ABN AMRO is in the midst of a sweeping overhaul that will see it shrink to become mainly a Northwest European retail bank. But there’s one exception to that downsized model that the Dutch lender is expected to reaffirm at its investor day next week: its commitment to remaining a top-three global derivatives clearing bank.

ABN is one of the three largest derivatives clearing banks in the world by revenues, putting it alongside giants such as Citigroup and JP Morgan at the heart of a vital pillar of the post-financial crisis regulatory landscape. In contrast to its US peers, though, ABN has shrunk its investment bank drastically in recent years, leaving little of note outside its home market beyond the clearing business.

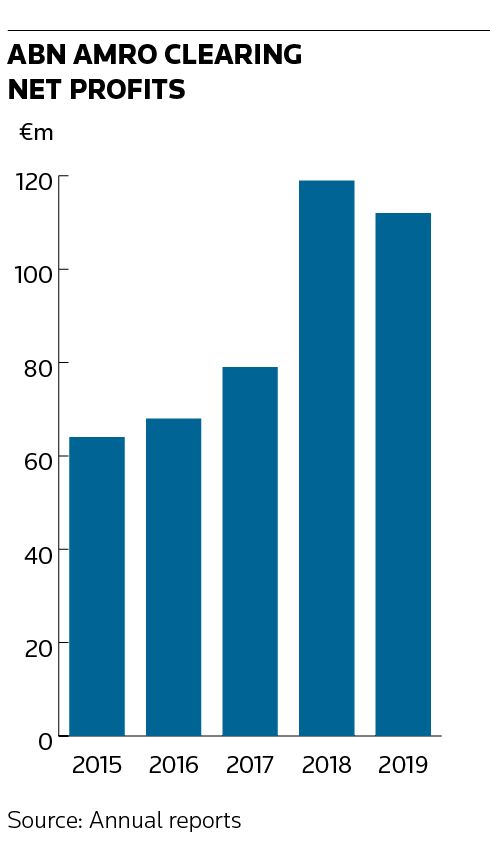

The decision to retain this unorthodox mix of activities has raised questions among analysts and investors, who wonder whether ABN has been unable to find a suitable buyer for the clearing unit. Focus has intensified further since ABN recorded a US$200m net loss when a US client defaulted during the March market turmoil, wiping out around two years’ worth of clearing profits.

ABN’s new chief executive, Robert Swaak, stuck with clearing while jettisoning other long-held activities after a corporate and institutional bank review this year, arguing it produces good returns and is counter-cyclical. But that is unlikely to put to rest questions over why a downsized ABN is so prominent in this corner of financial markets.

"ABN is very much retrenching to becoming a North-western European retail bank with a very modest markets business. Clearing obviously doesn't make sense in the context of the wider group – it's a legacy of empire building,” said Omar Fall, a banking analyst at Barclays.

Long history

Clearing has grown in importance since the 2008 financial crisis, as regulators have forced large swathes of the over-the-counter derivatives market through central counterparties. These clearinghouses act as middlemen in trades to prevent defaults cascading through the financial system. Banks offer clients access to these CCPs as well as futures and options exchanges in return for a fee.

ABN AMRO Clearing traces its roots back to the early 1980s, when one of its predecessors formed to support futures and options traders in Amsterdam at the first major derivatives exchange outside of Chicago. It grew over the coming decades, partly through acquisitions, including of Fortis’ clearing business in the wake of the financial crisis. ABN AMRO Clearing said in its latest annual report that it is active in more than 150 liquidity centres across five continents with 781 full-time staff.

The clearing business looks very different to those at other major firms – which tend to cater to large institutional clients – focusing more on smaller and medium-sized, quant-driven and high-frequency investors and trading firms, several of which are based in the Netherlands. In another departure from most of its clearing rivals, ABN has been shrinking its investment bank ever since it sold the majority of its markets division to Royal Bank of Scotland in an ill-fated merger just before the financial crisis.

Analysts estimate global markets have accounted for between 13% and 22% of ABN's CIB revenues in recent years (which came to €1.9bn in 2019) while clearing brings in just under a quarter of that CIB total. By way of comparison, JP Morgan earned about US$25bn from trading and securities services last year.

"Clearing is a legacy asset without obvious synergies with the rest of the bank – analysts talk about it every time ABN is reworking their strategy around CIB,” said Robin van den Broek , a banking analyst at Mediobanca. “They see it as diversification from the traditional banking business. Perhaps there's also not a buyer willing to pay top dollar for it."

Off the table

Swaak said on a first-quarter earnings call that everything – including clearing – was on the table as he reviewed ABN's CIB activities. He subsequently said in August that ABN would keep clearing, even as it exited all other non-European corporate banking activities.

“We had a close look at our clearing business, and I am convinced it will continue to contribute profitably to the bank,” he said on an August earnings call. “Clearing has had a historical strong performance. So the ROEs have been good. Clearing also offers diversification to the group, and it is indeed very counter-cyclical."

Van den Broek noted that Swaak is “doing some pretty rigorous things” in overhauling the CIB and the fact that clearing is escaping the axe suggests “it's not that bad a business".

“Then again, if you don't have a buyer on the other side, that limits your options,” he added.

Underperforming

There are good reasons why offloading clearing could be a challenge. The business has to hold regulatory capital equivalent to more than 30% of its risk-weighted assets, acting as a drag on returns. That compares to capital equal to 10% to 15% of RWAs for other banking activities.

ABN said in its first-quarter earnings presentation that the return on equity of clearing is above 10%. Analysts dispute this, noting that the business is effectively subsidised by other activities. Clearing on a standalone basis achieved a 10.2% ROE in 2018, but overall it has averaged about 8% over the past five years, according to S&P Global Market Intelligence, reaching a low of 6.8% in 2016.

“It's been an underperforming business,” said Stefan Nedialkov, a banking analyst at Citigroup, compared to the overall bank target of 10% to 13%.

There is also the fact that some of the types of clients ABN clears for can create risk-management headaches. Smaller, high-frequency investors and traders tend to hold less capital and be more reliant on margin financing than large institutional investors, potentially exposing their clearing bank when markets are under extreme stress.

That was evident when a US client default inflicted a US$200m net loss on ABN amid extreme volatility in financial markets during the first quarter. ABN says it has strengthened its risk management following that incident and has noted it had a good track record during volatile periods before this year.

“If a supposedly stable business loses €225m in one fell swoop, double the annual profits, investors will ask whether that's a good business to be in. It all boils down to whether ABN can fix their risk management culture,” said Nedialkov.