The Covid-19 crisis has made it clear that sustainable financing instruments offer higher returns for investors and lower funding costs for borrowers, according to a panel of market specialists at the IFR Asia Green and Sustainable Financing Roundtable.

“The performance of sustainability funds through Covid has been very strong, and this is giving additional conviction to investors,” said Venn Saltirov, portfolio manager in BlackRock’s Asia fixed income team. “Over the past six months we have already started seeing pricing differentials between sustainable instruments, particularly green bonds, and their conventional counterparts, and this is because of the more diversified investor base and greater resilience during downturns.”

Investors have poured more money into sustainable credit funds this year, with fund flows to environmental, social and governance strategies showing significant growth. According to Barclays research, emerging market credit funds recorded outflows of around 2.5% this year to July, but the subset of ESG funds in EM credit have seen inflows of 15%. Similarly, flows to euro-denominated corporate credit funds were flat, but ESG inflows reached 24%.

“There are very clear technical factors supporting ESG issuance in the right format,” said Atul Jhavar, head of green and sustainable capital markets for Asia Pacific at Barclays. “This is tremendous liquidity that issuers can take advantage of in their deals.”

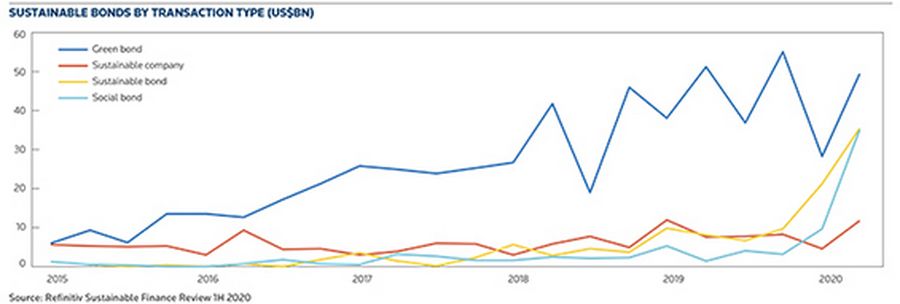

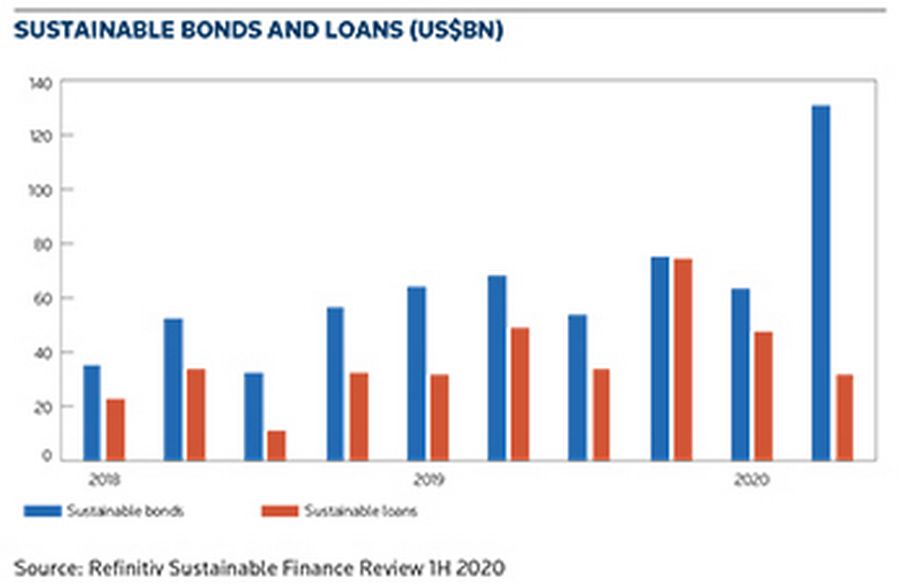

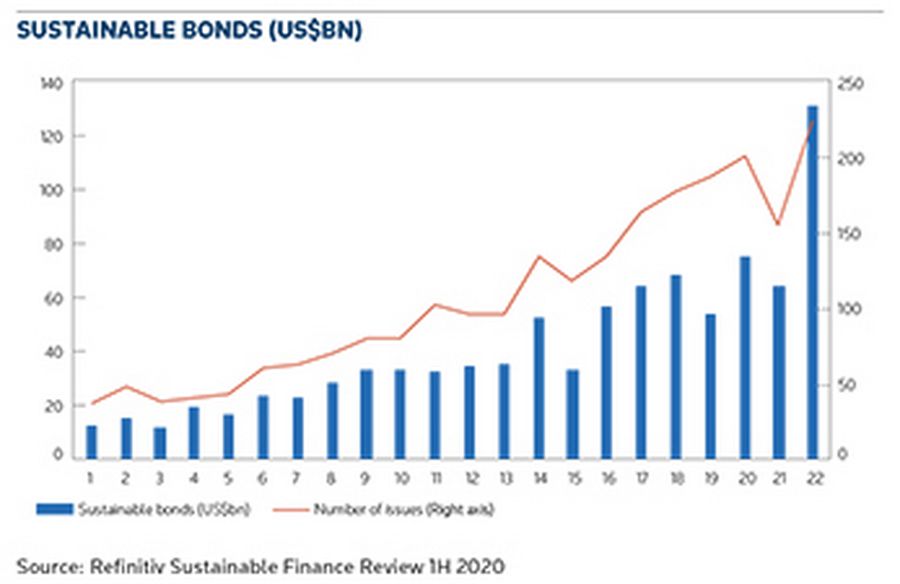

Sustainable bonds had a record three months in the second quarter of 2020 with total issuance approaching US$131bn, according to Refinitiv data – more than double the previous quarter. Total issuance worldwide reached US$194.5bn in the first half of 2020, up 47% from the same period in 2019.

