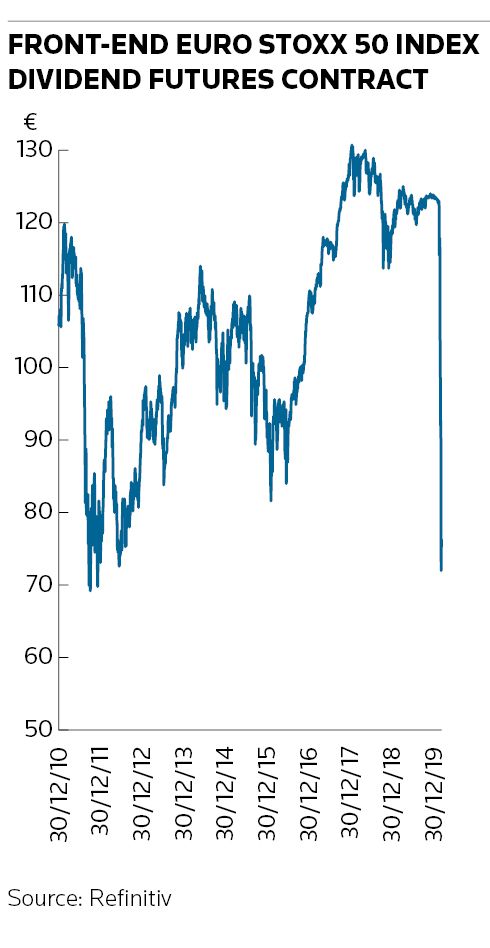

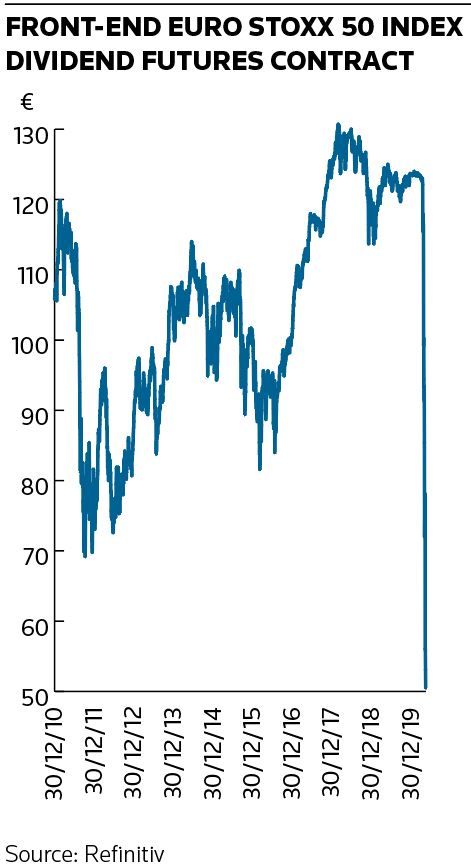

Futures contracts tied to European company dividends have plunged to their lowest level since at least the eurozone sovereign debt crisis, as a wide range of firms look set to halt payouts to shareholders because of the economic fallout from the coronavirus.

The Euro Stoxx 50 index dividend futures contract expiring in December – which captures dividend payments from mid-December 2019 to mid-December 2020 – has more than halved in value from above €120 less than a month ago to about €51 on Friday.

That is far below the previous low close of €69 for the front-end dividend futures contract recorded at the height of the eurozone crisis, according to Refinitiv data going back to the start of 2011.

The collapse in dividend expectations comes in the wake of European regulators demanding banks suspend dividend payments and government pressure on companies outside the financial sector to stop returning money to shareholders. More broadly, fears of a crippling global recession is also encouraging companies to stockpile cash.

"This is something that we haven't seen in the past: governments and even central banks telling large parts of the index not to issue dividends is unprecedented,” said Kokou Agbo-Bloua, global head of flow strategy and solutions at Societe Generale. “It’s a massive correction.”

The largest UK banks have axed interim or quarterly dividends in 2020 and agreed not to pay their final 2019 dividends, which they were about to start paying out, following instructions from the Bank of England's Prudential Regulation Authority. Most prominent European banks have also now suspended dividends for the 2019 fiscal year following recommendations from the European Banking Authority.

Many non-financial companies are expected to follow suit. France and Germany have both said any firm receiving state aid will have to suspend dividends. Analysts believe part state-owned companies will also come under pressure to do so, as will private-sector firms shedding staff or struggling in the current climate.

“Companies are in survival mode. They are cutting to protect cashflows,” said Agbo-Bloua.

Equity strategists at Barclays said they expected the economic fallout from the coronavirus to be as severe as the 2008 to 2009 recession, albeit briefer. They forecast European earnings per share will fall by about 40% this year, before rebounding in 2021.

“The hit to dividends should be of similar magnitude, as companies preserve capital/cashflow and prioritise social responsibility over pay-out,” the Barclays strategists said.

From 2008 to 2009, 60% of companies cut dividends, while earnings per share fell 43% in the pan-European Stoxx Europe 600 index, Barclays said.

NEAR-TERM PAIN

The sharp fall in front-end dividend futures contracts makes this sell-off stand apart from other recent equity market slumps. Historically, longer-dated dividends have tended to have a greater sensitivity to equity market declines because of the pressure from banks' exotics books hedging structured products, and the higher levels of uncertainty generally over that time horizon, said Edmund Shing, global head of equity derivatives strategy at BNP Paribas.

"However, in this event-driven market decline, a combination of a sharp decline in near-term earnings visibility together with pressure from national regulators and governments have driven a much larger decline in dividend outlook on short-term dividend futures maturities, most notably the 2020 maturity," Shing said.

Still, analysts indicate some of the moves could be overdone. The Barclays equity strategists said 2021 dividend futures, which reflect dividend payouts between mid-December 2020 and mid-December 2021, are trading at a 60% discount to consensus estimates, close to the worst point of the financial crisis of 2008.

“[This] looks aggressive even if we assume zero payments from key sectors,” they said.

“We believe the dividend hit this year, while severe, will be a one-off if the coronavirus shutdown does not hurt the economy in the long run.”