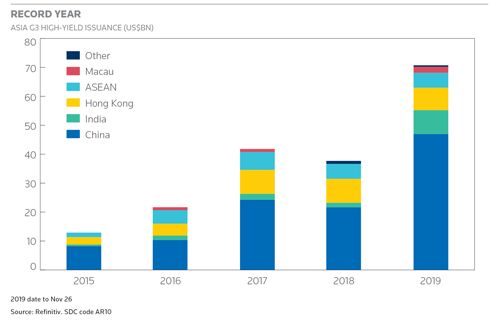

IFR ASIA: Welcome. 2019’s been a landmark year for Asian high-yield bonds. We’ve already beaten the 2017 all-time record and we’ve still got two months of the year to go! Let’s start off by asking everybody, what’s the reason that it’s been such a boom year. Dan, do you want to go first?

Daniel Kim, HSBC: Sure. Obviously, there have been a lot of different numbers flying around, but I think 2018 was a slower year. Obviously, market conditions weren’t as conducive as they were versus 2017. Volume-wise, we were about 30% down year on year, from 2017 versus 2018, therefore, we obviously had a lot of pent-up demand from the issuer side. So, we saw all of that start to come out in January.

We also saw positive market conditions. Some of that is related to the change in the FOMC rate stance, which has been one of the key drivers in bringing the current market volume that we’ve seen this year.

Adrian Cheng, Fitch: From my perspective, I think it’s really driven from refinancing needs from Chinese property developers, so we have seen a lot of high-yield issuance from mainland developers. How do we see it going forward? I think there’s still quite a significant refinancing need from now until the end of 2020, by our calculations – an offshore refinancing need of above US$32bn. Now, this is based on public figures. It may not be accurate, but it’s still a significant amount.

So, going forward, I think there’s still a need from developers. We can talk a little bit later about how the NDRC is controlling that, but I think the demand is still pretty strong this year, and maybe next year, the new NDRC rule will start having an effect.

Zhang Hongbao, BOC: I agree with Daniel and Adrian. I think, from the supply side, the refinancing demand is really increasing. Also, the demand in 2019 is a different story from 2018. 2018 was a challenging year for HY bond issuers, due to Fed rate hikes, trade conflict, uncertainty of global economic growth, and frequent credit risk events. However, this year, as global liquidity improved, we have witnessed market sentiment recovering stronger than the previous year. Some major central banks are cutting their rates, which has led to a looser liquidity environment. Meanwhile the PBoC has announced several policies to increase onshore liquidity. As a result, financial institutions have more cash on hand and may be more willing to spend it.

Also, we have noticed a tendency for investment-grade issuance to slow down. Some of our regular issuers have decided to not issue this year, and so some of our investors have shifted their attention from chasing higher-grade credits to higher yields.

China’s deleveraging policy has been relaxed. To a certain extent, this alleviates the burden on the weaker local government financing vehicles, real estate companies and some private sector firms in the onshore market. Credit risk has become lower, and investors have refocused on the high-yield bond market.

Monica Hsiao, Triada: To add to that, on the demand side we definitely saw a lot of fear last year, especially going into the summer. The deleveraging policies in China caused onshore yields to spike, which cooled off a lot of appetite for risk. China stabilised onshore funding costs once they turned toward easing but it was really when the Fed signalled their intention to ease that the whole rate environment changed to spur credit fund inflows.

This year, we have seen a lot of corporates front-load their new issuances to pre-fund their needs, and I think part of that was due to the uncertainty that some of the issuers faced from the NDRC side last year, not knowing how strict they would be about approving quotas or limiting the use of bond proceeds to immediate refinancing purposes. So, I think the minute the window opened this year in the first half, there was a big rush of pent-up supply coming out.

Between now and the end of next year, we expect another US$50bn-plus of high-yield redemptions to come, so I would expect a continued pipeline of new bond supply. We have to remember that tracking what we see in the liquid markets is only part of the story; in recent years there have been a slew of private placements, especially last year when the markets were tougher for public deals to get done. This means that for corporates, they still can access different refinancing channels.

