Let the good times roll! The top five US investment banks in terms of revenue and market share pulled in US$42bn in revenues from a stunning performance across trading and underwriting last quarter – US$17bn more than a year ago – helping them build massive reserves as they prepare to weather the impact of the coronavirus crisis.

Bank chiefs warned the exceptional trading and underwriting levels will not last – although analysts said the banks might have already set aside all they need to shield them from a rise in bad loans coming down the tracks.

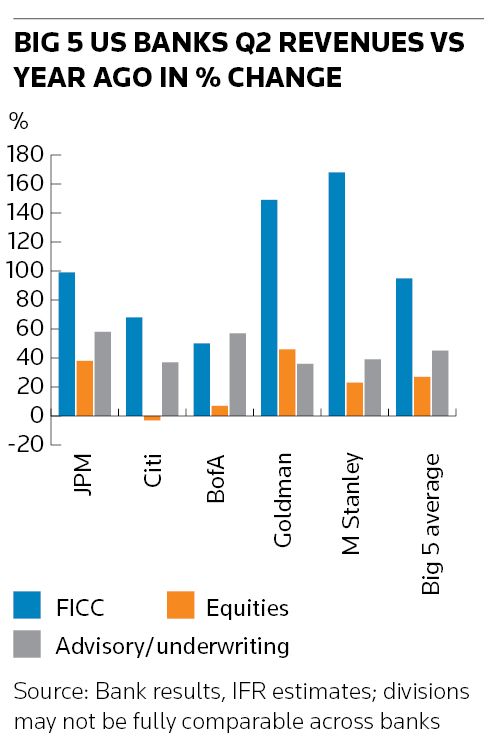

Revenues from fixed income, currencies and commodities from the big five banks hit US$23.4bn in April-June, up 95% from the same period a year ago. Equities trading brought in another US$9.9bn, up 27%. That meant the five banks pulled in US$13.5bn more from trading than a year ago.

The five banks, led by record results from JP Morgan, Goldman Sachs and Morgan Stanley brought in a further US$9.2bn from debt and equity underwriting – or US$3.7bn more than a year ago. DCM revenues jumped 57% year on year to US$5.1bn, and ECM fees hit US$4.1bn, up 84%. The other two of the top five are Bank of America and Citigroup.

But executives warned not to expect the good times to continue rolling. There are already signs of a return to more normal levels.

"For trading . . . cut it in half," JP Morgan chief executive Jamie Dimon told analysts on a conference call. "You should assume it's going to fall in half. We don't know . . . but we don't assume we have these unbelievable trading results going forward."

Bankers expect underwriting fees to drop in the remainder of the year, too, but many are optimistic that ECM and DCM desks will remain busy as companies and countries raise funds to prepare for tough times ahead.

Global debt issuance hit US$5.5trn in the first half of the year, up 35% from a year earlier and the strongest first half since records began in 1980, according to Refinitiv data.

Global ECM volume, meanwhile, was US$447bn in the first half – a five-year high and a 41% increase on the first half of last year.

"I think a lot of people said they prefunded a lot of their capital needs to make sure they get through whatever this crisis means for their company and their industry," Dimon said. "All this capital is not being raised to go spend. It's being raised to sit in the balance sheet so that you're prepared for whatever comes next."

Morgan Stanley chief executive James Gorman, on his analyst call, also said he expected investment banking division revenues to normalise this quarter and subsequently. "Clearly, it will be challenging for the back half of 2020 to meet the record first-half results,” he said.

"PERFECT STORM"

Banks said almost all areas of markets and investment banking were fired up last quarter, apart from M&A advisory where deal activity slowed.

"The second quarter has had the best of both worlds. The first part was all about macro, and the second half of the quarter was all about the spreads," George Kuznetsov, a partner at McKinsey CIB Insights, told IFR.

"It's been a perfect storm in a positive way for fixed income, which translated into the numbers we've seen so far."

High market volatility in April and most of May was beneficial for rates, foreign exchange and other macro products, as institutional clients repositioned portfolios. In latter May and June, volatility reduced and spreads started to normalise to boost credit businesses. "So on a combined basis you have these stunning results for the quarter," Kuznetsov said.

In FICC, the turnaround in credit flow business and continued strength in rates and FX was added to by a strong performance in repo and commodities, especially oil.

All five banks showed gains of at least 50% in FICC revenues, and both Goldman and Morgan Stanley had their best quarters in the area since the aftermath of the 2008–09 financial crisis.

Morgan Stanley's FICC revenues surged 168% from a year ago to US$3bn and Gorman said it had won market share as its streamlining of the business in late 2015 continued to pay off. He said the bank had excess capital it can put to use winning trading business.

In equities, activity was more mixed, with strong flow equity derivatives, secondary convertibles and cash equities partially offset by slower prime brokerage, structured products and corporate derivatives activity.

Goldman was the top bank for equities trading after revenues jumped 46% to US$2.9bn, its best quarter in 11 years, on strength in cash products and derivatives.

The record debt issuance and jump in ECM activity in May and June also helped trading, as well as producing bumper underwriting fees.

US$35BN RESERVE BUILD

But banks – like their corporate clients – are bracing for tough times, and the big five banks and Wells Fargo collectively set aside US$35bn in provisions for loan losses in the second quarter.

Profits at Morgan Stanley and Goldman held up far better than rivals as they were relatively unscathed from higher provisions. Morgan Stanley only set aside US$239m for provisions in second quarter, while Goldman's provision was US$1.6bn. Those were dwarfed by JP Morgan's US$10.5bn provision and Citigroup's US$7.9bn hit.

"This is by design. We have virtually no unsecured consumer loans, we do not have significant emerging market exposure, and we have modest exposure to the small business segment," Gorman told analysts.

Gorman said the results were a testament to the major restructuring to make his bank more diversified, less risky and better able to weather periods of market stress.

"Over the past decade we've dramatically changed our business model. The second quarter tested the model and we performed exceedingly well," Gorman said.

The banks said there had not yet been a big increase in credit losses and analysts reckon they could now be over-provisioned, or at least unlikely to set aside much more in the second half of the year. JP Morgan has a reserve of US$34bn.

![]()