Asia’s credit markets are facing an uneven recovery in the remainder of 2021, according to a panel of experts at a recent IFR Asia webcast.

Despite a rebound in economic growth, led notably by China, analysts expect the Covid-19 pandemic and the slow reopening of borders will continue to weigh on many Asian economies. That means investors will have to choose their spots carefully.

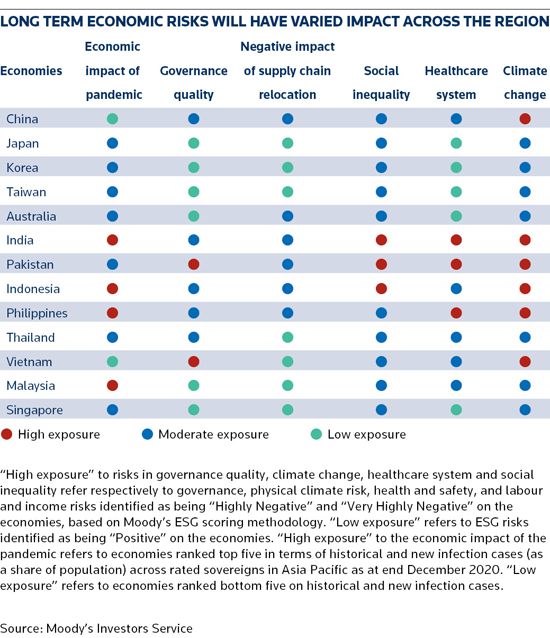

“There is increased divergence in the pace at which the region’s economies are recovering from the pandemic,” Michael Taylor, chief credit officer for Asia at Moody’s Investors Service, said at IFR’s Outlook for Asian Credit Roundtable.

“Although we’ve seen a number of economies around the region starting to show signs of recovery, and although monetary and fiscal policy is quite supportive, some of the economies in the region won’t see a really rapid rebound, and certainly won’t return to the levels of economic activity at the end of the 2019 by the end of this year.”

Shilpa Singhal, portfolio manager and senior credit analyst at NN Investment Partners in Singapore, said the volatility of 2020 underlined the need for “fairly careful credit selection”.

“Market liquidity is not back to normal levels, although it is much improved, and there is a need to be careful how you navigate these markets,” she said. “We are not talking about a post-Covid world yet; it will be a protracted way out.”

The panel, however, voiced confidence in the outlook for Asian credit investments.

Thu Ha Chow, senior credit analyst at Loomis Sayles, agreed that the recovery from Covid will be a long process, but said Asia would continue to lead the way.

“Asia remains a sweet spot. In terms of recovery, it’s probably going to be first to recover. But in terms of prolonged social distancing, with China being the anchor, Asia is also very well positioned to deal with a more prolonged social distancing environment,” she said.

TAPER TANTRUM?

Speakers at the January 26 event also flagged the potential for more rates volatility as the recovery takes shape – correctly pre-empting a sell-off in US Treasuries that has taken the 10-year benchmark to over 1.5%, up from 0.9% at the start of the year.

Manjesh Verma, head of Asia credit sector specialists at Citigroup, warned that tight spreads and low rates suggested investors were being too optimistic.

“If the recovery is a straight line, rates should be much higher than they are now. If the recovery is not in a straight line, and if there are hiccups – which we are more concerned about – then the spreads currently are implying there’s a lot of optimism, which we do not think is warranted,” said Verma, who noted that credit spreads across the region were only 30bp-40bp away from their 2019 tights.

Panellists, however, played down the chances of an increase in US policy rates in the near term.

“We’re going to have to think about tightening, but it is way, way too early to be talking about that,” said Chow.

After a jump in US Treasury yields, investors are looking for central banks to send clear signals that rule out a repeat of the “taper tantrum” that followed the US Federal Reserve’s move to scale back its quantitative easing programme in 2013.

“A taper tantrum would be very negative for this region, particularly if it happened very quickly and abruptly,” said Chow. “If it happened slowly and surely, actually it would be quite good for the credit market generally, because more yield delivers more funds into the asset class.”

Chow said the recent steepening of the US yield curve showed that a strong recovery would inevitably be reflected in higher longer-term rates, even though the US Federal Reserve has been clear that it does not want a repeat of the taper tantrum.

“Consequently, we favour high-yield over investment-grade for the lower sensitivity to rises in US rates and the benefit from a recovery,” she said.

Singhal at NNIP shares a similar view.

“The way out of the Covid crisis is going to be a slow, long-run process. At some point, markets and rates will start pricing that in, but we expect that to be gradual and better managed than post-GFC years,” she said.

