Credit derivatives contracts on struggling car rental company Europcar proved worthless when they failed to provide any payout to protection holders on Wednesday, raising once again questions about the efficiency of credit-default swaps as well as corporate bond markets more broadly.

The lack of payout on Europcar CDS is highly unusual even in this often bewildering corner of financial markets, not least because the company’s bonds had been trading at knock-down prices just hours before. It meant that bondholders had missed out on a golden opportunity to effectively make free money by selling Europcar debt at well-above market prices in the auction used to determine CDS payouts.

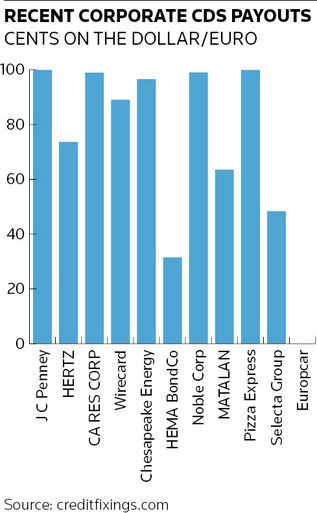

The result reverberated across the wider market, prompting the iTraxx Crossover index tracking European high-yield CDS to narrow by 10bp to 250bp on Wednesday, according to IHS Markit. It also contrasted markedly with other CDS events of late, following a period in which protection holders on average have secured record high payouts.

Critics of CDS are apt to suspect foul play whenever something odd occurs in this complex world. But, so far at least, experts are offering a more mundane theory: investors and traders got caught napping and the basic economics underpinning supply and demand in financial markets failed to produce results.

In the end, banks’ inability to source about €7.4m-worth of Europcar debt for the auction – despite the prospect of people being able to sell well-above market prices – led to the CDS contracts not being worth the paper they were written on.

“Protection buyers were asleep at the wheel,” said Athanassios Diplas, principal at Diplas Advisors, and one of the architects of the CDS market.

“That was always our worst fear: inertia, or people not paying attention. The [€7.4m shortfall] is so small it really looks like neglect almost – they were all counting on someone else to provide liquidity.”

CDS contracts are designed to allow traders to bet on how likely companies are to default without necessarily having to hold any of their debt. When a company files for bankruptcy or doesn’t repay what it owes, CDS contracts are supposed to compensate for the losses creditors would have sustained.

In reality, though, it doesn’t always work out that way given the intricacies of credit markets. And while lawyers have redrafted the fine print in CDS contracts over the years in an attempt to keep track with evolving market norms, credit derivatives still produce unpredictable results.

Hard sell

The CDS credit event following Europcar’s failure last year to make interest payments on its bonds is the latest such example. But rather than some contractual quirk or unexpected debt reshuffling causing the issue, this time it was the CDS auction that was at fault.

This process uses a company’s debt to determine the level of compensation CDS holders should receive. If a defaulter's bonds are trading at a certain percentage of face value – 73% was the average level that bank traders established in the first round of the Europcar auction – CDS holders would normally expect to receive a payout for the remainder of face value – €27 for every €100 of protection they owned in the case of Europcar.

The terms of Europcar’s debt restructuring meant that there were restrictions on trading a large portion – over 80%, according to some estimates – of its roughly €1bn in bonds. Even so, that still left more than enough debt to cover the US$91m of net CDS positions on Europcar identified by DTCC data.

Banks participating in the CDS auction – which act on behalf of clients in this process – had to fill €43.3m of requests to buy Europcar bonds. But in the final round of the auction, they made offers to sell just €35.9m, leaving a €7.4m shortfall.

That was despite the price of the bonds rising steadily from 71 cents on the euro up to a final offer of 87 cents to lure more sellers into this part of the auction. With still not enough bonds to be found to meet the earlier buy requests, the auction automatically settled at 100, providing no payouts to CDS holders at all.

It was “a missed opportunity for market participants given that anybody can participate” in this part of the auction and could have secured “an elevated price” for their Europcar bonds, strategists at JP Morgan wrote in a note to clients.

Anomaly

JP Morgan was the most active in the CDS auction, offering to sell €13m of bonds in total. Other banks such as Bank of America, BNP Paribas, Deutsche Bank, Morgan Stanley and Societe Generale offered just €1m of debt each.

"It's a bit of an anomaly," a credit strategist said. "There was no one selling bonds into the auction."

One working theory among traders and investors is that credit markets were simply caught flat-footed. “Maybe working from home and this early in the year, people didn’t get the alert that this was happening and didn't participate,” said one seasoned investor.

Mishaps in CDS can sometimes prompt a rethink of how certain features of the market work, though few are calling for that just yet in this instance. Diplas notes that the process that led to the Europcar result is a "feature, not a bug" of how the auction was designed.

“We warned people from the beginning to be aware that these things can happen if they don’t provide liquidity,” said Diplas. “You need enough people to participate actively in the auction to have proper settlement. If people don’t come in, that’s what you end up with."