Credit-sensitive benchmarks such as the Bloomberg Short-Term Bank Yield Index could be referenced in as much as US$20trn of financial instruments in the post-Libor world, according to estimates from Bloomberg, potentially accounting for about 10% of the entire US dollar market linked to such reference rates.

The projected volumes give a sense of the important role BSBY and other credit-sensitive rates could play in US financial markets in the years to come despite the expected predominance of the secured overnight financing rate, or SOFR, the risk-free rate regulators favour to replace US dollar Libor.

There has been increased focus on credit-sensitive rates such as BSBY, American Financial Exchange's Ameribor, IHS Markit's "CRITR" and the ICE Bank Yield Index in recent months amid concerns over the suitability of SOFR for activities such as bank loans.

Umesh Gajria, Bloomberg's global head of index-linked products, said Bloomberg fully supports regulators’ efforts to make SOFR the main reference rate in the roughly US$220trn market for financial instruments that have historically been linked to US dollar Libor.

But he still expects a credit-sensitive rate such as BSBY to be the main point of reference in the US$6.2trn market for US commercial loans. He estimates that could spawn some US$12trn in hedging activity in swaps and futures markets linked to those rates, while there will also be some niche use in other markets such as floating-rate notes and collateralised loan obligations.

"The main use case for these credit-sensitive rates is the commercial loans markets," said Gajria. "It will be no different to today where there are multiple rates across the entire market. We see a similar structure going forward: SOFR will be the predominant reference rate, but credit-sensitive rates will also exist in loans and other markets."

US regulators have been ramping up efforts to accelerate the move away from US dollar Libor following a sluggish start to the transition compared with countries such as the UK where the campaign to drop the controversial bank lending rate is far more advanced.

The percentage of US dollar trading activity in cleared and exchange-traded interest-rate derivatives linked to SOFR was just 6% in June, according to the ISDA-Clarus RFR Adoption Indicator, compared with 61% of activity in sterling markets referencing alternative reference rates.

Industry experts still expect SOFR to become the main rate for the US$200trn or so of US dollar derivatives contracts. But the US loan market has proved even more reluctant to drop dollar Libor, at least in part because of perceived issues with SOFR.

Credit concerns

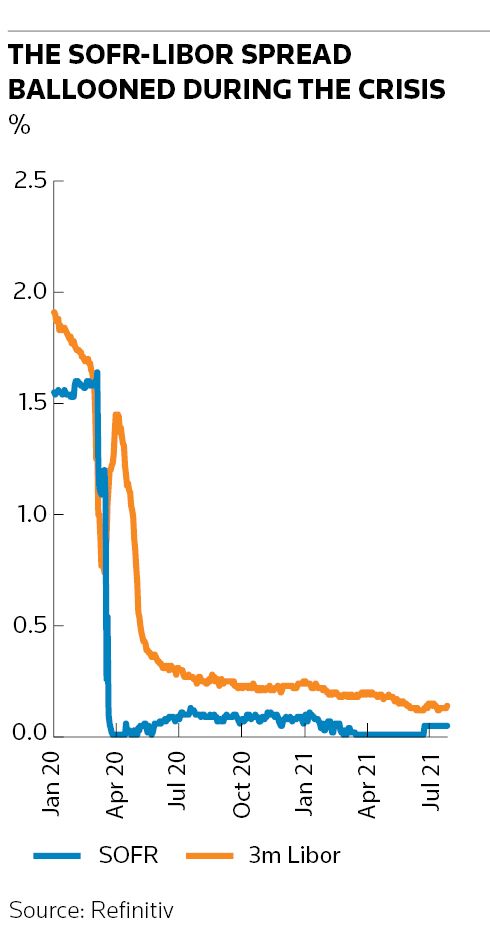

SOFR’s lack of sensitivity to credit spreads has been one major cause of concern, creating a potential mismatch during times of market stress between banks’ own cost of funds and the interest rates on loans they’ve made.

A June 2020 presentation from regional lenders PNC Bank and M&T Bank to a Federal Reserve Bank of New York working group said the resulting sharp decline in banks’ net interest margins could erode bank capital and discourage them from lending at low rates.

The discrepancy came into sharp focus during the coronavirus pandemic last year, when the risk-free SOFR sank to near 0%. That contrasted with a rise in bank borrowing costs, with three-month dollar Libor peaking near 1.5% in late March.

“For regional and smaller banks, SOFR is a terrible rate. It doesn’t really reflect their cost of funds,” said Paul Forrester, a partner with law firm Mayer Brown. “And it’s counter-cyclical. If a bank in distress needs to fund itself, you’ve got a measure going in the opposite direction to its costs. They need an alternative.”

A number of credit-sensitive interest rates have emerged to fulfil these needs, including IHS Markit’s Credit Inclusive Term Rate, or CRITR, the ICE Bank Yield Index, AFX’s Ameribor along with Bloomberg’s BSBY. All these rates are calculated using real transactions – the lack of which was one of the major flaws that undermined Libor.

Multi-rate world

Some bankers claim the development of multiple rates has slowed the transition to SOFR, but others have been supportive of these initiatives in the belief they cater to real client demand. Still, it is not clear whether there will be room for different flavours of credit-sensitive indices given the tendency in fixed-income markets for liquidity to gravitate towards one place.

BSBY has fared well in the early running, with Bank of America throwing its weight behind the rate on a number of transactions. That includes a US$150m loan for US retailer Duluth in June that BofA led, two floating-rate note issues from BofA totalling US$2.25bn and a SOFR to BSBY basis swap between BofA and JP Morgan.

US Bank also issued a US$1bn privately-placed floater in June. Elsewhere, CME Group has said it plans to launch BSBY futures later this year.

“SOFR will be the dominant index, but there has definitely been traction around credit-sensitive benchmarks,” said Tyler Wellensiek, global head of rates market structure and business strategy at Barclays.