In search of support

After a slump in international issuance in 2020, fresh thinking may be needed to restore the appeal of the Japanese yen as a global funding currency.

The grand buildings of the Bank of Japan and Tokyo Station stand as testament to Japan’s embrace of modern ideas at the end of the 19th century. The mastermind behind both structures, Japanese architect Kingo Tatsuno, spent four years studying architectural design at the Royal Academy of Arts in London and is credited as being the first to introduce European-style brick masonry to Japan.

The change in architectural style was mirrored in the wider society. The turn of the 20th century marked a period of rapid development for Japan, when the abolition of many old-fashioned restrictions helped unlock the country’s rapid economic development.

After a miserable year in 2020, it is the architecture of Japan’s capital markets that is now in need of a similar, transformational approach.

The yen has largely retained its value throughout the Covid-19 pandemic, along with its status as a safe-haven G3 currency, but it has lost its appeal as a global funding currency.

Indeed, cross-border yen issuance plummeted a whopping 65% in 2020 to its lowest in 36 years. International issuance in yen totalled just ¥1.164trn (US$11.26bn), according to Refinitiv data, compared to ¥3.309trn in 2019 and the worst year since 1984.

Bankers in Tokyo said foreign issuers and Japanese investors were equally affected by the breakout of Covid-19 and the subsequent response from central banks around the world, which scrambled to provide ample liquidity to help battered economies deal with the effects of the pandemic.

On the supply side, easy money elsewhere led to a decline in issuance from French banks, which have been the main issuers in the cross-border yen market in recent years, while other global banks simply looked elsewhere. With central banks in many emerging economies having adopted bond purchase programmes, according to a BIS report, regular sovereign Samurai issuers from emerging economies also stayed away.

On the buyside, uncertainty around Covid led Japanese investors to shift their focus to the domestic market. Pension funds, for example, were expected to be main buyers of bail-in-able bonds after banking accounts reduced their exposure because of higher risk weighting, but they turned defensive after suffering losses when the breakout of the coronavirus sent spreads widening for both foreign credits and domestic hybrid bonds.

Even after market conditions improved, pension funds remained reluctant for fears that the market could become volatile again if second and third waves of the virus hit Japan.

“They shifted focus out of the cross-border yen market to the domestic market as they chose to make money steadily by doing the ‘BoJ trade’,” said Akihiro Igarashi, debt syndicate head at Nomura. The Bank of Japan trade refers to buying domestic bonds and then selling them to the central bank, which expanded its corporate bond purchases in 2020 to help the coronavirus-hit economy.

Subordinated hybrid bonds were also an attractive alternative. They had been sold off badly when the market became volatile in March to May, but once things settled down, the product became very popular again. Even short-term investors started participating, motivated by the fact that subordinated bonds are more liquid in the secondary market than cross-border yen bonds and hence it is easier to sell whenever they want to take profits.

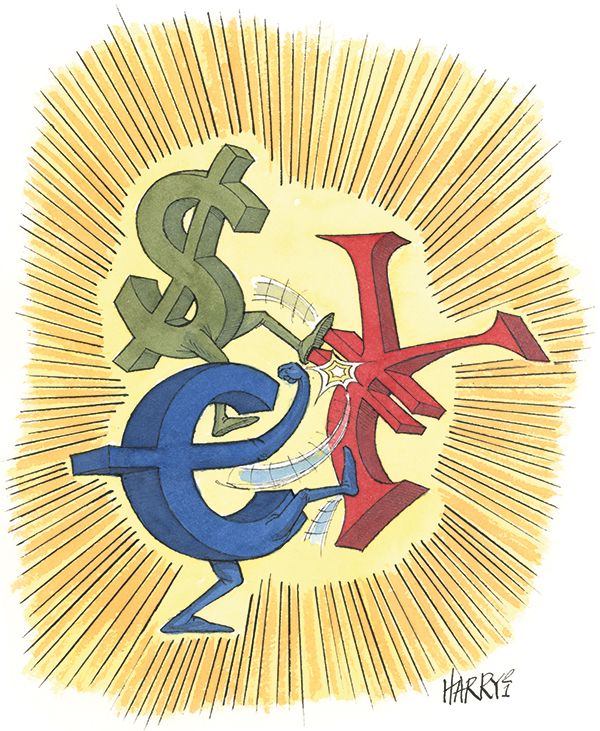

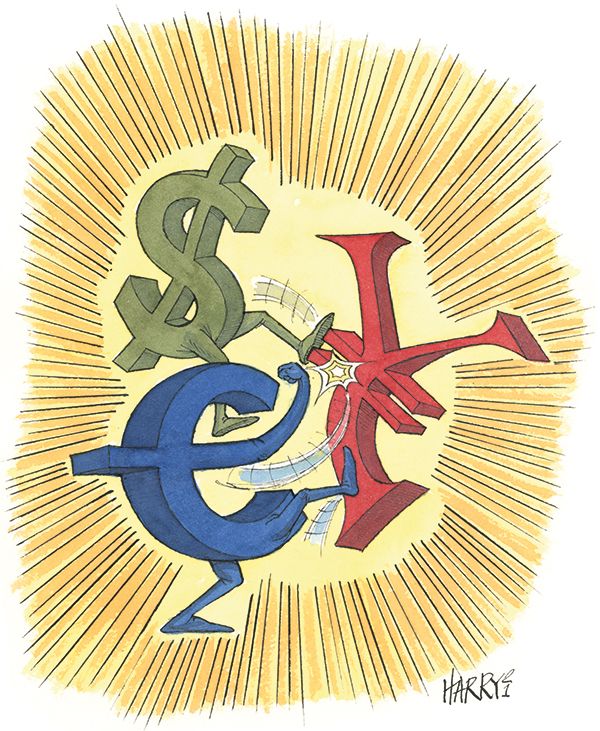

Even after the credit markets stabilised globally in the middle of the year, foreign issuers, although they were well aware of the importance of diversifying their funding channels, chose to issue in their mother currencies or in US dollars, with funding costs declining because of the easing by central banks and the US Federal Reserve in particular.

