IFR ASIA: Good morning everyone, and welcome to this live webcast on the outlook for Asian credit after the Covid-19 outbreak. Michael, what has changed and what can we expect?

Michael Taylor, Moody’s: Thanks very much, Steve and good morning to everyone. What I thought I’d do, because those are two very big questions that you’ve asked me, is provide a bit of background in terms of where we are and the nature of the economic shock that we’ve been living through.

What started out – as we know in the region better than anyone – as a China-centric shock has turned into a global shock. Initially, the shock hit China largely because of the lockdowns within China. That had an impact both on the demand side, in terms of China’s demand for products and commodities from the rest of the region, but it also had an impact in terms of disruption of supply chains.

China, as we’ve discovered, is so deeply integrated into global supply chains that any disruption in China has knock-on effects on the rest of the region and the world. Then, when the virus spread and we saw a growing impact across the world and countries responding with lockdowns to stop the spread of the virus, we started to see the impact on the rest of the world as well.

That took a number of forms, both in terms of demand shocks in terms of people staying at home and not going out spending as much and in terms of supply shocks and, again, that same disruption to supply chains. Then in financial markets, where we’ve seen quite a lot of volatility in the early part of this year.

You put all these different components together and it results in a major economic shock, both in a macroeconomic level but also when you start looking at particular sectors as well. Those sectors that are most dependent on a customer-facing experience, such as the services sector, travel and tourism, all of those have been particularly hard hit as a result of both the virus and the various public health measures that have been taken to respond to the virus.

In terms of our expectation for the economic outlook, we’re expecting a fairly significant recession across all of the major economies this year. Only China will record any positive growth this year at all and that’s a very modest 1% compared to the growth rates that we’ve been used to in the past. It’s going to be a world in which the major economies are shrinking by over 3% this year.

Not so long ago, people were talking about maybe there’ll be a V-shaped recovery and, once we take economies out of lockdown and once we remove the induced coma that economies have been put into, things are going to bounce back relatively quickly. I think it’s becoming increasingly clear that that isn’t going to happen. When we see a recovery, and we will see a recovery later on in the year, it’s going to be much more modest.

It’s essentially going to take until the end of next year, the end of 2021, before we see global output back to the levels that it was at the end of 2019. It’s going to be a long, slow, grinding recovery from here and that’s going to have major implications in terms of credit.

Just turning to where the risks are, well, there aren’t that many upside risks. The sole upside risk, really, would be if we discovered a vaccine or some effective treatment for coronavirus more quickly than is expected. Most of the epidemiologists talk about 12 to 18 months for a vaccine. There isn’t really a lot in terms of upside risks, but there are plenty of downside risks in terms of whether or not we start to see new outbreaks in the second half of the year.

Financial stress is one. Financial markets have held up relatively well despite all of the bad economic news but if financial stress were to start to spread, if we started to see asset quality deteriorate in the banking sector, for example, that would also constitute a downside risk.

We’re likely to see behavioural shifts. The evidence from China is that, during the lockdown, a lot of people shifted to online e-commerce and, as the lockdowns have been lifted in China, that pattern of behaviour has continued. That’s going to be highly disruptive to some sectors and, again, a major structural change.

This is what I’ve called the first crisis of the G-Zero world. We haven’t really seen a lot of global coordination and, if global coordination deteriorates further and if countries don’t work together to combat the virus spread, that increases the risk of a resurgence and that would increase the severity of the economic outcomes. There are a number of different factors that make up quite a heavy risk to the downside.

