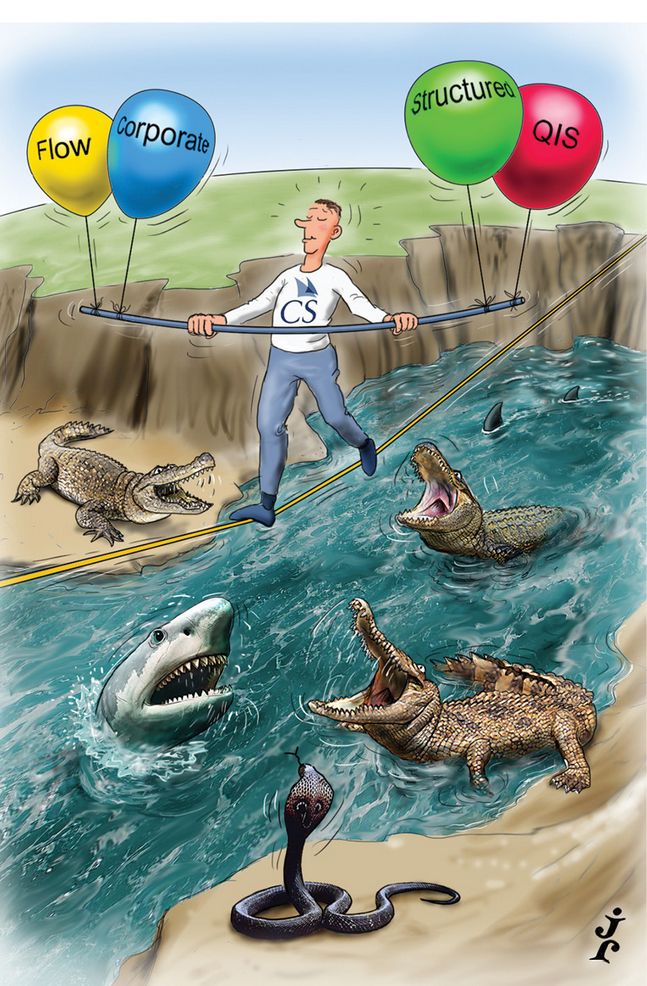

The right balance:

Equity derivatives businesses either flourished or foundered in 2020: flow trading volumes ballooned even as many exotics desks struggled. For continuing to grow a balanced and diversified business in this challenging environment, Credit Suisse is IFR’s Equity Derivatives House of the Year.

The global pandemic laid bare the sharp contrasts in banks’ equity derivatives units like never before.

March’s stock market plunge – accompanied by rocketing volatility and companies slashing dividends – created the most perilous environment for exotics desks in more than a decade. At the same time, surging volumes in simpler, flow products triggered a trading bonanza.

In an environment that promised outsized profits as well as huge potential losses for banks trading these markets, Credit Suisse stood out among its peers for having established a durable and diversified business model that rose to the challenges and grasped the rewards on offer.

“The cards that 2020 dealt us were the ultimate stress test of everything that we had been working towards in terms of being able to run a diversified business that could perform in all market environments,” said Michael Ebert, co-head of cross-asset investor products and co-head of financing and corporate derivatives. “We’re incredibly proud of how it worked out.”

Credit Suisse has long specialised in equity derivatives, but its recent success traces its roots to a reboot of the investment bank several years ago designed to take full advantage of the firm’s enormous private banking and wealth management unit.

And while aligning with the private bank was a top priority, management also decided it was crucial to create a well-balanced equity derivatives business. That meant not relying mainly on selling vast quantities of retail structured products to generate revenues – a strategy that ultimately upended some rivals when markets plunged in March.

Credit Suisse invested heavily to expand its institutional and corporate client base, while also developing its flow trading capabilities. Headcount grew by 40% from mid-2017 and the bank also ploughed significant resources into technology.

“We really looked at our capital commitment, our headcount commitment – how we were investing in our business – and made some pretty dramatic changes in order to give ourselves a more rounded and balanced portfolio of products,” said Ebert. “And that is what has served us extremely well.”

Credit Suisse reported its best equity derivatives results in four years in 2019. The first quarter of 2020 was the best three-month period in the last decade, while revenues roughly doubled across all client types in the first half of the year to produce the bank’s best results in five years across all product segments.

That included significant market share gains in flow trading and a standout period in corporate equity derivatives, extending financing to a range of hedge funds, private equity and institutional clients.

And in contrast to many European rivals with large structured businesses, Credit Suisse avoided suffering heavy losses when these markets swooned. Not concentrating too heavily on one region or one product type – including a concerted effort to move away from autocallable structures – helped bring greater balance to exotic books. A sustained focus on recycling risks from these exposures was also pivotal.

“We’re trying to be disciplined, we’re trying to be systematic and we’re trying to be widespread by the way we do it,” said Julien Bieren, head of structured equity structuring.

UPS Investment Trust, the pension plan for the multinational delivery company, was one investor that bought tail risk hedges from Credit Suisse as part of the bank's recycling of exposures from its structured business. When the value of these hedges increased significantly for UPS during the March turmoil, Credit Suisse honoured their agreements to let the company cash in those gains.

"Credit Suisse were excellent during the crisis," said Roxton McNeal, head of multi-asset investment strategy and allocation at UPS Investment Trust. "They were one of a few banks that really stepped up in these dislocated markets when we wanted to take our profits."

Weathering the storm better than many of its peers put Credit Suisse on a solid footing when client demand for structured products materialised, with the bank recording a substantial growth in structured note issuance in 2020. Here again technology was key, allowing the bank to package and distribute products to wealth management clients on an industrial scale.

“Even during the crisis there was a constant demand for products,” said Olivier Charhon, co-COO for global trading solutions. “You need to be able to deliver those products in a flexible manner.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com