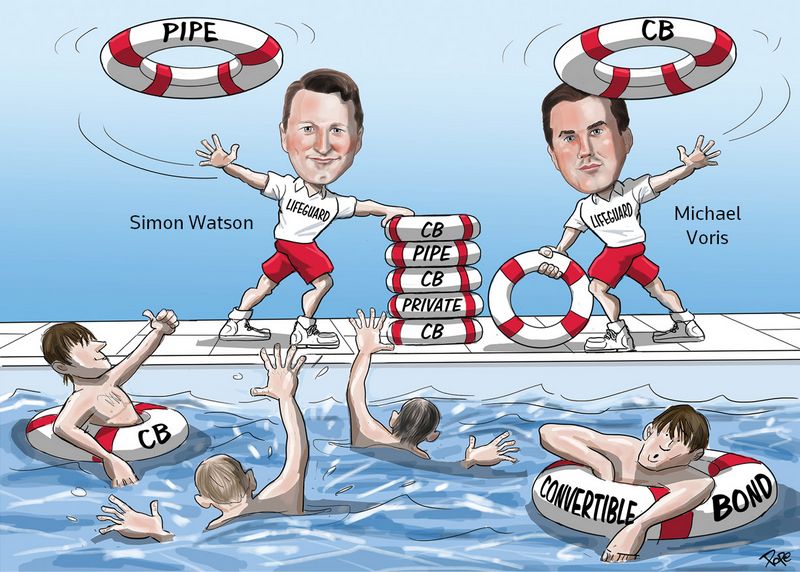

The lifeguard:

When the rubber hit the road, Goldman Sachs found a structure to meet clients’ needs. Public, private, structured, multi-tranche or rescue, the US bank was leading for both Covid-19 losers and winners. Goldman Sachs is IFR’s Americas Structured Equity House of the Year.

![]()

The year did not turn out as expected, beginning with opportunistic convertible financings in January and February, a brief closing in March, followed by fundraising from distressed companies, and ending with a flurry of opportunistic financings.

Those distinct phases of the year produced a massive increase in equity-linked product, and even more demand for bankers with the nous to know which structure – and marketplace – would suit each client.

Overall, 160 US companies raised US$89.2bn through publicly marketed convertible bond offerings in 2020, nearly double the US$49.3bn raised in 2019.

Issuance in the US was the highest since 2001, while Goldman’s market share of 17.9% was the highest for any bank since 2013. Goldman was a bookrunner on 68 convertible bond issues, earning league table credit of US$16bn.

“It’s personally hard to remember pre-Covid,” said Goldman’s co-head of Americas ECM Simon Watson.

“At the start of the year there was a strong tailwind from high equity prices,” said Michael Voris, who oversees equity-linked origination and was named a partner at the bank in November. “The biggest concern going into the year was the back half of the year amidst what, no matter what happened, was going to be a pretty contentious [presidential] election.

“There was a belief amongst many companies about getting to market early to take advantage of high equity prices and what was a fairly robust convertible market.”

MongoDB, a provider of database solutions for enterprises, was among those that turned to Goldman, in its case for an upsized US$1.15bn five-year CB in January that was used to refinance a deep in the money CB. That deal, which printed at a 0.25% coupon and 42.5% conversion premium, used the full-day VWAP as the reference price to ease the process of investors unwinding or putting on new hedges.

In April, when the realities of staying afloat in a pandemic became apparent, Goldman helped lead a three-tranche US$6.5bn fundraising for cruise ship operator Carnival, including a US$2bn three-year CB. The bank would earn outsized fees a month later on a similar US$2.4bn four-part liquidity plug for Norwegian Cruise Line, IFR’s Americas Structured Equity Issue of the Year.

Booking Holdings, the parent of Priceline; Burlington Stores; Sabre; Callaway Golf; National Vision; Pioneer Natural Resources and American Airlines were others that relied upon Goldman Sachs to sell convertible bonds to fund operations through the pandemic.

Each represented a unique challenge and had its own solution. For example American Airlines waited until its peers had funded, despite talk of it potentially slipping into Chapter 11. The delay meant hedge funds – the key audience for recaps – could roll profits on earlier trades into this one. This was important as a wide credit spread and very limited borrow meant this was a trade without a safety net for buyers. It also kicked off on a Sunday to get ahead of a busy week of issuance.

The public market route was not always the right one and Goldman often found private market options, outside the scope of league tables.

In May, Goldman was among a group of banks that helped facilitate a US$1.75bn CB private placement (PIPE) by Apollo Global into Albertsons, paving the way for the grocer’s US$800m IPO a month later.

On the advice of Goldman, Twitter sold a US$1bn CB PIPE to Silver Lake Partners in March as part of a settlement with activist shareholder Elliott Management. Wayfair, Nutanix and Farfetch, all of which could have funded publicly, turned to CB PIPEs led by Goldman to shore up funding or signal strategic turns in their businesses.

There were also large numbers of opportunistic convertibles issued. Shopify signalled a turn toward more opportunistic funding in September with a US$2.3bn, combo equity and CB funding bookrun by Goldman with the five-year CB printing at a coupon of just 0.125% with dilution at a 60% premium, the highest on a sub-1% CB since 2013.

Square, with Goldman as sole bookrunner, would push still higher in November with a US$1bn two-tranche, 5.5-year zero percent and seven-year 0.25% coupon, both converting at a 62.5% premium.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com