CHINA RECOVERY

China is further down the line towards normalising policy, having weathered the coronavirus outbreak first.

“We’ve definitely seen the worst, as it relates to the Covid-19 crisis,” said Patrick Liu, CEO of Admiralty Harbour Financing Group, an advisory firm specialising in Chinese debt capital markets. “The flip side is although overall we see a strong recovery, certain sectors are not really catching up.”

Government measures and easy liquidity conditions have allowed some companies to overcome short-term financial difficulties, and the property sector – which dominates Asia’s high-yield bond market – has performed well. As the focus shifts beyond Covid and policies return to normal, Liu expects more distressed situations around local government financing vehicles and non-property issuers.

“If you look at other sectors, the general industrial sectors are not performing at all,” said Liu.

Taylor at Moody’s agrees that more credit events are on the cards in China.

“We expect that defaults are going to rise, but that’s part of a deliberate policy of introducing more market discipline into the domestic bond market,” said Taylor at Moody’s. “I think it’s a controlled process; we don’t expect the government to allow a great swathe of defaults to happen this year.”

China remains an attractive destination for many investors.

Singhal at NNIP highlights the appeal of high-yield bonds from China’s property sector in a low-rate environment that has left investors searching for yield.

“We think those fundamentals are in a very good place. China is handling the Covid crisis much better than the rest of the world, and is also outperforming within Asia,” she said. “Ultimately, money has to go somewhere.”

PREDICTABLE POLICY

President Joe Biden’s election victory is also drawing interest in offshore Chinese bonds, after a string of surprises in the last few weeks of Donald Trump’s presidency that had targeted specific Chinese companies.

“It’s been very clear that the Biden administration is certainly not going to be seen as taking a softer stance on China in any fashion. I think what is extremely different is the manner in which this is going to happen,” said Chow.

Singhal at NNIP also believes the Biden administration will be less confrontational and more predictable, while Chinese issuers will be more cautious about relying on the US dollar market.

“Predictability and lower supply are both great things for bond markets,” she said. “We love the technicals of low supply, and we love less volatility, more predictability. That underpins our more constructive view on China under the new administration.”

Verma at Citigroup points out that the growing Asian investor base is supporting international issuance from the region, reducing the dependence on US capital.

“We have been seeing an increasing shift from western investors to predominantly Asian, and even within Asia, mostly to Chinese buyers,” he said. “New issuance structures are being explored (Yulan bonds for example) which will particularly be targeted more towards Asian investors.”

OTHER SECTORS

Beyond China, Singhal at NNIP sees value in the financial sector, noting that the Covid pandemic and low rate environment have encouraged rare issuers into the US dollar market, both in senior and subordinated formats.

“Just like the GFC gave birth to the bank capital instruments under Basel III, the Covid crisis did give some impetus for some of the banks to do some pre-emptive capital raising,” she said. “We do believe that the bank capital hybrid segment offers yield, together with diversification benefits, and liquidity when you need it.”

Chow at Loomis Sayles remains constructive on India, noting that international issuers have been remarkably resilient despite the country’s struggles to contain the coronavirus pandemic. The lack of supply relative to China has also supported valuations.

India still faces some serious challenges in putting the Covid crisis behind it, not least around vaccinating its near 1.4 billion population. It is also at risk of losing its investment-grade status, with a Baa3/BBB–/BBB– credit rating only one notch above junk and negative outlooks from two of the big three agencies.

Moody’s lowered India’s sovereign rating to Baa3 in June and kept it on negative outlook, noting that structural weaknesses were in place before the Covid-19 outbreak.

“We are looking at how the Indian economy responds from a point of view of the impact of the pandemic, and just how lasting some of those effects are,” said Taylor at Moody’s.

“What’s ultimately going to determine sovereign credit quality in general will be the ability to reverse the fiscal and debt deterioration that’s a result of the pandemic, and also respond to some of the longer-term challenges that the coronavirus poses in terms of economic scarring.”

Beyond the sovereign sector, the outlook for Asian credit in the remainder of 2021 will depend heavily on governments and central banks.

As vaccines allow economies to reopen in 2021, however, the panel expects policymakers will think twice before tightening monetary policy or reining in public spending.

“The gradual unwinding of government support is one of the big unknowns at the moment,” said Taylor. “One of the lessons that has been learned from the global financial crisis is that there are risks in withdrawing that extraordinary support too soon.”

Watch a replay of the discussion in full here.

To see the digital version of this roundtable report, please click here

Panellists' biographies can be found here.

To purchase printed copies or a PDF, please email gloria.balbastro@lseg.com