IFR Asia: Thank you. Bank of China and HSBC are at the heart of so many of these high-yield deals, so, Hongbao, how has the investor demand changed this year? Are Chinese investors still driving the big increase in Asian high-yield issuance?

Zhang Hongbao, BOC: Yes, that’s right. For the high-yield bond sector, I notice there are some new investors coming to buy the Chinese names. In our previous transactions, several high-quality bond issuers and banks have issued their first offshore bond, and the amounts of their issuances are really significant. Also, as I just said, in the first half of this year, some of the IG issuers didn’t come to the market, so a lot of investors turned to new mandates in the high-yield industry, especially to the real estate sector. Surprisingly, we also see interest from all over Asia and even from European countries.

IFR Asia: And Dan, have you seen the picture of investor demand change?

Daniel Kim, HSBC: Definitely. We are seeing a lot more newer names, especially from the China space, in terms of investors. They are a material source of investor demand for a lot of the Chinese high-yield transactions. That said, I still think a lot of the driving force for more of the publicly executed transactions are probably the international players, such as the global funds that are based in Hong Kong or Singapore. We’re increasingly seeing them becoming more active in Chinese high-yield than previously.

Monica Hsiao, Triada: Actually, to add a different perspective as a hedge fund from the marketing side, we are seeing a lot more reverse enquiries from US institutionals who are telling us that there just is not that much value left anymore in the US credit markets given the current yields. More US allocators are now looking at Asian credit markets, as a stand-alone market and not only as a sub-strategy of EM debt markets. And as a result, more due diligence is being initiated on Asian credit hedge fund managers by US institutional clients.

IFR Asia: Okay. Most of the high-yield issuance in Asia, as we’ve mentioned, tends to come from Chinese property companies. So, is that because it’s more difficult for non-property companies to come to market, and do you expect this to change and maybe create a more diverse Asia high-yield market? I’ll ask Hongbao that question.

Zhang Hongbao, BOC: First of all, we can see the issuance of HY bonds this year has increased significantly compared to last year. Both the number of deals and total volume reached record highs. Among them, Chinese real estate companies are undoubtedly the main force. They made up a larger proportion of the market this year, at about 58% compared to 44% in 2018.

The main reason is that most of the real estate issuers are regular issuers, and they are listed too. They have built up a more complete yield curve. It is easier to study the credit fundamentals than if it is a debut or not well-known name.

At the same time, the real estate industry’s default rate is generally lower than other industries. In some industries with default cases, such as photovoltaics or new energy, investors are more cautious when assessing the credit fundamentals.

From the perspective of cost, real estate issuers can accept higher financing costs, while the non-property companies are limited by their own industry profit margins. When considering financing channels, they usually opt for loans which offer a lower financing cost.

This year we also saw other types of issuers, such as logistics, energy and gaming. I believe there will be more high-yield issuers from other industries. You can see that the market is friendly to those issuers.

In addition, some investors view non-property issuers as a diversification play to their already heavy real estate bonds portfolio.

Daniel Kim, HSBC: Obviously, I agree with the comments made by Hongbao. I think one other important fact is corporate transparency. You don’t have to be, per se, a sector specialist to understand the real estate industry. There has been a lot of issuance from the sector, so a lot of information not only from the companies themselves is available in the public domain regarding the industry as a whole. So, it’s an area that a lot more investors can get comfortable with and can get a lot more facts and data. So, I think that’s probably one of the driving forces behind the demand for the real estate sector as well.

Now, when you look at specific industries or, let’s say, industrial high-yield from China or even from other countries, I think sometimes it’s very difficult for investors to really get their head around the transparency, the financials, the sector, etc. So, I think that’s one of the main reasons why investors are so comfortable with real estate names.

Monica Hsiao, Triada: I agree with all of those comments, but I would say that from the investor standpoint, obviously we would welcome more diversification. As it stands right now, 67% of the entire Asia high-yield credit market is represented by China. Within that, 81% is property developers.

That said, it is interesting that this year, as a whole for Asia credit, and not just within China high-yield, the amount of non-property, non-China bonds still did increase in volume by multiples as far as their rate of increase compared to last year.

