Fears of an unprecedented default from state-owned China Huarong Asset Management Co have sent shockwaves through the Asian credit markets, as investors reassess the likelihood of a government bailout for one of China's biggest overseas issuers.

US dollar bonds from the bad-debt manager, which has about US$22bn of offshore notes outstanding, fell by as much as 20–30 points, with most bond prices quoted in the mid-60s to low 70s on Friday.

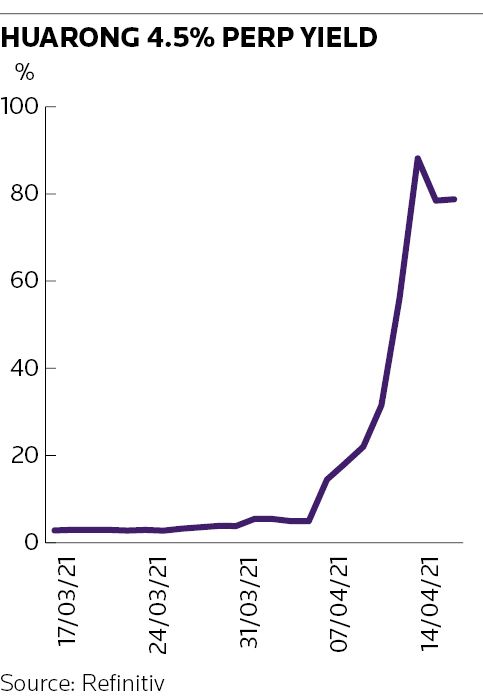

This followed a 10-point drop across the curve the previous week, worsening a sell-off that began with the April 1 announcement that Huarong needed to delay the publication of its annual results because a "relevant transaction" was still being finalised and the auditor needed more time and information to complete its review.

While many investors and analysts are still expecting a resolution that would avoid a potentially catastrophic default, few were willing to take that risk, conscious that China has pushed other state-run issuers into restructuring as part of its push to deleverage the economy and make the capital markets more efficient.

“Normally during this kind of event I would be quite relaxed, because I know that despite all the noise someone will come and sort it out," said a Chinese fund manager. "This is such a big issuer with such a lot of debt outstanding, but so far the authorities have not made any announcement.”

Huarong's extensive use of the international markets, where it is frequently traded, have also raised the stakes.

“Everyone thinks it’s just an Asia problem, but it’s not,” said a DCM banker at a Western house. “Everybody is going to be affected, including global funds.”

Some investors are understood to have bought Huarong’s US dollar bonds on leverage or through structured products, leading to forced selling that may have contributed to Wednesday's rout.

There was a slight recovery late on Thursday on reports that Huarong had prepared funds to repay a S$600m (US$449m) bond issue maturing on April 27. Huarong's US dollar bonds regained 7–10 points on the news, and were supported on Friday by reports it had transferred funds to redeem an onshore bond due on April 18.

The sell-off of Huarong’s bonds spilled over, with US dollar bonds from China Cinda Asset Management, one of the three other major Chinese AMCs, down about five points in the past week. On Wednesday, concerns about Huarong led to a general widening of Asian spreads, forcing Tencent Holdings to delay its deal by a day and pushing planned deals from China Water Affairs Group and BOC Aviation to the sidelines.

Keeping well?

Huarong is yet to provide any update on when it will publish its annual results or give details of the "relevant transaction", leaving investors fearing the worst.

One source of uncertainty for offshore creditors is the structure of the notes. Most of Huarong’s offshore bonds are issued through special purpose vehicles, with a guarantee from China Huarong International Holdings, its Hong Kong-based overseas financing vehicle, and a keepwell deed from the onshore parent. That keepwell structure could be tested if there is a restructuring.

Last year, a court-appointed administrator supervising Peking University Founder Group's restructuring rejected claims on US dollar bonds backed by keepwell deeds from the company. PUFG's keepwell bonds are now trading in the 20s.

Given the majority state ownership in Huarong, rating agencies have largely assumed the government would support it in times of crisis.

"Fitch believes a default of China Huarong would have grave political repercussions for the government," the rating agency wrote in June last year, pointing to the company's important policy role in maintaining stability in the banking sector.

"I think what we have learned is that implicit guarantees from China should not be assumed as they once were," said a UK-based investor, adding that individual credits should be assessed on their own merits without assuming any implicit guarantees. He said that this could lead to a reassessment of SOE credit risk across emerging markets, but most of the impact was likely to be limited to China.

"Many investors seem to have forgotten that the deleveraging programme initiated pre-Covid by China is still happening," he said.

S&P on April 9 placed its BBB+ rating for Huarong and its subsidiaries, China Huarong Financial Leasing and China Huarong International Holdings, on negative credit watch. Moody's, which rates Huarong A3, made a similar move on April 13, noting the group may face increased refinancing risk since it "relies heavily on confidence-sensitive wholesale funding", but said that bond maturities in the next 12 months were insignificant compared with Huarong's total assets.

The same day Fitch placed its A issuer rating on negative rating watch to reflect the "limited transparency" over the timeframe for resolving the issue and uncertainty over the potential impact if there is a prolonged delay in publishing the annual results.

According to analysts at ANZ, Huarong's MTN programmes require the keepwell provider, issuer, and guarantor to produce unaudited earnings by May 15. It will also be in breach of the Stock Exchange of Hong Kong’s listing rules if it does not file its annual report by the end of April.

"We expect onshore bank lines and support is being sharply curtailed and their covenant protection will be stronger than the bonds," the analysts wrote.

S&P said although the "relevant transaction" may enhance Huarong's credit metrics, "on balance . . . . the downside risk is higher" as Huarong's operating performance and asset quality were weaker than that of its peers in recent years, largely due to legacy exposures associated with former chairman Lai Xiaomin.

Lai was arrested in 2018 and was executed in January this year following his conviction on bribery, corruption and bigamy charges by a Chinese court. Since the incident, Huarong has launched a strategy to refocus on its core distressed asset management business and to offload non-core assets.

Investors said it seemed strange for new concerns to emerge at the company two years after the previous chairman's corruption was discovered.

"Huarong has political issues, too," said another fund manager. "It's not a normal AMC. I don't know what they will do in the end."