Interbank trading activity accounted for more than 80% of the US$3.1trn in interest-rate derivatives that left the UK for the US and the European Union in the wake of Brexit, according to IFR calculations using IHS Markit data.

The new analysis puts further context around the seismic shifts taking place in derivatives markets this year, helping to reveal a fractured post-Brexit swaps trading landscape that is inflicting damage to parties on both sides of the negotiations.

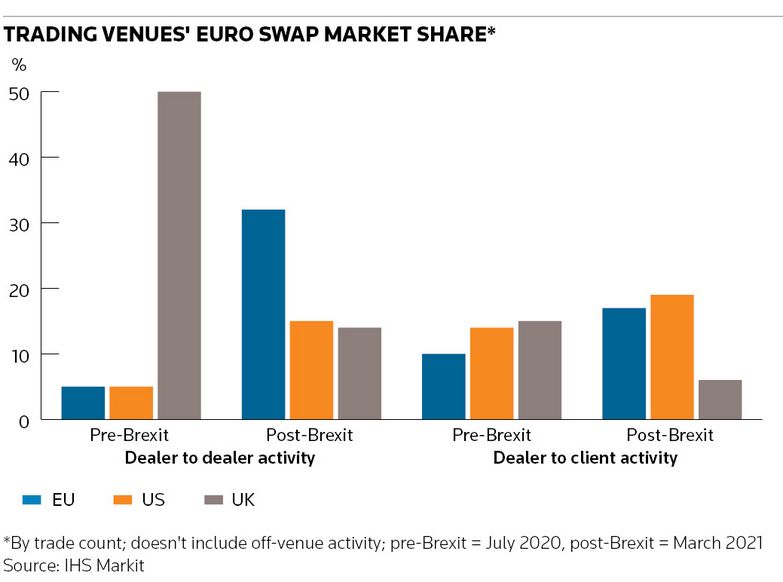

US markets have so far been the biggest beneficiary of the standoff between Brussels and London over financial regulation, scooping up an additional US$3.3trn in euro, US dollar and sterling swap trades in March compared with last July. Swap activity on EU venues also increased by US$2.2trn over that period, mainly thanks to a significant uplift in the region's market share of euro swap volumes from 7% to 26%. That came as UK venues' share of euro swap volumes declined from almost 40% to 10%.

But while EU venues have secured the greatest amount of interdealer euro swap volumes, they have slipped behind US swap execution facilities when it comes to client-focused activity – a segment of the market Brussels is thought to prioritise. Moreover, about US$2.5trn of client swap volumes across US dollars, sterling and euros during the first quarter occurred on UK venues, which currently lie out of reach of the EU’s largest investment banks.

The overall picture confirms how fragmented the market for interest-rate swaps subject to the so-called derivatives trading obligation has become – much to the frustration of many banks, investors and even some policymakers within the EU.

“Even if AMF . . . strongly advocates for forbearance or different legal interpretation of this DTO, the result was that the UK branches of EU banks . . . have to apply this DTO,” Benoit de Juvigny, secretary general of French regulator the Autorite des Marches Financiers, told ISDA’s annual general meeting earlier in May.

“There is a conflict of rule between [the] UK and EU27. As a consequence, the derivative market migrate[d] to [the] US. I really think that it’s a bad solution and I hope that the EU authorities will find in the future a different issue and a different solution,” he added.

Swaps migration

The EU’s refusal to recognise the UK’s financial regulatory regime for swaps trading as equivalent, even though it is largely identical in practice, has triggered what may well be the largest migration of derivatives trading in history.

EU-based firms haven’t been able to transact standardised swaps subject to the DTO on UK venues, and vice versa, since the start of the year. Instead, EU and UK-based firms can only trade on local venues or in countries with which equivalence agreements have been struck, such as the US.

EU platforms have subsequently grabbed a substantial share of euro swaps trading activity – a long-held goal of EU leaders. But those gains have been mainly driven by interdealer trades, with EU venues now holding almost a third of that segment of the market. Overall, interdealer trades accounted for almost 90% of the €1.75trn decline in euro swap activity occurring on UK venues between July and March, according to IHS Markit.

"The client move across the market has been material, but it hasn’t had as big an impact as the interdealer move," said Kirston Winters, managing director at MarkitSERV, IHS Markit’s post-trade processing unit.

Fractured market

The prominence of interdealer activity in driving the post-Brexit shift is to be expected given trades are typically far larger in this part of the market. It also marks an important step towards building a vibrant local swaps market.

But the increasingly splintered nature of activity from clients such as asset managers and pension funds, which Brussels is understood to be most focused on, shows the limits of the EU's ability to force more euro swap trading onto its shores. US SEFs accounted for the greatest chunk of client-led euro swap activity in March with a 19% share, overtaking EU venues on 17%, while 6% still occurred on UK venues. The balance took place away from trading venues.

The current trading landscape remains particularly frustrating for EU investment banks, which can trade on SEFs, but haven’t been able to access UK venues since the start of the year as a result of not having fully-capitalised UK-based subsidiaries.

That has cut them off from the significant portion of client activity still residing in London and caused the likes of BNP Paribas, Deutsche Bank and Societe Generale to lose market share in swaps trading this year. As well as holding on to some euro swap activity, UK venues accounted for 17% of sterling and 10% of US dollar client swap trades in March.

“We have a policy that has carved out [a decent portion] of the euro market to a place where there are no Europeans trading,” said one senior European banker. “There seems to be an inconsistency in policy that needs to be reconciled somewhere.”