Lack of transparency from the issuer is one key factor behind the relatively cooler reception from the market for non-property bonds. We have multiple examples of Chinese industrial private companies come to the roadshow, and at the beginning you see the management team very open to provide information, and then, over time, the information flow just trickles down to nothing. And in some cases, these Chinese industrial issuers make it very difficult to access them, so that obviously doesn’t help. This behaviour has been big reason why the demand from investors for Chinese Industrial bonds has been limited.

There is also a market psychology of people looking backward and they look at past performance, and naturally they become hands-off on industrial issuers because most of their bonds suffer more volatility on marks-to-market. Then they fall into a sort of complacency about the Chinese property sector to think, well, there should be reliable recovery value because there’s hard property, but, actually, if you look across the quality of landbanks of property, you really should be differentiating a lot more.

It’s definitely true that if you look onshore, the percentage of default is only 4% and then, within that, most of those defaults that are property-related are actually service-related – they’re not actually property companies. So, it’s easy to be complacent about it, but I would argue and posit that, actually, there are some Chinese industrial bonds that are of good value relative to the risk, but people have thrown out the baby with the bath water and just don’t look at any industrials. I hear of many buyside asset managers that simply refuse now to look at much outside of property bonds, especially going towards year-end. They don’t see the need to reach when this has been an overall decent year for credit investors.

Then on the non-China high-yield side, as you all may know, we had this incident with Duniatex, which, obviously, did not help Indonesia high-yield markets. There has been a lot of fear suddenly about the due diligence that should have been done but weren’t done on these private companies that issue offshore public debt for the first time. Having said that, we see some India renewable energy issuers that have had some success coming to the market recently, so there’s still hope.

Adrian Cheng, Fitch: I think just going back to what we discussed about Chinese property, apart from the transparency and the fact that there is an asset to be sold, I think what the investors may get comfort from about the Chinese property market is that, in a way, the property market is a little bit like a consumer market in China where the mentality of Chinese people is, “I need to own new property.”

So, there is still plenty of demand for Chinese property, and I think the way we should think about it is that the asset will get sold in the next one to two years, and that’s why I think investors get comfortable about the future. You know, in a market where it’s relatively stable and there’s still plenty of demand, I think the investors may get comfortable about the future cashflow of these property development companies.

IFR Asia: The demand is there, Adrian, but are Chinese property companies following through on their promises to deleverage and how healthy do they look financially and in terms of liquidity?

Adrian Cheng, Fitch: It’s a good point because I think we are at a crossroads where the sector is actually going downhill from here. I mean, we’ve seen phenomenal growth in the past seven or eight years, we had the miracles of tier one, and then tier two, and then tier three cities growing at a huge pace, but now I doubt whether those miracles will come back again, and I think the government is definitely stamping down on uncontrolled growth in the sector.

Now, how do property developers react to that? Most of them won’t slow down their growth in sales. Of course, that’s assuming they can generate sales, and that actually keeps their liquidity coming in, as well. You sell, your cash comes in, assuming you don’t go and buy a lot of land bank to maintain growth, which is the case because in an environment of slowing growth, you’re going to control your land bank acquisition as well.

For most of these larger high-yield property developers, they are going to slow down their land bank acquisition. They will keep contracted sales constant so that there is liquidity coming in, and then hopefully, that is enough to help them generate liquidity. On top of that, for those which have good access to the market, they will try to access those markets to keep refinancing their debt. But I think, for the larger players, there is a trend to deleverage slowly, but they are doing well to keep liquidity.

Now, on the other end of the spectrum where we’re looking at Single B or Triple C players, those which struggle with contracted sales, whether because their execution is poor or the location is poor, those which don’t generate sales are clearly going to struggle. Add that to the fact that the banks and trust companies aren’t lending to them, and I think that shows the trend for them.

There are two approaches for them. One is to sell projects and, therefore, begin to exit the industry. The second one is try to drive more sales, and how do you do that in a tightened environment? I hear some small developers telling me, oh, they’re still looking to grow 20%–30% or even higher in contracted sales. Now, for us, that’s a bit of a dangerous strategy. That means your leverage is going to go up, you’re going to struggle with funding, and struggle with liquidity. So, for those companies, we’re keeping a close eye on them and how they execute it. To sum up, I think for developers it’s a bit of a diverging trend wherein the big ones are okay, but the smaller ones are diverging.

