiatives by governments, regulators, central banks in the region to consider these issues. We have some countries that are designing domestic guidelines like in the case of Indonesia. Even though they are not strictly in line with the ASEAN green bond principles, they do offer some guidance for issuers.

Looking at some other countries, Thailand is taking a more hands-off approach and letting the markets decide by itself. We’ve seen some recent issues in Thailand like the BTS group bond that was very well received by the market locally. That’s very encouraging for local transportation, which is a major issue in terms of infrastructure financing for the region.

The good thing is that there’s a lot of capital waiting out there to be invested as well; when we hear of the order books for offshore issuers in Europe and other places, we see some very strong appetite. We hear of investors that may not be directly willing to invest, for example in Indonesia, like the Japanese investors, maybe because of credit constraints, but if they see some green opportunities, they may be actually willing to put capital to work.

We had the largest pension fund from Japan with a very strong mandate to invest in green and sustainable bonds as well. So that’s very encouraging I think.

IFR ASIA: On the loan side, Andrew, where do you see demand for green sustainable loans coming from in Asia at the moment? Is it the same kind of story, coming from property and sectors like that, or are there any others?

Andrew Ashman, Barclays: Yes, similar to Sean’s comments, the renewable sector has been very active. There are some sizable capex requirements in that sector that fit well with the green loan use of proceeds. We’ve also done a lot of work in the real estate sector. A good example is Frasers Property, which is now one of the biggest issuers of green loans in the region.

The commodity sector has also been active. Olam is another of the leading issuers into the green loan market using the product to capitalise on their good work in ESG.

Overall we have seen activity across a diverse range of sectors. In terms of geographic hot spots, I am really pleased to see Singapore is emerging as a leading centre of green finance. Again, that is driven by the dominance of the real estate sector and the commodity traders. We’re also starting to see green loans coming out of Australia, India and even some of the emerging markets like Indonesia as well.

IFR ASIA: Eric, are there any particular government initiatives that are driving ESG investment and issuance or any regulatory moves elsewhere?

Eric Bramoulle, Amundi: Maybe I can say a few words about the French initiatives as I am a French citizen. Ahead of COP21 we had article 173, which was a push on disclosure for investors, especially institutional ones, on what are the policies for climate-related risks.

This was the first attempt from a European government to push forward the initiatives on that. Of course, the result is you have companies who are not reporting anything and now it’s public. Everyone knows who are, let’s say, the good players. This is definitely favouring the issuance of green bonds.

IFC was the first one and then the European Investment Bank, which is an arm of the European Central Bank, formed a partnership with us last summer in order to invest in green securitised debt, private debt and high yield corporate bonds.

IFR ASIA: Jane, as an issuer in multiple currencies, are there any parts of Asia where there’s particularly strong investor demand for green or sustainable bonds that you see are particularly in the local currency?

Jane Yuan Xu, IFC: By now, we have recorded US$10bn of issuance for our own green bonds. Last year, we issued US$1.6bn in value of green bonds in 11 currencies, and particularly in East Asia. If I look at IFC’s own investment, 49% of investment was in East Asia & the Pacific, which in the last fiscal year in June was in climate-related businesses.

We do see higher demand to issue more local currency green bonds in various markets. Some companies now are doing really well, but they don’t want to take foreign exchange risk because they don’t have revenue in foreign currency. The initiative among the ASEAN countries on the ASEAN green bond principles is very helpful particularly. I know a lot of commercial banks are thinking of going to the market to issue local currency green bonds.

IFR ASIA: Are there any parts of Asia where you think perhaps demand is held back a little bit or are there any factors that could constrain demand?

Jane Yuan Xu, IFC: I think the parts of Asia that are a bit slower tend to be the ones that are less developed, while for most middle-income countries I see very strong demand going forward. Again this also goes up to the government level. IFC has been working with central banks on sustainable banking in the region, particularly in Indonesia, Mongolia, China and now with the Philippines government, they might come up with some new policies to encourage banks to underwrite more sustainable/climate assets.

