Investors are expecting a new green quantitative easing programme to start the new decade as the ECB seeks greener investment opportunities and more sovereigns ready green bonds for late 2020 to finance multi-billion euro clean infrastructure projects.

The new EU taxonomy is also expected to drive further growth in the rapidly developing green bond market, and countries including Germany and the Netherlands are announcing massive new green projects to meet emissions targets set by the Paris Agreement on climate change.

The ECB's new president, Christine Lagarde, is starting a one-year review of the central bank's policy framework. Finding a way to tackle climate change, which she described as "mission critical", has been one of her priorities since taking office in November.

"We expect Christine Lagarde to kick-start the new year with a greener agenda. Heading into a new decade, investors could see a green quantitative easing programme on the table,” said Scott Freedman, fixed income portfolio manager at Newton Investment Management.

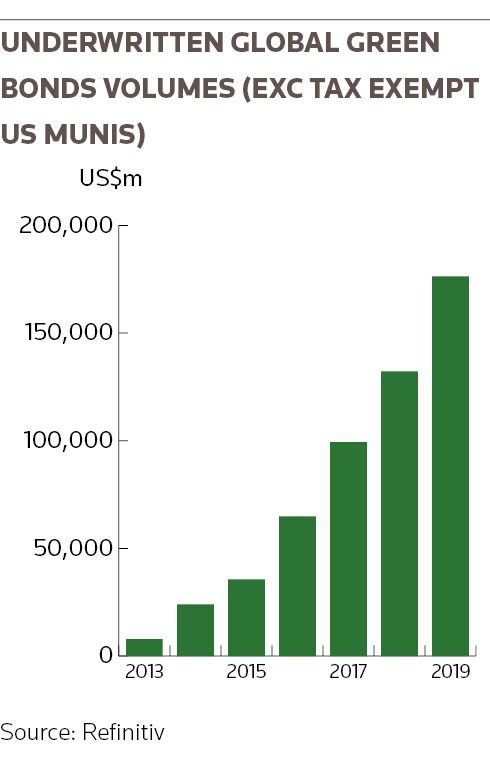

Green bonds saw strong growth in 2019 – to US$172.4bn, up 31% from US$132bn a year earlier, according to Refinitiv. The data exclude tax-exempt US municipal bonds.

Volume is expected to climb higher in 2020 after December’s EU taxonomy gave a common classification for sustainable activities to give investors more clarity by setting standards and labels for green issuance.

The ECB could commit to buying more green bonds as part of a monetary stimulus package as fears over climate change rise, but this is politically contentious as it could favour some countries and companies over others.

MIXED VIEWS

Jens Weidmann, the head of Germany's Bundesbank, has argued against lower risk-weightings for green assets and for no favour to be shown to green bonds through green QE, while French central bank governor Francois Villeroy de Galhau has said that the ECB should build climate risk into its lending rules and economic models.

Other options, including a haircut on "brown" bank collateral, the promotion of transition bonds or using the ECB’s foreign currency reserves to stimulate climate-friendly projects are also possible, but green QE risks overwhelming the young sustainable finance markets.

"For the sake of market growth, it would be better if the ECB doesn't start buying more green bonds. It could squeeze green spreads in relation to non-green spreads and risk a buyers' strike," Freedman said.

GREEN SOVEREIGNS

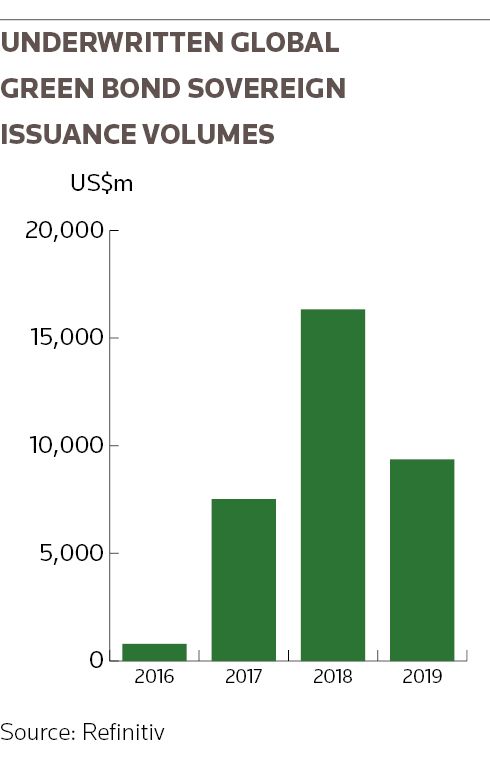

Green sovereign bond issuance totals US$34bn to-date, and hit a high of US$16.4bn in 2018, before dropping to US$9.4bn last year, but this figure is expected to jump this year.

More sovereigns – including Germany – are gearing up to issue green bonds in late 2020 to fund new infrastructure projects, while other debut issuers such as Italy, Sweden and Denmark are expected to tap the market.

Spain is also committed to offering an ongoing supply of green bonds. Meanwhile, investors including Columbia Threadneedle are applying pressure on the UK to issue green Gilts, but are meeting resistance from its Debt Management Office.

"Given the net zero targets in law and ambitions of the sovereigns, there is going to be increased focus on green climate-related infrastructure that will need to be funded,” said Caroline Haas, head of sustainable finance, financial institutions and SSAs at NatWest Markets.

MODERNISATION

Germany’s government has launched a €86bn 10-year plan to finance the modernisation and expansion of its railway system, including the electrification of more routes. The federal government is planning to finance €62bn and state-owned rail company Deutsche Bahn will fund the remainder.

The Netherlands has also set up a €50bn fund with the aim of investing in projects to help tackle climate change.

“I would expect a significant amount of this to fall under green proceeds," Freedman said, referring to both the German and Dutch programmes.

Green sovereign issuers are also expected to tap existing deals. Chile raised US$1.65bn last week through a US$750m 12-year bond issue and a tap of its 3.5% 2050s.

New green sovereign bonds are likely to encourage more domestic companies and municipalities to follow to gain the reputational benefits that green bonds confer, as seen in Ireland after the Republic’s October 2018 debut.

Germany’s debut issue is eagerly awaited, as it is expected to start a green Bund yield curve by issuing green and conventional Bunds.

This is a different strategy from other sovereigns that have issued green bonds on a syndicated and standalone basis and will clearly highlight any green premium or "greenium".