“Issuers this year were in crisis mode, raising funds from wherever [cheap] funds were available,” said Igarashi. “As a result, the yen market was left as an ‘auxiliary’ to the dollar and euro markets.”

Some bankers expect foreign issuers will return to Japan in 2021 to expand their investor base, but others are sceptical, expecting cross-border yen volume to remain low as long as US and European central banks continue their ultra-accommodative policies.

STILL LOW RISK-TOLERANCE

Notably, the yen market became less attractive to some Japanese issuers, too.

A record-breaking ¥1trn four-tranche deal from NTT Finance, a unit of Japanese telecom giant Nippon Telephone and Telegraph, did showcase the depth of liquidity the market can offer. However, Nissan Motor, rated Baa3/BBB–/A (Moody’s/S&P/R&I), could only raise ¥70bn in the domestic market. Later in the year, the auto maker tapped the US dollar and euro markets to raise more than ¥1trn-equivalent.

The contrast between the response to Nissan and NTT – which has a AAA rating from local rating agency JCR – clearly shows most Japanese investors still prefer bonds with very high ratings, and remain selective to Triple B issuers.

After the Nissan deal, some Japanese bankers and even authorities have spoken out about the need to develop a market for Triple B issuers.

“We realised how small the domestic market is,” said Haruhiro Ikezaki, head of debt capital markets at Mitsubishi UFJ Morgan Stanley.

Masanori Ogiwara, Morgan Stanley MUFG’s head of fixed income capital markets, also noted there is a big gap between the Japanese and overseas markets in the depth of liquidity for Triple B issuers, although he argued Nissan’s domestic and foreign deals should not be compared given the deals priced at different times and in very different conditions.

Many Triple B issuers currently depend heavily on bank lending, and hence they would be in big trouble if banks were unable to lend. In early April, when the government was about to declare a state of emergency, banks did back off lending even short-term money, sending the commercial paper market into a kind of panic mode, with some issuers having to pay an unheard-of 1%.

“They may be faced with limited choices if they cannot rely on banks,” Mitsubishi’s Ikezaki said. “It is an urgent task for us to increase investors’ risk tolerance.” He also said his company should help develop the high-yield bond market.

UNLOCKING POTENTIAL

Other bankers share this sense of urgency to make the yen market more attractive for foreign issuers. To do so, they have tried or are planning to introduce western-style marketing practices.

In contrast to the US dollar and euro markets where most new issues are announced and priced within a matter of hours, it takes days or sometimes weeks to price a bond in Japan. Even NTT Finance needed more than 10 days to price its bond, or even longer if the sounding process is included. Unusually, it needed two days after the final price guidance was set before it actually priced.

Foreign issuers tend to be a little quicker than that in the cross-border yen market, but Aflac did an exceptionally good job last year. In March, with the coronavirus spreading rapidly around the world, the US life insurer shortened the marketing period to one and a half days to minimise its exposure to volatile markets.

Yen bankers stress that the Aflac trade is not a one-off.

“We do tell potential issuers that we can do 1.5-day marketing,” said Kazuma Muroi, executive director at Mitsubishi’s DCM division.

That said, not all Japanese investors can make investment decisions so quickly, and hence a shorter marketing period will result in a lower response.

“It is a matter of choosing size over speed or speed over size, so it’s up to the issuer,” Muroi said.

Meanwhile, SMBC Nikko is planning to introduce the same kind of price discovery process that is standard in the global markets, using more flexible initial price thoughts rather than fixed marketing ranges.

“We haven’t decided on which deal to use IPT, but we do talk about it with some foreign issuers,” said Hiroyuki Kinoshita, head of global fixed income capital markets at SMBC Nikko.

Some bankers are sceptical whether the Japanese corporate culture will accept such global practices. Regional investors are slow to make decisions because of their internal approval system, while some Japanese issuers stubbornly believe they are only able to communicate thoroughly with investors via a long marketing period.

However, the cross-border yen market has fully adopted the pot system, and even the domestic market has started to drop its traditional dependence on the retention format, a sign that Japanese market participants can be convinced to abandon old-fashioned styles. From January, the Japan Securities Dealers Association has introduced a new rule on domestic bond issues requiring bookrunners to share investor information with issuers.

To unlock the yen market’s full potential, Japanese bankers may find they have to design new ways to connect foreign issuers with Japanese investors and deepen the domestic market. As the architect Kingo Tatsuno discovered more than a century ago, new ideas can have a lasting impact.

To see the digital version of this report, please click here

To purchase printed copies or a PDF, please email gloria.balbastro@lseg.com