Cedric Rimaud, CBI: I think this question of local currency versus foreign currency bonds is quite interesting because, in general, countries want to see more local bonds being issued, because of the Asian crisis that brought this mismatch between foreign capital and local liabilities. The problem is that the capital that is available is often in foreign currency, in dollars or euros. To hedge a long-dated project is quite challenging in some markets, and in others it is relatively easy because of the ability to fund locally given the credit rating in the country.

What this market really needs is to find some new ways of hedging those risks, the long-dated foreign exchange exposure that investors or borrowers may be taking on.

Two weeks ago, the Climate Bonds Initiative organised an event in Jakarta at the Indonesian stock exchange with the TCX Fund, which is based in Amsterdam and is providing this kind of hedging solutions. Still, we feel that it’s relatively early days and I think this market really needs these kinds of products to be able to grow.

I don’t know if the bankers here have a view on that, but I think that’s quite important.

Sean Henderson, HSBC: I think it’s a fair point because if you look at project bonds, it’s one of the things that’s seen relatively slow development in Asia. While underlying revenues are often denominated in local currency, the capital market investor base for project bonds is probably deepest in US dollars. Then when you think about the investment required to move to a more sustainable economy, a lot of those infrastructure projects are going to be generating local currency revenues.

I think it is an important point that the development of the local bond markets and the development of green finance in these local markets is going to be important to helping build that infrastructure.

I don’t think these markets are necessarily that far behind, however. I think the dollar bond markets have perhaps developed first, but I think that many of the largest global investors that have been buying these bonds in G3 also have a large presence in many of these local currencies sites, and so I expect demand for green bonds will spread quite quickly into local currencies once it’s well developed within Asia.

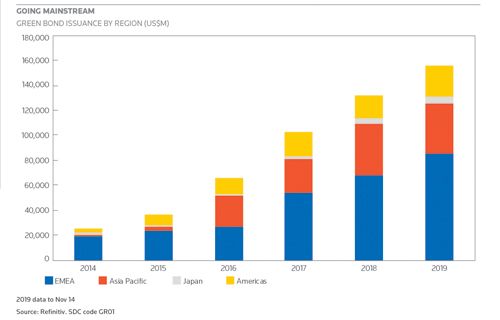

Eric Bramoulle, Amundi: I just want to talk about the signs of the market at the moment. Three years ago, the total stock of green bonds in ASEAN was about US$200m. In May this year it was US$7.5bn, spread over mainly Singapore, Indonesia but also Thailand. We see the market has finally reached a significant step.

IFR ASIA: Let’s talk to our two Singapore based issuers who’ve been leading the way in ESG finance. Jayant, why did Olam decide to take a sustainability-linked loan last year and what kind of work went into that?

Jayant Parande, Olam: Taking a step back, the sustainability-linked loan came at a much later stage for us. Just as a very brief background, we are a global agri business, headquartered in Singapore, with operations in over 60 countries globally, several of them in emerging markets. One of the first things we had to do was to make sure that we have a sustainable supply chain while setting up the business model. We’ve been in business for 30 years and that is how we started off – having sustainability at the heart and the core of our business.

Until recently the debt portfolio – though very diversified, continued to focus on conventional bilateral bank facilities, syndicated loans, revolving credit facilities and then bond issuances and private placements.

Over the last few years, we have been engaging with banks as well as multilateral financial institutions who had a lot of interest in supporting sustainability-linked financing. I guess it’s something which was inevitable, as we already had a sustainability framework in place, and a business model which was aligned to sustainable financing structures.

Sustainability-linked financing is closely aligned to our core purpose of re-imagining global agriculture and food systems, so it was almost a natural addition to our already diversified debt portfolio. That’s when we initiated discussions with just a couple of banks initially, and with significant interest and support from our relationship banks, we enhanced the facility-size to half a billion US dollars with 15 banks joining the bank group. This was Asia’s first sustainability-linked club loan, where we get an interest-rate reduction for improving on our ESG ratings.

We followed that up very recently with another one – a sustainability-KPI linked loan of US$525m.

IFR ASIA: I guess you’ve got all the reporting in place already and it’s less of an arduous task when you need that to confirm that you’re sustainable enough to do the loan.