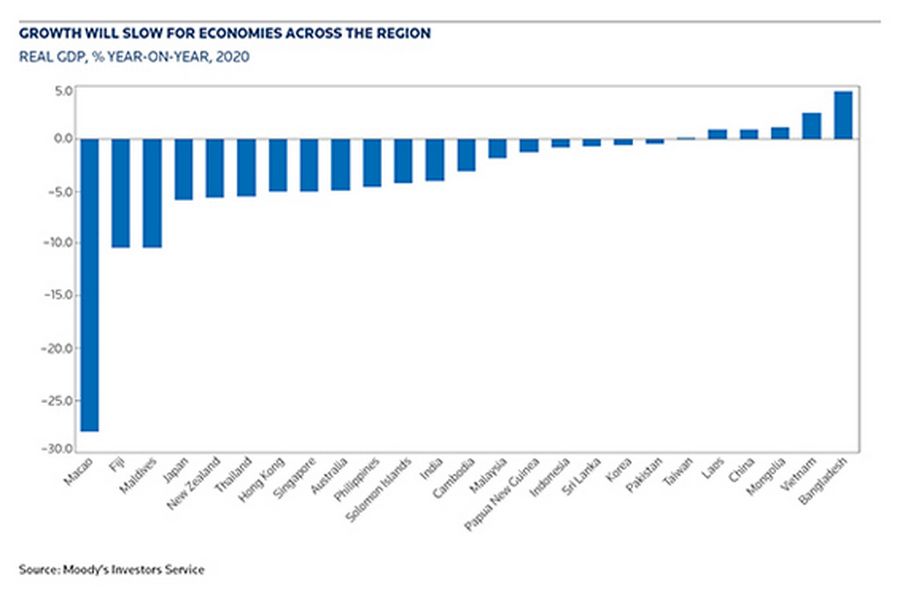

Finally, I’m going to talk about the impact across the region. What we’re expecting to see is that growth is going to slow across all of the major economies in the region. Obviously, the ones that are the most tourism-dependent will be very badly hit. (See chart on page 4.)

Also, the disruption to supply chains and the decline in demand from major economies and major regions that have been sources of demand for the region’s exports, in Europe, in the US and North America, is going to have an impact on Asia’s growth, not only this year, but I suspect it could well have long-term implications too. The region’s economies are very export-orientated. If there’s a move towards shortening supply chains, making them more robust and some reshoring or relocation of supply chains, all of that is going to have implications for the region.

There are quite a number of downside factors to consider here and maybe we’ll get more chance to go into those in a bit more depth later on.

IFR ASIA: Thank you, Michael. Morgan, as a fund manager, how do you react to that rather bleak assessment? What can you do to respond to these risks?

Morgan Lau, Fidelity: Good morning, everyone. From what we’ve seen in March with the market in turmoil due to various factors – obviously the pandemic being one of them and the oil price adding to the volatility – at least in the short-term, the focus would definitely be on liquidity. We have seen how dislocated the market could be in this kind of scenario, where everything that could go wrong went wrong.

Liquidity is going to be a key for us in the investment process but, in the medium to longer-term, there are a few things that we’re also looking at. This pandemic is really causing us to rethink what kind of sectors we should invest in going forward. If you look at the kinds of changes from this pandemic compared to SARS in 2003, this time, it has stopped normal life for long enough for behaviour to change. Also technology, with the internet and mobile phones, is enabling very different behaviour in terms of working environments and even schooling. All those behaviour changes are not going to go back to normal even after we come through the pandemic. I like to think that the world will be a better place but we just have to think about what kinds of sectors will be affected.

Some of the real economy, where human-to-human contact is more important, will definitely be affected. For some entertainment industries, for example, cinemas or casinos, will they have to change their business model? On the other hand, some companies are benefitting from the internet economy. A lot of technology companies, they’re traditionally a lot more high-grade. The investors are going to have more focus on the high-grade sector but those companies also have lower leverage, especially the internet companies. We’re going to have to rethink how all those jigsaws are going to piece together.

As Michael mentioned, Covid-19 is definitely going to change the supply chain and that’s going to have some impact on the sector that we would look at. Another topic that has been very popular lately is, obviously, the potential for the US dollar to go into negative interest rates. In that case, we’re going to have to apply some of the experience we have seen in the Eurozone and in Japan to the US dollar market as well.

We are also going to have to look at investment behaviour if we do get negative rates. A lot has been discussed about savings. The savings habit of America is quite different from the rest of the world, so a negative rate may not have the same effect. We have to look at all this as well because, ultimately, it’s going to have a big impact on the investment process because, as US dollar investors, we are not very used to dealing with negative rate investments.

The last thing that I want to mention is probably in terms of credit fundamentals. Since the peak of the sell-off in March to right now, we have seen a lot of policy responses, a lot of stimulus measures. Traditionally, we’d be looking at companies in China or in India or Indonesia where a lot of them are state-owned entities and we expect a lot of support from the government, and we factor that in to the investment process in terms of valuation. Now we are seeing a very similar response, even in the US – both at a company level as well as a security level, when they actually purchase securities directly.

All those things, we’re going to have to factor into our investment process. Some of them might have a longer-term effect and some of them might have a medium-term effect. As soon as the crisis is over, we might not see them anymore, so we just have to keep checking. I don’t have a definitive answer, but these are all things that we have to consider right now and going forward as well.

IFR ASIA: Let’s go to Alan at this point. Can you give us a bit of an update on pricing levels today versus where we were at the beginning of the year? Have credit spreads settled since the March sell-off?

