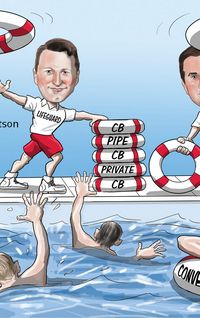

Hopes for recovery

A well-timed, swiftly executed S$850m (US$630m) convertible bond helped re-establish Singapore Airlines as a blue-chip issuer and reduce its dependence on state support.

Like all airlines, SIA was battered by the collapse in passenger traffic as a result of the Covid-19 pandemic. Singapore’s flag carrier lost S$3.47bn in the six months to September 30, compared with a net profit of S$206m over the same period in 2019.

It had turned to controlling shareholder Temasek Holdings in May to raise S$8.8bn from a rights issue that was wholly underwritten by the Singaporean sovereign wealth fund, which holds 55.46% of SIA.

Having ensured its survival, SIA then launched a five-year CB on November 12 that was a crucial test of its ability to raise funds without the support of the state fund.

Codenamed “Project Swift”, the deal was launched immediately after news of a breakthrough in the search for a coronavirus vaccine and the announcement of a Singapore-Hong Kong travel bubble. The entire execution was completed over a period of 24 hours from inception to pricing.

Sole bookrunner HSBC provided pricing certainty to SIA and underwrote the entire transaction prior to launch, a key consideration for the company as it weighed different funding options.

The announcement from drug companies Pfizer and BioNTech on November 9 that their coronavirus vaccine was more than 90% effective in clinical trials offered hope that global economies could soon return to normal. Global stock markets and especially airlines and other travel-related stocks jumped on the news the next day, with SIA’s shares surging 14%.

The SIA deal received overwhelming demand, riding on the renewed interest in investments tied to a post-pandemic recovery and a rotation from new economy stocks to traditional cyclicals. A rare opportunity for equity-linked investors to gain exposure to Singapore through a non-property play also helped.

The offering was more than four times oversubscribed, attracting US$3.5bn of demand. More than 100 investors participated in the transaction, including outright investors, hedge funds, equity investors and some private banking clients.

This allowed SIA to increase the deal from a base size of S$750m and price it at a coupon of 1.625%, within the 1.25%–1.75% range. The conversion premium of 45.77%, from a 42.5%–52.5% marketed range, was the highest for any Singaporean convertible bond since 2008.

The book was very different from the Temasek-led rescue package earlier in the year. About 69% of the deal went to hedge funds and 31% to long-only investors. Geographically, 45% was placed beyond Asia.

The credit spread of the CB was assumed at 300bp, implied volatility at 30% and the bond floor at 92.

The CB traded around 100.75–101.50 on its first day and gained further as market sentiment improved, finishing 2020 around 108.

The deal helped SIA re-engage with the capital markets. Less than two weeks later, it sold a S$500m 10-year bond to a small group of private investors.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com