China’s efforts to contain debt risks in the property sector will support Asia’s high-yield bond market amid a renewed search for diversification, according to a panel of market specialists.

Held on October 6, the IFR Asia High-Yield Webcast came at a time of renewed scrutiny over Chinese developers following a credit scare involving China Evergrande Group, Asia’s biggest issuer of high-yield bonds.

A document circulating on social media appeared to show Evergrande warning of systemic consequences if it failed to win approval for a long-delayed domestic listing by January, when investors could demand repayment of Rmb130bn (US$19bn). The company dismissed the document as fake, but fears of a liquidity crisis knocked 20 points off its US dollar bonds and hammered its share price in late September, only for prices to rebound just as sharply days later after Evergrande said investors had agreed to roll over at least Rmb86bn of that total.

Buddhika Piyasena, head of Asia Pacific corporates at Fitch Ratings, said the incident made it clear that authorities are not making exceptions in relation to domestic listings for Chinese property companies – even for a large player like Evergrande, which Fitch rates at B+ with a stable outlook. The backdoor listing of Hengda Real Estate, Evergrande’s main onshore property arm, has been held up in China’s approval process since 2016.

Evergrande’s predicament has become more complicated since regulators unveiled new policies restricting highly leveraged developers from taking on additional debt.

Piyasena sees the increased oversight as a prudent move for a sector that accounts for 15% of China’s GDP, including ancilliary businesses. But he expects it to be a gradual process.

“The government really wants to reduce the risk in the sector. They want to manage risk down,” he said.

“We don’t think the government is going to create a systemic risk by trying to avoid one.”

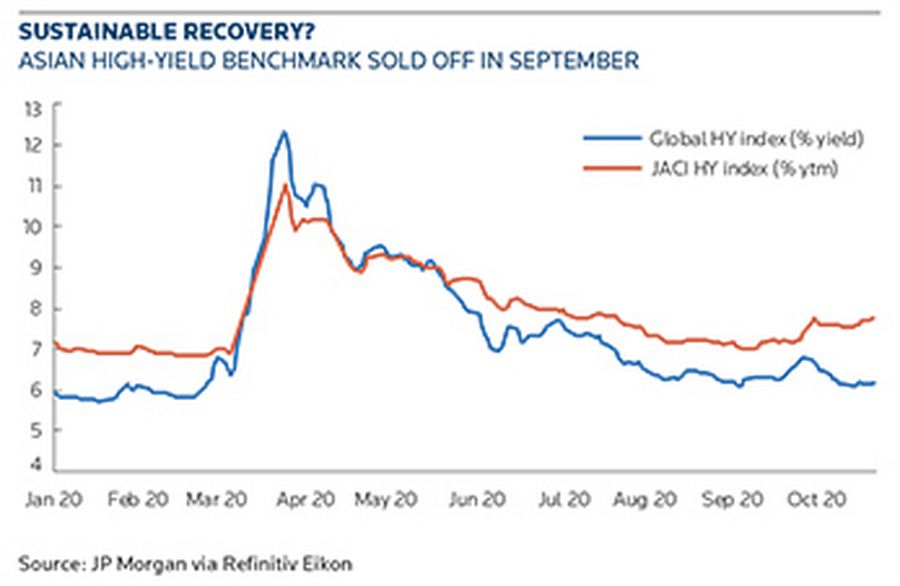

Nonetheless, the Evergrande saga has given investors pause for thought, dragging prices down across the sector. The average yield on Asian high-yield bonds has jumped to 7.6%, according to the JP Morgan Asia Credit Index, up from 7% in early September, when it came within a whisker of February’s pre-Covid levels.

As of October 6, the spread between Single B and Double B China property bonds has widened 60bp-80bp for two and three-year paper in just a month.

“Valuations have been reset from the summer’s peak in performance, especially for lower rated property bonds,” said Monica Hsiao, CIO and founder of hedge fund Triada Capital. “Since March and April we saw a huge rebound given all the liquidity chasing yields, and in recent weeks – especially post the Evergrande saga – bonds have been repriced with wider dispersion. What has come out of it is more credit differentiation which is actually good for people like us who focus on fundamentals.”