Alan Roch, Standard Chartered: Thanks for the question. I think spreads have definitely not recovered entirely but, when you look at the direction of travel especially in the last month or so, we’ve definitely seen them tighten. We’ve actually seen Asian spreads, overall, tighten versus the US spreads. In the high-yield space, that move is not complete. For example, we remain, I think, about 200bp wider in Asia high-yield verses US high-yield.

What we’ve seen is a bit of a delay factor. In the US, where the market reopened, as far as primary is concerned, much earlier that Asia, you’ve seen a gradual tightening of spreads there well before we saw that in Asia. We’re starting to see that here now. Part of the reason why this has accelerated in Asia overall in the last month or six weeks or so has been the ability of the Asia primary market to reopen and the willingness of issuers to come and print deals.

With these deals coming, you’ve seen a good performance of these transactions in secondary and they’ve enabled the re-pricing of a lot of the bonds in the sectors in which they were operating in and you’ve had a self-fulfilling prophecy to quite a large degree, which has encouraged other issuers to come, themselves re-pricing their own sector or their own part of the curve. We’ve definitely played quite a bit of catch-up with regards to the US now.

Perhaps a question to Morgan is whether the buy-side thinks there’s more to come in terms of spread compression. I think a lot of investors are looking at those differentials versus the US to establish whether there’s a value in Asia or whether there should be more value.

I would also like to make a comment with regards to what Morgan was saying earlier on the sector selection and the name selection. I think what we’ve seen in Asia is those issuers that the market is very comfortable with – and Zhenro Properties has been one of them – you see these names being able to attract significant liquidity in primary and, therefore, over-performing their peers in secondary as well.

Beyond the spread performance per rating category or per sector, what you’ve increasingly seen is a selection of specific issuers where the market is very comfortable providing liquidity in primary and in secondary and these really are over-performing others in their sector that are, perhaps, a little bit less followed by the market.

IFR ASIA: Thanks, Alan. Zhenro is an excellent example of a company that has issued bonds both before and after the Covid-19 crisis. Kenny, what’s your experience been like?

Kenny Chan, Zhenro: Thank you for the question. First of all, right now I think investors are very cautious, but I think they are looking for opportunities as well. Back to February, when there was the outbreak of the virus, investors were asking many questions, especially when the sales centres and the construction sites were forced to shut down. Overall, investors are so eager to understand the status. I think corporate transparency becomes a very hot topic. We have to talk to investors almost on a weekly or monthly basis and make sure they can understand the whole picture. In March, people were very eager to understand how China’s central and local governments are going to respond and how they’re going to support the economy. In April, after we delivered the annual results for 2019, investors were more interested in how we are going to maintain liquidity and how we’re going to face the current challenges. So far in May, I have a feeling that, overall, the sense of confidence is already getting better.

Right now, investors don’t just look at the return, I think they also look at the rating agencies actions. In the past two months, the rating agencies have been doing more and have been very active, even if you look just at our sector, many of our peers were downgraded or had their outlook changed. I think investors are also looking into these fundamentals again. Companies who got downgraded or had a change of outlook, they may not able to make the investment or they may not be able to buy the plots.

For companies that can maintain a steady rating, I think investors overall will feel more confident about the company. For the next two or three more months, I have a feeling that investors may prefer the top 20 or top 30, especially those who focus on sales as a high-turnover business model. I think developers who have a lot of assets or maybe are primarily focusing on recurring income may not be performing very well because, if you look at the past two or three months, many commercial property developers have been giving rent-free periods to their tenants. Their margins are diminished and the overall cash generated from recurring activities is also affected. You can see that for commercial property assets, the overall stock price or the bond price, they do not perform very well. For companies focused on high asset turnover, I think they could perform very well.

IFR ASIA: Thank you, Kenny. I think I’m going to go back to Michael at this point to pick up on one of the things that Kenny mentioned about credit ratings and the actions that have been taken over the past couple of months. What have we seen from Moody’s and what’s your outlook there, Michael?

Michael Taylor, Moody’s: Thanks, Steve. I think the first point to make is that credit ratings are an ordinal scale so there really is no point in us moving all credit ratings down in lockstep because that’s not really the purpose of a credit rating. What we’re trying to do is to differentiate by degrees of credit risk. What we’ve been trying to do is take a much more measured approach in terms of how we look at this situation.

