The most deadly pandemic in a century has done little to dampen demand from UK corporate pension schemes for financial arrangements that allow them to hedge against their members living longer than expected, with some consultants predicting 2020 could be a record-breaking year for such deals.

So-called longevity swaps have become a popular tool for UK pension schemes to pass on some of the risk of their members beating life expectancy assumptions.

The coronavirus pandemic brought about a brief hiatus in dealmaking, while also prompting pension funds to consider reviewing existing deals after the jump in deaths raised the prospect of schemes facing substantial margin calls.

But the market for new transactions is up and running once more as trustees look past this year to the longer-term bill they face from member payouts over the coming decades.

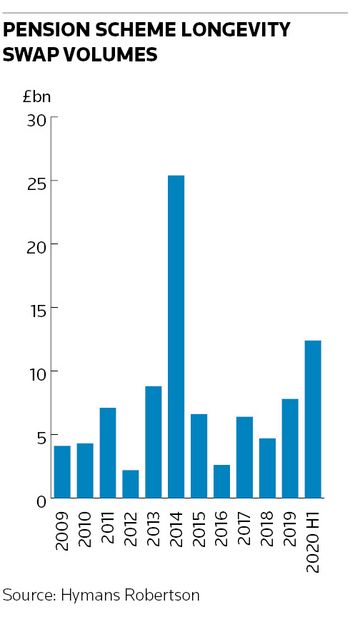

Corporate schemes have entered into £12.4bn of longevity swaps so far this year and deal volumes are expected to top £25bn before the end of 2020, according to a recent report from Willis Towers Watson, potentially producing a record-breaking year of transactions.

“A lot of schemes are able to continue to do good work on strategy and there’s still a continuing pipeline of these deals,” said Richard Wellard, a partner at Hymans Robertson.

“The transactions that closed this year would’ve been the end part of a long process. Closing these transactions would have involved those parties getting comfortable that the terms still represent good value for money in the long term."

The UK is at the forefront of longevity swap activity thanks to the large number of companies that are committed to giving retired staff a specified level of pension payout. About 14,000 employers handle £1.5trn in assets on behalf of 10.5m members of these defined benefit schemes, according to a 2018 UK government report.

There have been about £91bn of longevity swaps since 2009, according to Hymans Robertson, as companies have offloaded some of the risk of pensioners living longer than expected and saddling them with expensive payments.

These usually involve the pension scheme making regular fixed payments to a swap provider based on how much the scheme is expected to pay out to pensioners over the course of the transaction.

The swap provider (usually a re-insurer) pays the scheme an amount in return based on the members who are alive at that time. So if pensioners live longer than expected, the re-insurer makes up the shortfall.

HIT HARD

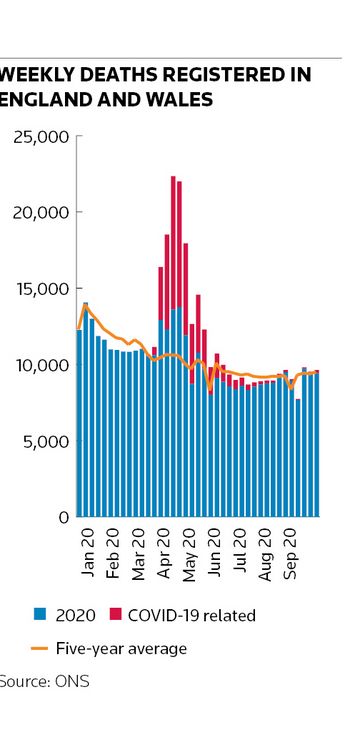

The UK has been one of the worst hit countries from Covid-19, with 65 deaths per 100,000 of the population, according to the John Hopkins University, compared with just 12 deaths in Germany.

But, perhaps surprisingly, the pandemic did not close the longevity swap market for long. UBS entered a £1.4bn transaction in the second quarter, adding to a £10bn deal from Lloyds Banking Group spread across three schemes and a £1bn transaction from Willis Towers Watson in the first three months of the year.

There has been a backlog of deals to work through given that these transactions are complex and take time to bring to market. Consultants say there are still a handful of multi-billion pound transactions in the works this year that have yet to be announced.

Moreover, experts believe the pandemic won't dramatically alter the longer-term mortality outlook and that these deals will still make sense for many pension schemes.

“It may sound odd to say in the middle of a pandemic, but the consensus outlook on longevity hasn’t shifted radically,” said Tim Gordon, a partner in the risk settlement group at Aon.

“Although we’re all worrying about Covid-19 right now, over a 10 to 20-year time frame I don’t think it will have that great an impact on mortality.”

Longer-term projections for mortality are what matter for schemes faced with paying out pensions for years to come. A range of factors feed into those forecasts including demographics, the economy and spending on health and social care.

“The longevity outlook has always been hugely uncertain, even outside of Covid-19,” said Gordon.

REVIEW TIME

While Covid-19 has failed to halt new deals, its effects have certainly been felt on existing transactions. Consultants say this year's higher-than-expected deaths may well trigger large collateral calls for pension schemes, potentially prompting trustees to call a review of the valuation models underpinning these swaps.

"Covid will magnify the shortcomings in these collateral calculations. The algorithms were never designed with a view to dealing with a material spike in deaths and they may well over-react to the spike," said Wellard.

"The challenge is going to be, if you’re going to review the model: how do you agree a long-term view in the middle of a pandemic?”