Crisis guide:

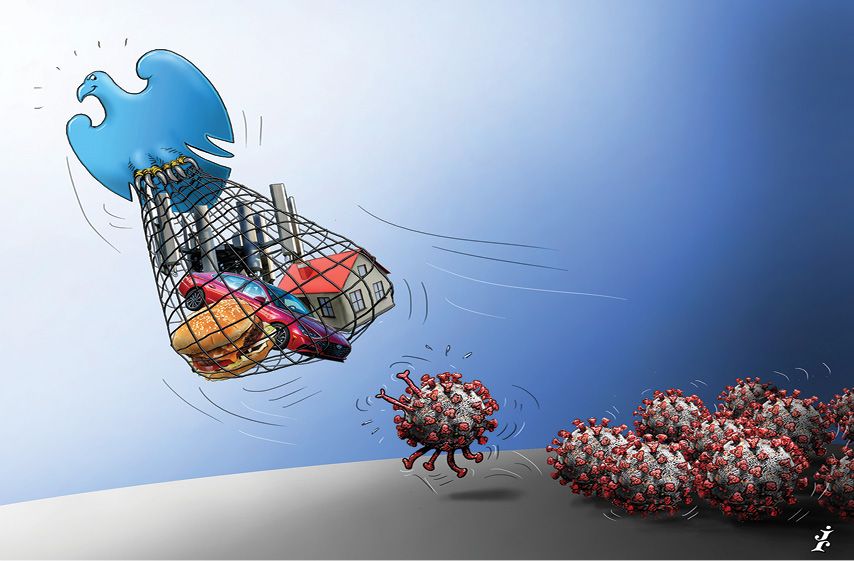

In a year when a once-in-a-century pandemic disrupted everything, one bank stood out when it came to bringing together technical and structuring expertise, a willingness to take risk and sheer determination. After winning market share with some of the year’s premier debuts and funding established borrowers whose businesses were rocked by the health crisis, Barclays is IFR North America Structured Finance House of the Year.

Barclays’ securitisation team managed to shine as issuers sought a steady hand to guide them through the trickiest market conditions since the 2008 financial crisis and the weakest year for supply since 2015.

“When it’s the toughest and darkest hour, that’s when you redouble your effort,” said Marty Attea, head of securitised products origination at Barclays.

Private equity firm Roark Capital, which hired Barclays to structure all six of its whole business securitisations in 2020, endorsed Attea team’s outreach and the bank’s commitment to its clients.

“It’s a combination of the consistent interaction, service and their deep knowledge of the market and investors,” said Greg Smith, head of business development and capital markets at Roark.

During the early days of the virus outbreak in mid-March, credit markets came to a screeching halt as spreads gapped out and bond prices plunged. In a rapid response to avert a market collapse, the government pumped cash to affected workers and businesses, while the Federal Reserve rolled out novel programmes to jump-start lending.

Getting moving

Despite all the unprecedented federal aid, securitisation was one of the last parts of the bond market to reopen. After seeing almost no supply for five weeks over the course of March and April, Barclays played a key role in getting the market moving again.

On April 16, Barclays was a joint lead for the first public ABS deal – a US$800.5m prime auto issue from General Motors. A week later, it structured the first post-Covid-19 equipment securitisation – a US$1.1bn offering from Dell.

In subsequent weeks as investor appetite picked up, Barclays helped to reopen the market for issuers of esoteric assets. It was the lead-left for GoodFinch’s US$252m solar residential loan deal and a US$360.5m cell tower issue from Vertical Bridge.

Barclays stood out for raising funding for Avis and Hilton Grand Vacations, whose revenues had plummeted as pandemic decimated car rental and timeshare demand.

Another feather in Barclays’ cap was its structuring of the debut US$368m securitisation for fintech lender Affirm in July. The deal was the first point-of-sale ABS issue where collateral does not pay interest and came when investors were cautious about consumer credit.

Affirm’s buy-now, pay-later model has been untested in a recession as it emerged after the previous economic downturn.

“We just showed them a lot of creative ideas and said this is how we are going to get the ratings agencies and investors comfortable with the new platform,” Attea said.

After two days of calls and video meetings with nearly 50 investors, 30 of them participated in the deal.

The strong debut led Barclays to bring two more ABS issues for Affirm, which went public in January 2021.

Barclays also retained its dominance in whole business ABS where it fetched record-low pricing on the debut offerings from fast-food chain Wingstop and restoration and cleaning franchisor ServiceMaster Brands.

Even after a rather brisk second half, ABS issuance totalled US$197.4bn in 2020, down 19% from the US$245bn a year earlier, Refinitiv data show.

As a result of the Attea team’s efforts, Barclays rose two notches on the ABS league table from its pre-Covid placement, finishing top for 2020, according to Refinitiv.

Barclays ended eighth and seventh in RMBS and CMBS markets, respectively.

The bank played a key role in restructuring of MFA Financial’s debt as the mortgage real estate investment trust struggled to meet margin calls from its repo lenders during the most chaotic market days in March. Barclays, Athene and Apollo Global Management came up with a US$1.6bn financing package for MFA, paving the way for the REIT to return to the RMBS market later in the year.

Barclays also structured a US$423.5m CMBS secured by Sotheby's headquarters in New York. The struggling auction house has ratings of B+/B1.

“I think we all just adapted,” Attea said. “This is the time you show up and say, ‘It’s okay, we’re going to get this deal done for you. We’re in it together.’ This business is all about trade and relationships.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com