The European Union made capital markets history on Tuesday by pricing the largest plain-vanilla single-tranche euro deal ever – a €20bn 10-year that hit the size limit for the NextGenerationEU programme and came within a whisker of setting a demand record for the borrower with books closing at more than €142bn.

The deal was the first from its NGEU programme, with the impressive outcome coming even after the supranational having already issued almost €90bn from its SURE scheme since October.

“It really went above and beyond our expectations. It was not planned to print €20bn – originally it was planned for €13bn–€15bn but when we saw the depth of demand we realised even €18bn would not be enough in view of allocations, so we went for the full size,” said an EU funding official. “Not just in terms of the size we placed, which was beyond our wildest dreams, but also it was a very swift execution, high quality order book and it experienced stellar secondary market performance as well.”

The borrower will be prolific in the coming six weeks. It has already sent a request for proposals for the second NGEU syndication just days after the inaugural trade priced, and is planning a third outing before August. It will also look to raise €5bn for the European Financial Stabilisation Mechanism in July to roll over a loan to Portugal.

“We raised more than expected in the inaugural deal which alleviates a little bit of the pressure in future deals. We don’t feel under pressure. It’s an ambitious funding target but we are building on the success of SURE," said the official.

"We expected strong demand and that has been confirmed by the first transaction, and given that we will offer different maturities we expect to attract different buckets of demand. We will not overdo it and we will adjust the size again to the concrete orders we have in the book.”

The July 2031 benchmark sets the tone for what will be the biggest funding programme ever seen in Europe – with some €800bn to be raised by 2026 to finance the EU's response to the Covid-19 pandemic – and one that will reshape the region's bond markets, making the nearly completed SURE programme look like a mere appetiser.

"This is a hotly anticipated deal," said Peter Goves, fixed-income research analyst at MFS Investment Management, ahead of the deal pricing.

"The market clearly welcomes the growing prominence of a relatively liquid, high-quality issuer. The market is therefore likely positioned to absorb such supply well."

High bar

The issuer already set the bar high with its SURE debut in October, finding demand for the €17bn two-part social benchmark of some €233bn – the biggest order book ever seen.

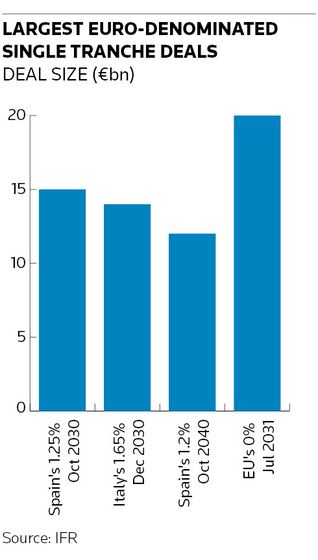

This time, however, it was the deal size that set the borrower apart: €20bn exceeds by €5bn the largest plain-vanilla European sovereign bond, Spain's €15bn 1.25% October 2030 that printed at the height of the pandemic in April 2020.

“The deal had such an overwhelming response in terms of just how deep the real money bid was and that ended up convincing us as a group to print €20bn," said a banker on the deal.

"Even then allocations were exceptionally harsh and arguably even more harsh than the SURE programme had faced with materially lower deal sizes. It had one of the highest compositions of real money accounts I’ve ever seen. The vast majority of the account base is now looking at the EU as a fully fledged government bond.”

Demand was dominated by fund managers (37%), bank treasuries (25%), and central banks and official institutions (23%). Insurance and pension funds (12%), banks (2%), and hedge funds (1%) completed the allocations.

Unlike the SURE programme, with a ceiling of €10bn per tranche, the EU now has more leeway with a €20bn issue limit.

"The past year has been an extraordinary yet very rewarding journey for the borrowing and lending team of the European Commission," Johannes Hahn, European Commissioner in charge of budget and administration, told IFR. The commission borrows on behalf of the EU.

"From a very small issuer going to the market for less than €1bn per year in back-to-back lending, we have issued some €100bn across our programmes in the past nine months. We are fast becoming one of the biggest issuers in euros, relying on a fully fledged diversified funding strategy for our market operations."

Extraordinary journey

The NGEU programme, the second phase of the EU's pandemic response after the SURE scheme, has a funding target of about €80bn over the next six months, but there is scope for that to be increased given that the issuer is moving away from back-to-back lending, according to a banker away from the deal.

“The €80bn target is the low end, so there’s room for them to extend funding up to €125bn," he said.

Similar to the strategy adopted for the SURE debut, the issuer enticed investors with a generous starting point.

“It was an inaugural trade so they had no room for mistakes, especially with the size of the programme and all the focus on it," said a second banker away from the deal. "In my opinion they maybe paid 1bp too much, but then what is 1bp on [such a large] programme?”

Pricing was tightened 3bp from IPTs of mid-swaps plus 1bp area to land at less 2bp. There was a 3bp–3.5bp new issue concession at final terms, according to the EU funding official.

The borrower's €10bn 0% October 2030 SURE bond, the closest recent liquid reference point, was quoted on Tuesday morning bid at less 6.7bp, according to Tradeweb. That bond, part of the debut deal under SURE, had a book of over €145bn, just €3bn more than last week's transaction.

BNP Paribas, DZ Bank, HSBC, IMI-Intesa Sanpaolo and Morgan Stanley were joint lead managers. The deal paid fees of €20m.

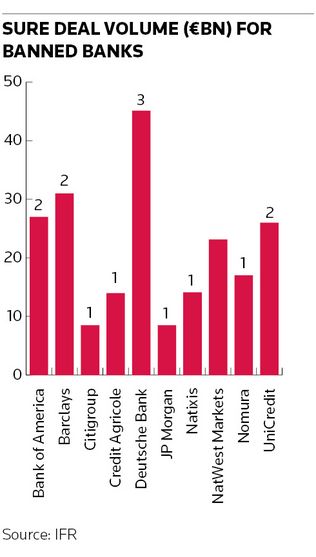

The candidate pool of leads for the trade was limited after the EU barred those institutions found guilty of breaching antitrust rules from running NGEU syndications. That ban did not last long, however, with the commission on Friday saying that eight of the 10 excluded banks were once again eligible to handle NGEU deals. The eight institutions that have been assessed and found eligible for participation in future bond transactions are Nomura, UniCredit, Credit Agricole, JP Morgan, Citigroup, Barclays, Bank of America, and Deutsche Bank, a Commission source said.