Chen Yi, head of global capital markets at Haitong International Securities, said China’s curbs on excessive debt are a very good sign for investors.

“When the government wants to control the leverage in the property sector, it is a good time to buy more bonds, if you are confident in the sector and in the name,” he said.

RED LINES

Chinese regulators in August introduced a pilot scheme requiring 12 developers to submit financial data each month. The guidance sets three “red lines” measuring leverage, gearing and liquidity. Companies will be allowed to increase their debt by 5% per year for passing each of the three ratios, up to a maximum of 15%. The guidelines are expected to be rolled out to all major developers by early next year.

To stay within the red lines, developers must maintain a liability-to-asset ratio (excluding advance sales and contract liabilities) of no more than 70%, net gearing of no more than 100%, and unrestricted cash to short-term debt of at least 1x.

Albert Yau, CFO and executive director at property developer Zhongliang Group Holdings, described the policies as “quite reasonable”, noting that developers can still grow their debt by 10% if they hit one of the red lines.

“The key here is for some developers, equity in the longer term will be the focus, other than raising debt,” said Yau.

Evergrande, for example, has recently announced plans to list its property management business and an electric vehicle subsidiary. KWG Living and Shimao Services are both in the market with Hong Kong IPOs this week.

On the debt side, Yau expects the policies would lead to fewer surprises for investors from unexpected big new issues that put pressure on the overall market, but is confident that quotas will be granted for genuine refinancing requirements.

“I don’t see any problem obtaining NDRC quota for refinancing based on the guidelines issued last year,” he said. “Actually it’s a good thing.”

Hsiao said the new policies for developers were more tailored than China’s previous efforts to reduce financial risks.

“Generally this will temper the equity upside, but it should be largely healthier for credit in that it is forcing the developers to deleverage or at least restrain themselves from aggressive expansion fueled by debt.”

Fredric Teng, head of high-yield capital markets for Greater China North Asia at Standard Chartered, said the Evergrande episode was a reminder that high-yield credit can be a volatile asset class.

“The lessons learned here are, for issuers, always plan ahead. Try to fund ahead,” he said. “For investors, diversification is a very important part of risk management. Yes, Evergrande is very attractive from an investment return standpoint but it comes with volatility.”

BEYOND PROPERTY

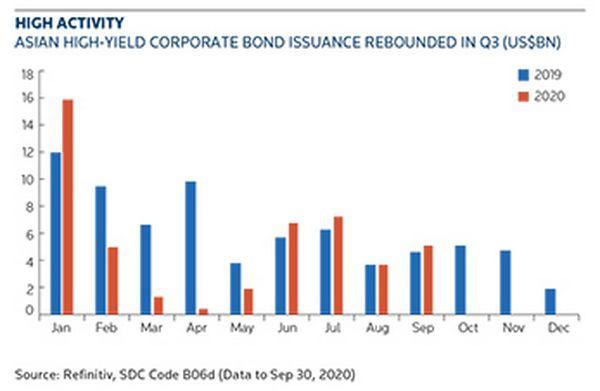

Despite the renewed scrutiny, China’s property sector still accounts for the vast majority of high-yield bonds sold in Asia.

Developers with high-yield or cross-over ratings sold almost US$1.9bn of US dollar bonds in the week beginning October 12, after a pause for China’s golden week holidays starting October 1. Deals have come from across the credit spectrum, from Fantasia Holding’s US$200m three-year non-call two at 10.15%, rated B+ by Fitch, to a US$300m five non-call three from Logan Group at 5.3%, rated BB by Fitch. Greenland Holding Group, which – like Evergrande – has breached all three of China’s new red lines, according to analysts, was able to sell a US$250m 1.5-year bond offering, rated Ba2 by Moody’s, at a yield of 6.95%.

The high yields on offer in the property sector are a problem for others.

“Apart from the LGFVs, I don’t think the market will come back in the near term because first of all the yield is not affordable for the issuers,” said Chen at Haitong. “Second, given that the majority of past defaults come from the non-property sector, investors have concerns about reinvesting.”