Jayant Parande, Olam: For an agri business with operations in over 60 countries it’s a challenge to have everything in place that you need. Yes, having a business model which has sustainability at the heart of the business makes a big difference. We had already voluntarily initiated a comprehensive annual sustainability report a few years back and continue to do so, so we already had that in place. We then had to work with the banks to create a financing framework around it, which we worked on.

Sean Henderson, HSBC: If I can just add a quick comment, I think it makes a huge difference when you’ve got a corporate culture that’s already built around sustainability. I think it was a natural step for Olam to do a sustainability linked loan, but I think it is also encouraging as it shows the topic of sustainability is not just applicable to renewable energy companies. It’s actually impacting every industry, whether it’s from how industries will need to adapt to climate change, through to the sustainability of their business practices. Olam’s framework links to a very broad framework and measure of sustainability which I think was very attractive for a lot of the banks.

I think it also helps that the banks are really thinking very progressively around how they deploy their balance sheets. HSBC’s got a commitment to put US$100bn into sustainability-linked financing by 2025, so with a relative lack of corporate issuance and loans sitting out there at the moment, obviously it’s a very attractive opportunity for the bank to see somebody like Olam coming to the market.

I think that is critical for both sides to be working at developing this market, but certainly we think that it’s a huge step forward to see an increase in the diversity of sectors and issuers thinking progressively around sustainability, not just the obvious renewable energy type of candidates.

IFR ASIA: Mike, what kind of decision process went into deciding to issue green loans and also around the flavour of loans, given that there are so many different kinds of ESG financing?

Mike Tan, Frasers: I guess for us we’re similar to Olam: sustainability and being green is part of our DNA. We’ve been doing that for many, many years. When we saw the APLMA guidelines come out for the green loan principles in March 2018, we adopted it as quickly as possible and we worked with a couple of key banks and tried to roll that out. It’s hard as Jayant mentioned to manage a business that is global. We are in over 20 countries, we have so many different product lines and we have over S$33bn of assets globally. Inevitably in construction you use a lot of fuel that releases CO2. We run a very big hospitality business in over 70 cities and all these rooms will have plastic bottles with mineral water. We are actually moving away from that and having water dispensers in each room.

So the journey is quite long, but this is part of our DNA. In the last 12 months I think we’ve done about five green loans and about S$3.3bn in total. We actually have two different kinds of green loans. One of them is a pure project green loan which is linked to BCA. We have an easier time compared to Olam because BCA has clear criteria. They have green mark certification standards such as gold plus, platinum for us, so we can just adopt that. These standards are renewed every three years by BCA.

The more difficult one is the GRESB, the Global Real Estate Sustainability Benchmark, which we have two loans linked to. That’s harder because it’s a ranking, so we are actually ranked together with all the property developers or asset managers globally. Then you get a rating from there.

Right now our Aussie subsidiary, Frasers Property Australia is has GRESB 5*(ranked 1 globally) for residential developers in 2018. They are targeting to be carbon neutral by 2028. It’s a moving target so if you have the next guy who is a lot more sustainable, a lot more green than you, then you get pushed down further.

IFR ASIA: Mike, what kind of feedback have you had from investors?

Mike Tan, Frasers: I think generally the investors are open and they’re supportive, especially the younger investors. As far as banks are concerned we find that European banks are very helpful and key, but the Asian banks seem to care more about spreads and credit rather than how green we are. This could be partly due to the way they are measured by their shareholders and the way the central banks measure them in terms of their credit and their liquidity with their customers.

Andrew Ashman, Barclays: To build on Mike’s point, we are starting to see more Asian banks publish green lending targets. Taiwanese, Singaporean and Japanese banks are starting to announce sustainable finance polices and targets. Over time those targets will help drive the green loan market – more of those investors will establish dedicated green lending portfolios which drive liquidity in this market.

By bookrunning a green loan syndication, you get a sense over time that there is growing support from the banks across the region.

Mike Tan, Frasers: I think across the club loans and the syndications we’ve done, we probably brought in 20 new banks who have never done a green loan before, but it was a hard process educating them. We’ve seen a lot of our partner banks who have followed us to do the first green loan starting to roll that out with their own customers in Singapore. So you will see more and more green loans using the BCA agreement, for example.