Obviously, there are certain sectors where we’re seeing a much bigger impact than others. We’re trying, essentially, to look through the cycle. For strong companies with strong balance sheets and strong cash flow, what we’re trying to do is to look past this immediate impact and to look ahead over the next 18 to 24 months. That’s resulted in what we hope is a slightly more measured approach.

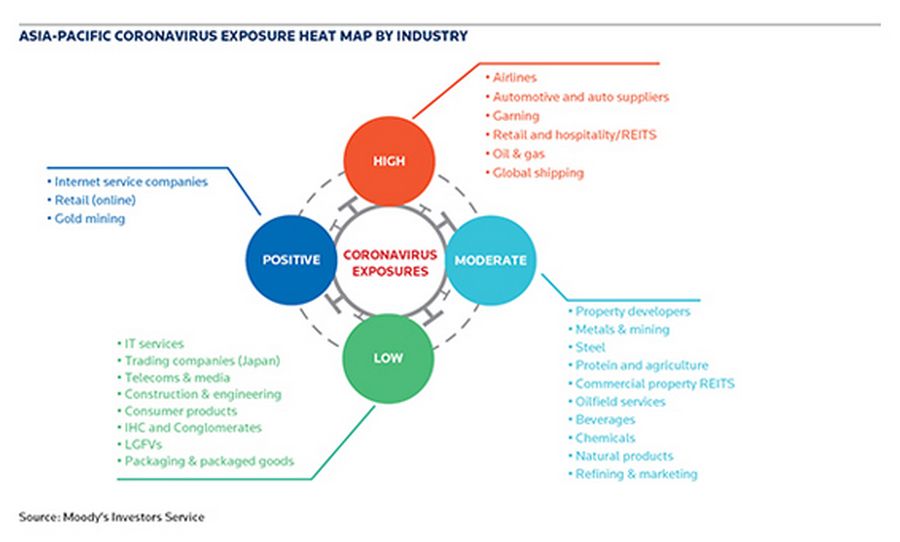

Not all sectors are equally exposed. There are some companies where we expect there to be a positive impact arising from the coronavirus exposure, particularly in terms of online retail, as I talked about earlier. There are others where we are seeing a very high impact and those, as you might expect, are the ones with exposure to the services industries where the impact of these lockdown measures is greatest. We’re seeing it in airlines. We’re seeing it in automotive, gaming, retail and hospitality and, of course, also in shipping, because of the commodities impact in oil and gas. Those are the sectors that we see as being most exposed. (See Chart on page 6.)

Coming back to the point that both Morgan and Kenny made about government support, we do see continuous support for a number of sectors and strategically important industries and companies, and we expect that to remain. A lot of policy measures have been announced in Asia. Credit guarantees for companies have been pretty widespread across a lot of the major economies. This goes back to a point that Morgan raised, that we look at support ordinarily from a point of view of state-owned enterprises and other government-related issuers but now we’re seeing a broadening of that safety net to include other industries and other companies that are not necessarily state-owned companies.

We are seeing a broadening of support as a result of these policy measures, and whether or not they will persist beyond the immediate crisis is a very important point. The expectation is that this is going to be a crisis management measure and eventually it will be rolled back. Certainly, in the near term, we are seeing quite a bit of support certainly for strategically important industries.

IFR ASIA: Morgan, do you see it becoming harder to assess government support? Is there a danger that some private sector companies become overly reliant on government measures that will be withdrawn at some point?

Morgan Lau, Fidelity: We have always taken a more ultimate approach in our analysis. Even for SOEs or LGFVs in China, we’ve always looked at the sustainability or viability of the business model first and the financial matrix, just like rating agencies, I’m sure. We always look at that. I think it’s actually the other way around, where the experience from looking at SOEs from various Asian countries is helping us to determine what might be a viable business and what might be a strategic business in this environment, where policy responses or government support are more widely spread.

It doesn’t really change our approach but it probably means that now, when we look at a company from a country where traditionally we don’t really expect that kind of support, we will factor in the question whether it is strategic, and might be supported by the government. It’s just one more factor for us to consider. It doesn’t really change how we look at credit fundamentals as such but we’re adding more dimensions to the analysis.

IFR ASIA: Are there sectors on the other side that you are staying away from now as a result of the Covid crisis?

Morgan Lau, Fidelity: I don’t think there’s anything that we’re staying away from but, obviously, some of the sectors are harder hit because of a combination of the pandemic and oil crisis. There are sectors that we’re staying away from because of valuations and the volatility but, in general, we are not ruling any sector out – apart from the ones where we don’t normally invest due to our industry approach. Other than that, no, we’re not staying away from any sectors.

