The world’s largest investment banks are expected to report only a modest decline in revenues in the second quarter following a record prior-year period, as a rise in equities trading and dealmaking fees should go some way to offsetting a sharp drop in fixed income revenues.

The top 12 global investment banks are projected to report second-quarter revenues of roughly US$50bn across fixed income, equities and investment banking, according to preliminary estimates from analytics firm Coalition Greenwich. That would mark a decline of a little more than 10% from a record-breaking second quarter in 2020, but would still be around 30% higher than during the same period in 2019.

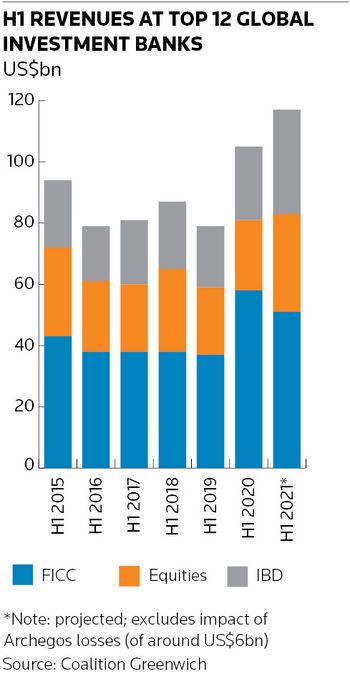

The overall solid performance builds on a strong first quarter, putting these banks on track to produce their best first-half revenues in a decade – even after around US$6bn of losses from the collapse earlier this year of Archegos Capital Management.

“Investment banks’ revenues are lower following one of the best quarters ever last year, largely driven by a normalisation in fixed income, but they’re still much higher than they were two years ago,” said Michael Turner, head of competitor analytics at Coalition Greenwich.

“2020 was the best year for investment banks for a decade. We’re expecting revenues to be lower this year, but even in a bearish scenario they should still be much better than over the prior five years,” he added.

Many of the large US investment banks are scheduled to report earnings next week, including Goldman Sachs and JP Morgan on Tuesday. JP Morgan chief executive Jamie Dimon has already warned of a sharp fall in trading revenues from very high levels last year, but also noted “investment banking could have one of the best quarters we've ever seen".

Debt trading normalisation

A drop in fixed income, historically investment banks’ main source of earnings, is expected to be the biggest driver of the decline in trading revenues. Coalition Greenwich estimates a 35% decrease following an extraordinary year-earlier period when government and central bank responses to the coronavirus pandemic – along with market volatility and record debt issuance – spurred a surge in trading activity.

That provided a once-in-a-decade opportunity for “flow” trading desks specialising in simple products such as bonds, swaps and futures. JP Morgan’s fixed income revenues doubled in the second quarter of 2020 from a year earlier in what Dimon called an “exceptional” period.

That dynamic has flipped this time, with flow trading revenues across rates, foreign exchange and credit projected to fall the most, while more complex business lines such as distressed credit and structured finance have fared better.

“You’ve got this two-track world in fixed income, with flow trading coming down from the volatility and government response-induced boom last year, but at the same time more illiquid businesses doing well,” said Turner.

Equities, dealmaking gains

Despite the overall decline, Coalition Greenwich still expects second-quarter fixed income revenues to come in more than 25% above their second-quarter 2019 levels. Meanwhile, investment banks’ other core activities have continued to hum along, leading to a projected 20% revenue increase in equities trading and investment-banking fees from a year earlier.

The increase in equities revenues comes from a pick-up in structured derivatives activity, Turner said, as well as gains in prime services thanks to record client balances. Elsewhere, equity flow trading revenues have declined from a bumper second quarter last year against a calmer market backdrop.

That picture contrasts with the first half of 2020, when some banks suffered eye-watering losses in structured equity derivatives books, while others enjoyed a flow trading bonanza as investors switched up positions in response to the pandemic.

Mergers and acquisitions and equity capital markets drove the projected second-quarter increase in investment banking revenues, with ECM performing strongly despite a marked drop-off in SPACs from the first quarter.

Debt capital markets revenues are expected to be flat, but still about 50% higher than in 2019, as many companies refinanced their debt following a deluge of issuance last year.