Chinese issuers outside the property sector have often struggled to gain traction with investors. Wind and solar power company Concord New Energy Group, rated BB– by Fitch, priced a US$90m three-year green bond in September at 10.75%, raising just US$6.5m of new money alongside an exchange offer.

The default of Peking University Founder Group on US$3bn of offshore bonds has not helped. The administrators this year rejected claims from holders of offshore bonds supported by a keepwell deed from the onshore parent, highlighting the legal shortcomings of a popular credit enhancement mechanism.

Felipe Duque, partner in the international capital markets practice at Allen & Overy, said the PUFG case confirmed what lawyers already knew about the differences between a keepwell deed and a guarantee. He said the clarity provided by the restructuring was a “healthy development”, similar to how Indonesian apparel maker Delta Merlin Dunia Textile had taught investors in 2019 not to assume that the interest reserve account, without proper structuring, would be used to service coupon payments. (Duniatex issued a US$300m debut bond in 2019, when it was rated BB–/BB– (S&P/Fitch), but defaulted on its first coupon payment.)

“These have led to some refinements in documentation to make things a bit more predictable,” he said.

There have been some success stories outside of China property. Fosun International, the owner of lifestyle brands including Club Med, on October 12 priced US$400m of five-year non-call three bonds at 5.95%, well inside initial guidance of 6.4%, to refinance a 6.875% note maturing in 2021. The new notes are rated BB by S&P.

Still, convincing other Chinese companies to engage with international bond funds remains a challenge.

“You’re talking about a market where the issuer has many other funding opportunities, be it via the onshore bond market or the loan market, both onshore and offshore,” said Teng at StanChart. “Is there an opportunity within this existing market to diversify? Absolutely yes.”

SOUTH-EAST ASIA

Beyond China, it has been a difficult year for lower-rated issuers. Indonesia, a mainstay of the Asian high-yield market, has seen more restructurings and distressed exchanges than new fundraisings this year.

Since May, MNC Investama, Garuda Indonesia, Modernland Realty and Alam Sutera Realty have either restructured their bonds or sukuk or made proposals to exchange them, as liquidity dried up ahead of debt maturities.

In the primary market, chemical producer Pandita Industries came up short in August with its bid to print the first Indonesian high-yield bond for over six months. The privately owned company, which makes downstream and intermediate chemical products, had been aiming to raise US$200m from its debut offshore bond with expected ratings of B–/B–.

Coal miner Indika Energy, rated Ba3/BB– (Moody’s/Fitch), finally ended the lull in mid-October with a US$450m 8.25% five-year non-call two.

“The recovery has been somewhat uneven,” said Piyasena at Fitch. “China definitely is a bright spot, whether you look at property and other policy-driven sectors, or the industrial machine. Retail has come back. But when you move to countries like Indonesia things are much slower. The property sector and the coal sector are areas we are quite concerned about there.”

In India, JSW Steel (Ba2/BB–) was able to print a US$500m 5.5-year bond at 5.95% on October 12, but Vedanta Resources’ curve took a heavy hit from a failed attempt to take its India-listed subsidiary private.

“We are starting to see more credit differentiation in the market, and liquidity matters,” said Piyasena. “We have already seen a number of distressed debt exchanges, and we expect to see many more as days and months roll by – especially in Indonesia.”

Further ahead, the potential of Asia’s emerging markets mean investors cannot afford to ignore the region as the turmoil from Covid-19 subsides.

Duque at A&O tips Vietnam as a source of future high-yield issuance, after a number of companies approached the international market in 2019.

“Long term, if you look at the demographics, the trade flows, we believe that could be the third big market to develop outside of China,” he said. “It still feels like early days. Issuers are still very focused on pricing, ultimately… and it’s hard to beat onshore funding currently.”

Hsiao at Triada sees event-driven opportunities in South and South-East Asia.

“Outside of China there are interesting corporate event plays now in secondary markets,” she said. “We are looking at India, Indonesia at micro-stories, especially as some regional corporates had been collaterally affected in sentiment by Modernland’s default and Alam’s distressed exchange.”

For further details of the speakers, please click here, or view the digital version of this roundtable here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com