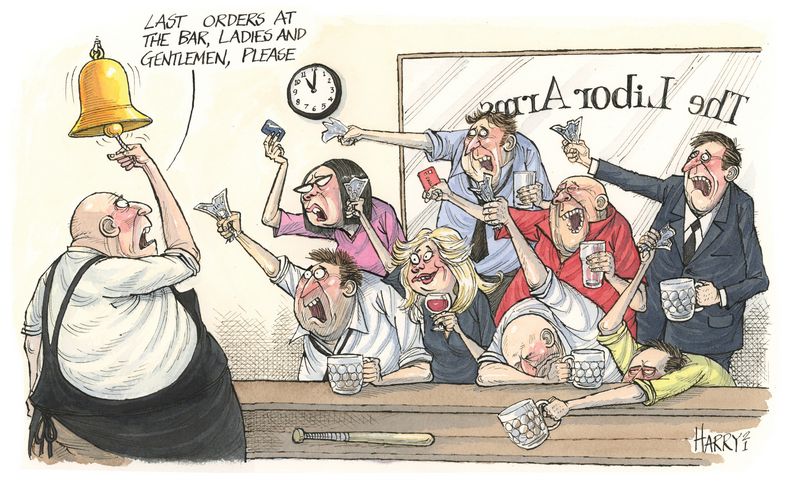

Covid-19 was a major distraction for everyone in 2020, including those in the midst of the huge task of transitioning Libor to a new set of risk-free rates. Nevertheless, at the end of December 2021, Libor as we know it – for all but some important US dollar benchmarks – will be no more.

![]()

Libor, the average rate at which banks borrow unsecured funds across a number of terms and currencies, and the reference rate against which the small matter of some US$350trn in financial contracts have been written, is on the way out.

Faith in the rate as a viable benchmark has been on the wane for some time, driven by a collapse in the market for wholesale bank lending and the rates submitted for inclusion sometimes based on “expert judgement” rather than actual transactions. It is a truth universally acknowledged that Libor was no longer fit for purpose.

Notice of its impending doom came in 2017 when the UK’s Financial Conduct Authority announced its intention to stop compelling banks to submit the rates needed for its calculation. Libor will be replaced with different benchmarks across different currencies with, for preference, the Sterling Overnight Index Average (Sonia) for sterling transactions and the Secured Overnight Financing Rate (SOFR) for those in US dollars.

That trajectory has been known for some time – and market participants and regulators have been busy preparing the groundwork for months – but with the now tight timeframe in mind, are things on target?

“I think the banks and the big corporates are on track with the timeline,” said Katie Kelly, senior director for market practice and regulatory policy at ICMA. “There’s been so much happening recently and, as we get closer to the cessation date, the more critical it becomes for everyone to prepare for the change.”

For the most part, many of the deadlines within the official timeframe have been hit, with the interaction between regulators and market participants ordered and supportive, even with the drag on resources that emerged during the pandemic.

“What has been impressive with this process has been the way that industry bodies have all come together to work towards transitioning Libor,” said Andrew Petersen, finance partner at Alston & Bird. “There have been some key developments in 2020 to keep the timeline in place.”

Major milestones

In June 2020, the Financial Services Bill was introduced to the UK Parliament, which will bring forward legislation to extend and enhance the FCA’s powers to help manage and direct an orderly wind-down of Libor and to help deal with “tough legacy” contracts (those written without envisaging an end to Libor).

In October, ISDA launched the IBOR Fallbacks Supplement in the standard definitions, thereby reducing the risk associated with the disappearance of a key reference rate in the interest rate derivatives market. Changes came into effect on January 25 2021.

In December, the ICE Benchmark Administration, responsible for publishing Libor rates, began consultation on its intention to cease publication of the settings. The end of the consultation period is expected to confirm December 31 2021 as the final date on which Libor will be calculated for all currencies and terms except for the most active US dollar settings. These have been given an extended lifetime of June 2023 but for legacy products only.

Different paths, same journey

Continued publication of US dollar Libor rates to 2023 is an indication that not all parts of the market are in the same state of readiness for the transition. The news raised concerns, in some quarters, that the whole project was at risk of being disregarded rather than it reflecting a slip down the priority scale during the pandemic. That would be a significant issue for the US dollar market.