IFR ASIA: Jayant, have you had a good response from investors and what kind of impact has it had knowing that you’re meeting the sustainability target?

Jayant Parande, Olam: Yes, it’s certainly been an incredible support from banks in terms of wanting to do more such sustainability-linked loans. In fact, after we closed and announced the first transaction, we had enquiries from banks to see what more they could do in this space. There is already a significant awareness and an intent to do more.

On the matter of banks being concerned about pricing spreads, I guess it’s important at some point of time for regulators to allow a lower risk-weighting for green and sustainable financing, which is one of the ways where banks can pass it on to customers as well.

As of now I don’t think that kind of framework is in place, but that’s probably what we would look forward to going ahead.

IFR ASIA: Over to you then, Andrew, because if green loans are cheaper for issuers then that’s coming out of the banks’ bottom line. I guess they need some help from regulators.

Andrew Ashman, Barclays: That’s absolutely right. The funding cost of a green loan is the same as the funding cost of a traditional loan. So banks are having to bear the cost of any pricing discounts that are offered on a green loan. I agree with Jayant that if the regulators offered some kind of capital relief on green lending or a withholding tax waiver it would really promote the green loan product across the region.

Mike Tan, Frasers: I think this could be partly due to a generational view. A lot of the central bankers and regulators are our age. If you had a couple of millennials like Greta Thunberg, for example, it would have been different. The issue is that they’re looking at things from a credit and liquidity perspective, and just because the bank lends a green loan it doesn’t mean that the customer has much better credit quality. We’re in it for the long game, we are in it for climate change, we are in it for our children’s generation.

So in the long game being green is important, in the short game, maybe not. I think that’s something that we should think about.

Jane Yuan Xu, IFC: If I may add, I want to comment on why the developing countries’ banks are acting slower, because we have been working extensively with commercial banks that are in several different countries. Essentially it’s really down to the policy direction or the strategy of the banks’ shareholders. The overall understanding about green finance is still evolving.

A lot of people start with a typical view that it is all about renewable energy. However, we see there is huge potential going to green property, going to climate-smart agri businesses or going to climate-resilient infrastructure.

That is actually what IFC has been trying to do. We have an advisory service working with the regulators, getting them to understand the credit profile and economic benefits of different types of products. They will see the risk and the benefit and also we’re working with the banks. Showing them the cases, teaching them about how you underwrite a green project. It doesn’t mean just because it’s green then it will not become a non-performing loan. There is a technical aspect you have to understand and then you can build that into your credit underwriting process.

I think it’s really about the dialogue from the industry sharing with the regulators. If you lend to those kinds of clients, taking a proactive approach to go greener and more sustainable, this is creating a better climate down the road and lower credit loss.

Eric Bramoulle, Amundi: I think on top of it you can add that apart from the cost you have the increase in value of the project itself. Today someone who wants to create a building that is green can expect a better value in 10 years because people see value in the green project.

IFR ASIA: Eric, looking at it the other way, are asset managers putting more pressure on polluting industries?

Eric Bramoulle, Amundi: Yes, we are. We do different initiatives, but the main one has been the Climate 100 initiative where we have more than 300 international investors. The idea was to coordinate action in order to talk to the top 100 polluters in the world. They are generating two thirds of the industrial polluting emissions in the world. We are better together than alone, this is the message.

So, this is now coordinated. On the other side we have taken a major step because we want by 2021 to have all our funds rated by ESG criteria, and to vote according to ESG criteria in shareholder votes. So we put more and more pressure on not only issuers but also corporates on the equity side.

IFR ASIA: Jane, what about IFC, are there any particular quotas for ESG investment?

Jane Yuan Xu, IFC: IFC has environmental and social performance standards, so basically for any investment they make, whether it’s equity or lending facility or risk assuring facility, we’re expecting the company to work with us, agree to our performance standards and also agree on the roadmap to build an internal system to reach a particular target for the relevant industry.

Other than that, in our global portfolio we have a target that 28% of our IFC investment has to be climate-related. In the last fiscal year in June, IFC corporate reached 29%, so they were two years ahead of their target.

To see the digital version of this roundtable, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com