IFR ASIA: We have some audience questions coming in. Michael, I think this is really for you: why would gaming be considered high-risk as a result of the coronavirus?

Michael Taylor, Moody’s: You can make the argument that gaming is moving online so, surely, that’s a positive outcome. I think we would regard online gaming as being part of the e-commerce space. What we’re talking about here, in terms of that high-risk category, are essentially the casinos. It’s the likes of Marina Bay Sands here in Singapore or it’s the casinos in Macau.

Clearly, if people cannot go and gather in large groups and we either have lockdown in place or social distancing, that means that the number of people who can go to a casino is going to be lower and, as a result of that, revenues will be lower.

We’ve seen the impact, both at the macro level in Macau where growth is one of the most severely disrupted in the region, but we’re also seeing it in the casino sector as well. When we’re talking about gaming as being a high-risk area, that’s primarily driven by the casinos.

IFR ASIA: Kenny, I’m curious how things have changed from a logistical perspective. Are we ever going to go back to face-to-face investor meetings and extensive travelling that you’ve been doing to explain your story to the market?

Kenny Chan, Zhenro: It’s a very good question. To be honest, I used to travel a lot. I sometimes go to Singapore, sometimes to Europe and then sometimes back to China and Shanghai and talk to my investors, talk to my shareholders, talk to my banks and also, most importantly, talk to my rating agencies but, because of the current challenge, basically, we are grounded.

Before the outbreak of the virus, I think many developers and many listed companies have regular updates for investors – including our team. We always send investors a newsletter on a monthly basis. After the outbreak, you can see more developers and more listed companies are willing to host teleconferences. In the past two months, we’ve had at least five teleconferences and we keep the investors posted with the status.

I think it’s still really important to have face-to-face meetings so investors can get a feel for the company, and we can have a feeling of what our investors want. In China, and even in Asia, the overall situation is getting more stable, and I believe that maybe cross-border travel could be reopened in a month. Here in Hong Kong the rating agencies are also asking us to have a face-to-face meeting when they are back to the office.

Even today, if we have a teleconference, I think it’s good to have face-to-face contact, but I think it’s temporary. It won’t be permanent. Like other developers, we have been doing more online sales for the past two months but I think it’s just marketing. It won’t be a very important sales channel. I think on the whole buyers are still very eager to see the projects and to feel the projects. I think these kinds of teleconferences or phone calls will be only temporary.

Alan Roch, Standard Chartered: Communication is key between issuers and investors – it’s always been the case but even more so now. When the market is under a bit of pressure, there is a big differentiation between those issuers that communicate efficiently with their investors and those that don’t. I think that is probably the key statement.

In a world where currently people cannot travel, the mentality is, really, do what you can with what you have. Video conferences or audio roadshows, of course, we’re promoting these because, to be honest, there’s nothing much more that we can do. I think both buy-side and sell-side participants are receptive to that.

I’m not of the opinion that this will remain the go-forwards solution. I think it’s a stopgap measure to ensure that people continue to communicate, because that’s really what we need to protect. But I think the minute we can start traveling, the reality is the value that you have in the face-to-face interaction and building a relationship on a personal level between an issuer and an investor, I think that will continue to be privileged.

I struggle to see an issuer consciously choose to communicate via audio instead of taking a flight to see an investor. Maybe the extensive travelling will be reduced for roadshow purposes and for the regular issuers doing the standard Hong Kong, Singapore, London roadshow, maybe that doesn’t need to happen as often as it did. But I think the minute we’re allowed to travel, that face-to-face contact will again be privileged and, to be honest, so it should be.

IFR ASIA: Kenny, do you think it’s a good or a bad thing that investor roadshows may not continue?

Kenny Chan, Zhenro: To be honest, it must be a bad thing. In the past five years, on average, I travel at least 60 times a year. Basically, in a conference call, sometimes it is a group conference call and some of the participants may not be very willing to ask questions. It’s very hard to draw their attention when it’s in a phone call and they may be distracted by people or other stuff. Having a face-to-face, I think, is much better.

Last week, when we launched our bond deal, we had a conference call. In the past two years, when I have conference calls with investors, on average, we will have around 90 to 120 participants. The last time, there were over 200 investors online. I think they are very willing to understand what is going on.

If the roadshow cannot go on, I can feel that some investors may not be very willing to invest happily, or maybe they will just cut down the scale of their investment until the market is becoming more certain. It’s definitely not good if we have to cancel all these roadshows.

To see the digital version of this roundtable, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com