IFR Asia: Thank you.

Monica Hsiao, Triada: From the property developers we track on a regular basis, we have seen this year that a number of property developers did deliver on deleveraging promises. And Adrian is right. There’s still a number of things they can do to manage their liabilities, such as simply withhold buying more land. So, if their land bank is large enough and of decent quality, they can hold off for a while. But I think what’s more important to us is whether the company has access to multiple funding channels.

We all know that the easing policy by the Chinese government does not apply to property developers. As a result, funding conditions for Chinese property developers are still overall tight. That said, China has not completely shut down trust financing/funding channels so some developers still have access to that source of financing. Earlier, I mentioned private placements as another fundraising channel for some issuers. I believe the key issue for the property developers is access to funding options and whether they have enough cash relative to short-term debt. I believe liquidity matters the most when you realise that all these companies need to constantly refinance.

Adrian Cheng, Fitch: Yes, I think that’s one of the themes we’re also facing this year. For low Single B and Triple C players, we are actually asking them to constantly provide us their plans of refinancing their maturing debt in the next 6-12 months, and we’re keeping a close eye on them.

Monica Hsiao, Triada: One comment from Adrian relating to the lower quality Single Bs is important: nowadays you definitely need to be a lot more careful picking single names. This is what I was alluding to earlier about the complacency by the market in the pricing of some credits. That said, in current bond valuations, there is now a growing credit spread difference in valuation between the lower quality Bs and the higher quality Bs, and there is even a larger divergence between Single Bs compared to Double Bs.

Yesterday, I was just taking a look at relative valuation and I was surprised to see we’re being paid up to 4% higher for some Chinese Single B high-yield property bonds, compared to US Single B bonds. This is not even accounting for the fact that there’s a difference in duration, because in our Asian high-yield credit markets, our average duration is much lower – with only two to two and a half years, whereas for the US high-yield market the average duration is between four and five years. So, if you look at it from that perspective, Asian high-yield markets are very cheap right now, so it’s definitely worth the time to do your work.

IFR Asia: Hongbao, can I ask what impact are the Chinese onshore funding conditions having on the US dollar high-yield market, because I guess if they’re funding in dollars, it’s either because they can’t issue in renminbi or they think it’s more attractive to issue in dollars.

Zhang Hongbao, BOC: Yes, as we all know, Chinese onshore market liquidity has improved a lot this year. The deleveraging policy has been slowing down this year. So, I think that a lot of companies would also consider refinancing in the domestic market, which means the offshore market would lose part of its good-quality investment grade names due to the disadvantage in price. I think that’s another reason to push some of the investors to buy high-yield bonds. Also, some of the financial institutions who have money on hand are finding a way to balance their onshore and offshore positions.

IFR Asia: Dan, do you see a similar thing happening there?

Daniel Kim, HSBC: Yes. For a lot of issuers with any other markets, they’re always going to compare their rate of borrowing domestically versus offshore, so cost is obviously going to be a key factor of which market the issuer will pick. Secondly, for a lot of the previous issuers who already have loans or bonds outstanding in the offshore market, they tend to just use the offshore market to refinance, just given the necessary approvals such as regulatory, etc.

So, we’ve seen quite a bit of new issuers this year who predominantly looked at domestic markets and are now looking at overseas. It’s not necessarily because their funding conditions have tightened onshore, but one of the rationales they’re telling us is they want to start diversifying their investor base to offshore as well, not just onshore.

Adrian Cheng, Fitch: Yes, this is definitely true for the smaller homebuilders which have got listed and the next natural thing to do if they have the NDRC approval is to go to the market ASAP. However, with the new NDRC approval where the use of proceeds can only repay offshore debt in the next year, it will be interesting to see how that changes from 2020 onwards. You may see a drying up of new issuers coming into the market.

To see the digital version of this roundtable, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com