The great fixed income trading boom touched off in the wake of the Covid-19 pandemic that powered record performance across the largest banks is coming to a close, according to bank executives at JP Morgan and Citigroup. The end will come just as the US appears to be taming the virus and largely reopening its economy.

Still, relative to historical trends, trading could be seen as humming along.

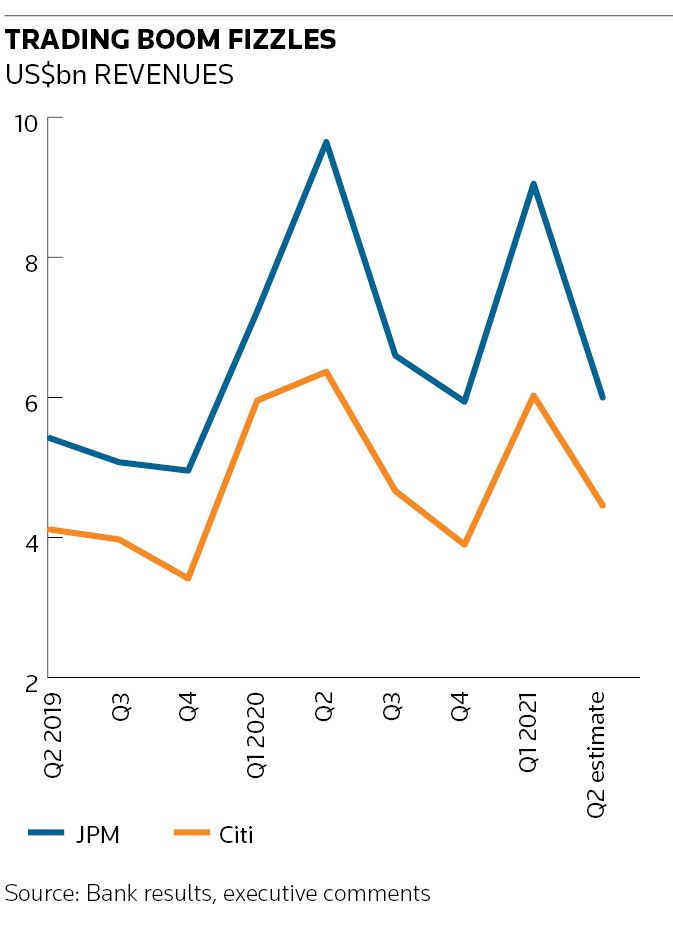

Both JP Morgan and Citi warned that trading would be down considerably from year-ago levels when fixed income commodity and currency trading spiked to record levels across Wall Street. Compared with 2019, however, trading revenue remains robust and the boom in investment banking led by equity underwriting and M&A is likely to offset some of the trading decline – at least for JP Morgan in the second quarter.

Chief executive Jamie Dimon said the bank is expecting trading revenue north of US$6bn in the second quarter ending June 30. That’s down about 38% from the year-ago period when the bank posted a record US$9.6bn in trading revenue. Revenue from FICC trading in that quarter had been double the level compared with the 2019 second quarter.

“Remember, the quarter last year was exceptional,” Dimon said at a financial conference earlier this week. “The last quarter is exceptional. This quarter is what I call more normal . . . which is still pretty good, by the way.”

Trading revenue coming in above US$6bn at JP Morgan would be more than 10% higher than the 2019 quarter equivalent.

Over at Citi, chief financial officer Mark Mason warned that trading revenue could be down around 30%, with “a mix of continued strong performance in equities, offset by fixed income in light of the strong prior year”.

A year ago Citi saw FICC revenue spike 68% to US$5.6bn while equity trading treaded water. Even with a 30% decline in trading revenue the bank would outperform 2019 levels by more than 5%.

Banks are in a very different place than they were a year ago, Mason said. “If you think back to the second quarter of 2020, at least for Citi, we were looking at markets revenues back then that were up 50%. We had seen record levels of debt issuances from our clients.” And the bank had taken down expenses pretty meaningfully in light of working remotely and the general economic shutdown.

The second quarter is likely to reflect higher expenses as those temporary savings evaporate, and the bank boosts investment in its ongoing transformation alongside strategic investment in areas such as wealth, investment banking, and the treasury and transactions services franchise, Mason said.

Morgan Stanley declined to offer an estimate for second-quarter trading but chief executive James Gorman said after going through three phases in the quarter trading is re-energised.

"It's a little hard to figure out exactly how it's going to land because we've still got, I don't know, 15 trading days or something left," Gorman said.

"It started quite strong. And there was a period of about three, four weeks where I felt people were sitting on their hands a little bit, and now it's re-energised."

Second wind

As trading slows down, investment banking is powering on.

“Investment banking could have one of the best quarters we've ever seen,” Dimon said. Investment bank revenue could be up between 15% and 20% from the prior quarter on robust activity in ECM, DCM and M&A.

That is no small feat considering investment banking revenue was up 54% last year at JP Morgan, hitting US$2.8bn.

Citi will not be so lucky. Mason is expecting investment banking revenue to decline “in the low- to mid-single-digit range”.

That is down from the strong performance last year, when the bank saw investment banking revenue rise 37% to US$1.8bn.

“We do see strong M&A performance, and we do feel good about the pipeline and the dialogue that we're having in investment banking,” Mason said.