Much of that burst in issuance can be attributed directly to the Covid-19 pandemic. Green bonds, as well as unlabelled issuance from sustainable companies, were roughly steady compared to last year, but sales of social and sustainable bonds leapt as sovereigns, multilaterals and banks raised funds for Covid-19 relief and recovery efforts.

“The social impact of Covid has been twofold. The first is medical, protecting people from the virus and treating those who are affected. The second is the impact on corporations and jobs. That clearly ties well with the concept of a social bond,” said Dominique Duval, head of sustainable banking for Asia Pacific at Credit Agricole.

“This year we have seen 80bn (US$96bn) of issuance to cover the effects of Covid-19. Some are labelled as social bonds, such as Bank of China’s SME bonds from its Macau branch, and some as SDG bonds. For a social bond transaction, an external review from a third party and reporting are highly recommended in line with market standards. On top of that, some issuers have sold bonds without a social or sustainable label, but may use the proceeds for Covid recovery efforts.”

Social bonds – which includes deals labelled as ‘Covid-relief’ bonds – reached US$44.8bn in the first half, according to Refinitiv data, more than double the whole of 2019. Social bonds accounted for almost one-quarter of the global sustainable bond market in the first half of 2020, compared to less than 5% during the first half of 2019. Sustainable bonds, which are aligned with the UN’s Sustainable Development Goals but may have been prompted by Covid-19 funding requirements, also jumped to US$56.7bn, more than double levels seen during the first half of 2019.