“The US dollar market is the biggest, the most important, the most pervasive market and it’s critical to get it right,” said Padhraic Garvey, regional head of research for the Americas at ING. “I don’t think the extension is a sign that the exercise is being rejected; it was just evident that stuff hadn’t been done and a realisation that forcing the transition through for 2021 ran some risks.”

So the extension reflects a level of pragmatism being applied to the task in unprecedented times. The majority of the deadlines hold.

“The timetable continues,” said Petersen. “I don’t think the extension should be seen as a spanner being thrown into the works. It’s a recognition that legacy issues remain and that a bit more time is needed to work through the transition in an orderly fashion. The regulators are still encouraging new business to be written against SOFR.”

Nevertheless, there are still some technical issues that need to be ironed out in order to smooth the process. SOFR, for instance, needs more work before it reaches the point where it is widely adopted in transactions and becomes the liquid benchmark of choice.

“We need the development of robust SOFR term rates to see it being more accepted as an alternative benchmark rate in the market,” said Garvey. “That should be in place by the middle of 2021.”

Quicker in the UK

Sonia, as the preferred benchmark in sterling, is further down the path in being embraced as a benchmark, and the transition has been progressing faster in the UK than in the US.

“The UK has been quicker to adapt,” said Greg O’Reilly, a senior analyst in Moody’s structured finance group. “Sonia has been in existence since 1997 and we consider it has been stable enough to use for analysis since 2006. Credit and liquidity risk are very limited, and there is history.”

New business in the bond markets has already made the switch over to Sonia, for instance.

“There have been no new benchmark floating-rate notes or securitisations written against sterling Libor with a maturity after 2021 for some time,” said Kelly. “And most deals written post-July 2017 have included fallback language to accommodate the change to a new rate, either on cessation or non-representativeness of Libor.”

And, in derivatives, liquidity providers were encouraged to adopt Sonia instead of Libor as the benchmark in sterling swap from October 27.

It is fair to say, though, that transition in syndicated loans has been slightly slower. In a move directly related to the pandemic and its effect on corporate cashflows, the FCA announced that the original target of completing transition away from Libor across all new sterling Libor-linked loans by the end of the third quarter of 2020 was to be extended to the end of first quarter of 2021.

“Many companies had different priorities over Covid,” said Kelly. “Managing liquidity over the period of volatility was more of a concern for some but, overall, the market managed well. And for most of the big players, the transition remained of the highest importance.”

Not so fast

While the biggest companies have the resources, both in terms of human capital and technology, to cope with the demands of the transition, that is not the case throughout the economy. For some, there may be fewer incentives to make a start on making the switch.

And while the consensus is that the industry (at least outside the US) is on track, it pays not to be complacent.

Francois Jarrosson, a director for hedging and derivatives in the global advisory team at Rothschild, has a warning to that affect. “We’re not far enough ahead,” he said. “There are still some uncertainties that need to be removed. There’s a mismatch risk around the timing of trigger events of loans and associated hedges. We need an easily managed standard for interest calculations and we need greater liquidity in non-linear derivatives. If you ask treasurers at random whether they are ready, then the answer is most likely no. There’s little benefit in being a first mover. There’s more risk in doing the wrong thing.”

There are also major problems for legacy deals where any changes to terms and conditions need consent.

“You need a quorum to accept any changes, which would be difficult enough on its own,” said Jarrosson. “But in many instances loans, bonds and derivatives have been sold on and you will find it rather tricky to harmonise the conflicting interests of lenders, bonds holders and counterparties.”

The effort on gaining consent to change contracts on bond, loan and associated derivatives deals is compounded in the case of securitisation.

“The fundamental problem for deals without an active sponsor is that there is nobody driving the change,” said O’Reilly. “It can be very difficult to get fallback language on underlying securities and loans amended, and none of the parties are required under the documents to do anything yet.”

So despite extensive progress, there remain problems to overcome, questions to be resolved and the spectre of a synthetic Libor for certain legacy trades. Nevertheless, the Libor transition juggernaut is rolling and cannot be ignored. The quicker the market adjusts of its own accord, the better for everyone.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com