Car rental ABS issuance is expected to accelerate later this year, driven by the highly anticipated return of Hertz which is expected to soon emerge from bankruptcy and take advantage of increased investor confidence in the sector.

Hertz is expected to emerge from bankruptcy soon and may look to refinance any outstanding ABS as well as a US$4bn funding vehicle that is being used to finance a restocking of its vehicle fleet. Hertz clinched that funding vehicle in November as an interim two-part "delayed draw" securitization, which is supported by Apollo Capital Management.

The company will also likely tap the term ABS market to refinance any portion of the US$1.65bn in debtor-in-possession financing it has used to buy cars and trucks, analysts said.

The absence of Hertz, which along with Avis Budget Group are the only issuers in this ABS sector, slashed car rental ABS issuance to $1.35bn in 2020, down from US$4.1bn the year before, IFR data show.

With volumes expected to soon pick up, market participants are encouraged by the strong investor confidence in the sector, which is being buttressed by record high used car prices.

"The recovery in the rental car space has a lot to do with used car prices. People are selling their used cars for more than what they paid three years ago," said Breckinridge Capital Advisors trader John Bastoni.

Used car prices – which determine the recovery values for lease, fleet and car rental ABS – are hovering at record highs due to blistering demand and a computer chip shortage that has affected new vehicle production.

The widely-followed Manheim used vehicle value index rose to a record high in April to 194.0, which was a 54.3% increase from a year earlier.

Investor demand

Investors are showing interest in the higher yields available in the car rental ABS sector, compared with prime auto loan bonds that makes up the bulk of auto ABS paper.

Avis earlier this month fetched strong demand for the first car rental securitization of the year, the US$800m AESOP 2021-1, which was led by JP Morgan, Bank of America, Credit Agricole and Deutsche Bank.

A US$584m Triple A rated "A" tranche which had a weighted-average life of 5.50 years, cleared at a spread of swaps plus 50bps, which was close to an all-time tight for the sector. This was also tighter than the average secondary spreads of 55bp seen for comparable five-year car rental paper, which have contracted by 90bp so far this year, Bank of America data show.

On the other hand, average secondary spread on three-year, Triple A prime auto ABS is trading at just 7bp over swaps, according to BofA data.

"The outsized returns within Hertz and Avis have been already been made, but there is still opportunity to get attractive yields," Clayton Triick, senior portfolio manager at Angel Oak Capital Advisors said.

The strong reception for Avis deal will likely pave the way for Hertz's expected return to the term ABS market, if it clinches financing and exits from its Chapter 11 bankruptcy in June.

"We expect Hertz to refinance the legacy ABS debt after the expiration of its interim ABS agreement at the end of September," Citigroup analysts wrote in a research note in April.

The balance on Hertz's outstanding ABS across 11 deals issued between 2015 to 2019 amortized to US$2.47bn in April from US$6.04bn 10 months earlier, according to Fitch.

Hertz will need financing to rebuild its rental fleet, which it agreed to whittle down to repay ABS investors. Earlier this month, it selected a US$6bn package headed by an investor group led by Knighthead Capital Management, Certares Opportunities and Apollo Capital Management to emerge from bankruptcy.

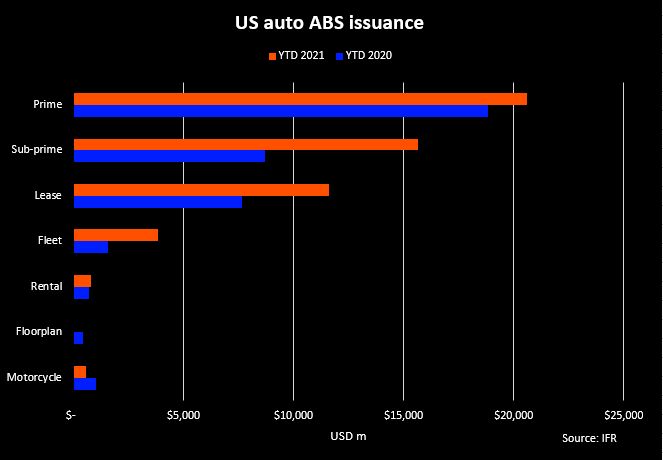

A re-energized car rental sector will pump up an already robust auto sector as lenders are busy funding a resurgence in vehicle sales following the plunge last year due to the pandemic.

Overall auto issuance has totaled US$53.1bn year-to-date, which is up 27% from the same span in 2020, IFR data show. Citigroup analysts on Thursday now project annual auto ABS supply to hit US$128bn, up 23% from last year's total.