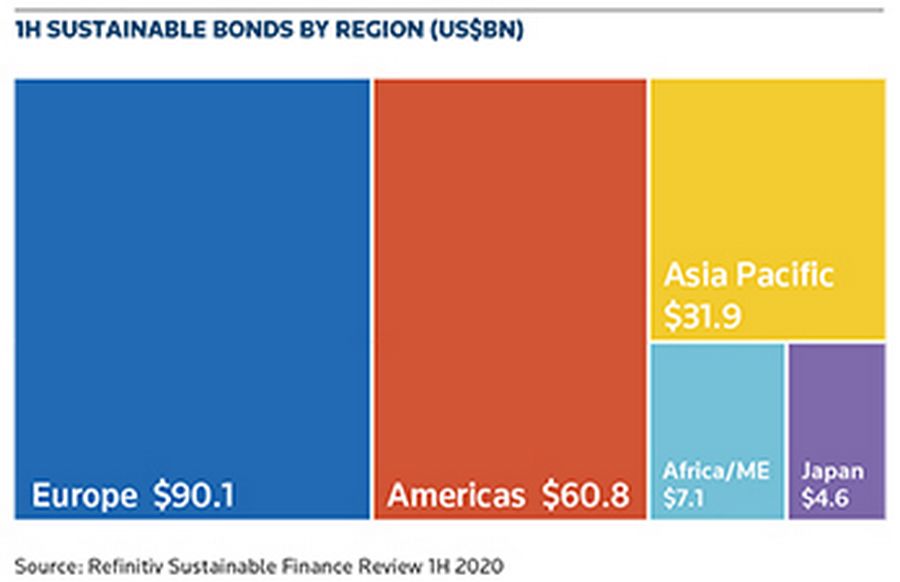

“The sustainability concept has grown a lot wider than just looking at green projects. Awareness has grown quite considerably over the last four months, which is encouraging. Asia is behind our colleagues in Europe and the US but is certainly catching up,” said Augusto King, head of capital markets at MUFG Securities Asia.

More issuers are showing an interest.

Kaisa Group, a major Chinese property developer and a frequent borrower in the domestic and international markets, recently set up a sustainable financing framework, according to Ken Suen, co-chief financial officer.

“From an issuer’s point of view, we always look at how to communicate with investors, how to broaden our investor base and reduce our financing cost,” he said. “We talk regularly about our financial performance, but rarely about how we contribute to society. For example, Kaisa is very involved in urban regeneration projects, which are not just about making money but also upgrading society by improving public facilities. Through this process we hope to broaden our investor base, and ultimately we hope to bring down our financing costs as well.”

Borrowers can also lower their funding costs through sustainability-linked loans, which come with an interest margin tied to pre-agreed sustainability targets. The format continues to gain traction in Asia, mainly through bilateral loans, but there is a debate around how rigorous the performance targets should be.

STANDARDS

“There is a lot of flexibility for those promoting good behaviour and we are seeing a lot of variety in sustainability-linked loans in the market, including in Asia. We’ve seen two-way pricing, both backing good behaviour and penalising poor ESG performance,” said Dominic Gregory, partner at Bryan Cave Leighton Paisner.

Variety may be good for borrowers, but it raises challenges for investors seeking to monitor the impact of their funds. The European Union has led the push for standardisation with a sustainable finance taxonomy released earlier this year, but lenders and investors in Asia still need to grapple with various local interpretations.

“We’re helping some corporates and banks craft their sustainable financing frameworks, and there is no harmonisation at the moment. Some approaches are more thematic around specific areas, such as reduction of carbon emissions, some are more about general business practices and cover a range of things,” said Gregory. “The important thing is not just a completely consistent taxonomy around the globe, because there are differences between countries, but more the concepts behind it.”

Each country has its own agenda around sustainability, and attitudes to clean energy vary significantly across Asia. Regulatory initiatives have been helpful in stimulating issuance and raising awareness, but local differences complicate the picture.

King at MUFG points to Thailand’s recent sovereign bond as a sign that standards are slowly converging. The Ministry of Finance priced a Bt30bn (US$997m) sustainability bond in August and is targeting Bt100bn of green and social bonds over the next two years to deepen awareness in the local market. Foreign investors bought about 20% of the deal, IFR reported.

“The local markets have a lot of components to consider, so it is hard to standardise all those. In the cross-border or G3 market, there is more standardisation,” he said. “For the Thai Ministry of Finance transaction we actually brought in our EMEA colleagues to look at what is acceptable for that market. Hopefully the local governments will be a lot more proactive in leading the way and hopefully we can see some convergence here.”

The ASEAN grouping has also introduced its own set of standards around green and social bonds, but are very closely aligned with the principles laid down by the International Capital Market Association. In China, too, recent deals have been structured to comply with local and international guidelines.

China Construction Bank in late July priced a US$1.2bn dual-tranche green bond that met the Climate Bonds Initiative’s global standards, as well as local green finance requirements in China and Hong Kong.

“For this transaction we thought it was important to structure it in line with global standards, because the first question you will get from investors in Europe is: what are the assets, are they really green? You have to make sure it aligns with international investors’ expectations,” said Duval.

China this year removed some categories of coal from its list of assets eligible for green finance, one of the key differences with international standards.

“There has been a lot of work going on behind the scenes between regulators in China and the EU around best practices, and this year they revised domestic standards around green and brought them a little closer to international standards,” said Jhavar. “I think with a lot of big markets, there has been a recognition that as they open up to international participants they do need to align this, and hopefully that will continue.”

Saltirov at BlackRock called for standardised reporting to allow investors to track the impact of their money, for example in terms of litres of water recycled, clean energy generated and emissions saved.

“The reason green bonds are growing so fast is because standards have converged, and the capital markets thrive on standardisation,” he said. “We need to safeguard the integrity of this market, by setting robust frameworks for the use of proceeds and making sure the reporting is comprehensive.”

BlackRock evaluates every green bond issuance using a proprietary green bond taxonomy that shades each green bond on a scale that ranges from ‘off-scale’ to very light to dark green that tracks use of proceeds, associated environmental benefits and the issuers’ ongoing commitment to allocation and subsequent impact reporting. MSCI, which runs a popular green bond index, will also remove securities that do not meet ongoing reporting requirements, forcing passive money to exit.

“If a green bond issuer misuses the bond proceeds and does not meet its initial commitments, we divest,” said Saltirov. “The green bond community is fairly small, and people really care about these things, so if you make that mistake once you will probably lose access to that market for many years to come. It’s not something companies will take lightly.”

INTEGRITY

Transition finance continues to divide opinion. Duval at Credit Agricole pointed to the importance of supporting initiatives to reduce carbon emissions, even if the projects may not meet strict green criteria. Transition bonds, for example, have helped space-starved Hong Kong produce cleaner energy by switching from coal to gas power and could play a role in reducing Asia’s reliance on coal energy.

“It’s a key challenge in Asia,” she said. “We believe we should support the transition to low-carbon, not just by stopping financing brown assets.”

Saltirov at BlackRock, however, argued that standards around transition finance are not yet fully developed. “Maybe gas is OK for Hong Kong, but is it the same for India or Indonesia?” he said.

Gregory at BCLP described transition finance as a “classic dilemma” for lenders and investors. But he said the market should remain free to make decisions based on individual circumstances rather than a one-size-fits-all approach.

“Because it’s not a regulated market, protecting against ‘greenwashing’ comes down to credibility,” said Gregory. “In Asia one trend we’re seeing is that the focus is not so much on the product but on the integrity of the parties that are involved.”

The Covid-19 pandemic has put ESG credentials under greater scrutiny for all market participants, on both the buy-side and sell-side.

Suen at Kaisa Group sees that as an opportunity to engage with investors from another angle, as many global funds may not be aware of initiatives to reduce the China property sector’s carbon footprint.

“The Chinese government has said by 2022 they would like 70% of buildings to be green buildings, so there is definitely more talk at the policy level,” said Suen at Kaisa Group. “Sustainable financing is going to be a hot topic for the entire issuer and investor universe.”

Barclays this year announced a commitment to align its entire financing portfolio with the Paris agreement and aims to be net zero by 2050 for direct and indirect emissions – a target that includes the impact on the environment of all the business activities it finances around the world, across all sectors.

“Banks can and should play a leading role,” said Jhavar. “Barclays this year committed to increase disclosure around the climate impact of our portfolio, and we will eventually make this methodology open source. We are working with BlackRock on some of these initiatives in developing data and methodologies to quantify the impact of our portfolio and how to monitor this in a more sophisticated manner.”

MUFG Bank recently set up a Rmb5bn (US$732m) green credit fund at its China subsidiary to support environmental conservation efforts in the domestic market.

“If a deal qualifies for the criteria of that fund then the lending rate will be lower,” said King. “There are incentives we are looking at in terms of how we can promote more sustainable financings by differentiating between returns.”

Credit Agricole has stopped financing certain assets that are very carbon-intensive, such as coal-fired power plants, and has created incentives for loans to low-carbon businesses. Its objectives include expanding its own green loan portfolio to €13bn by 2022, double 2019’s level.

“To support that we have a ‘green-up’ discount liquidity factor, which means the internal liquidity cost for green loans will be lower.” said Duval.

Saltirov believes the bond market can offer a similar carrot to potential issuers, a result of growing demand for sustainable investments.

“A dedicated green bond with a clear framework should attract a wider investor base, stronger order book and potentially tighter pricing, all things being equal,” he said. “We see strong demand for green, social and sustainable bonds from both regional and global investors. The only constraint is supply, not demand.”

To see the digital version of this roundtable, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com