Financial infrastructure firms are stepping up efforts to develop a new trading ecosystem to support the development of the market for NextGenerationEU debt amid expectations the bonds will form a crucial part of euro funding markets for years to come.

CME Group’s BrokerTec, Deutsche Boerse’s Eurex and bond-trading platform Tradeweb are among the firms ramping up efforts to encourage trading and financing of NGEU debt in secondary markets, with many participants also looking ahead to the potential launch of NGEU futures contracts next year.

“We are aiming to support ... what is probably the most significant European capital market development since the introduction of the euro,” said Carsten Hiller, head of fixed-income sales for Continental Europe at Eurex. “The market for NGEU bonds is developing, and with it the secondary market and repo market need to grow too.”

The European Union only began issuing bonds in June under the NGEU programme, which is aimed at financing the EU’s recovery from the pandemic. But it has already raised €45bn across three syndications and is aiming to sell a further €35bn before the end of the year. That comes on top of about €90bn raised under the EU’s unemployment-focused SURE programme.

The scale of the projected NGEU issuance (which is set to top €800bn over the next five years) has already triggered a buying frenzy among investors, with some predicting the securities could even rival German government bonds as the main risk-free asset in euros.

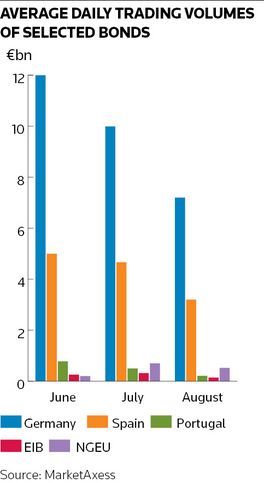

Average daily trading volumes in EU debt were still low at about €530m in August, according to bond trading platform MarketAxess, albeit at a traditionally quiet time of year. That was about 7% the volume of trading in German bunds, but still 3.7 times higher than volumes in European Investment Bank debt, the largest supranational debt issuer in the eurozone, and already surpassing activity in Portuguese bonds.

"What we need is more issuance and the size of outstanding bonds to grow. Then you will start to see more active trading in the [interdealer] markets and appetite to take positions," said John Edwards, managing director at BrokerTec, the interdealer trading platform.

BrokerTec is currently waiving execution fees on NGEU trading and plans to launch a market-making programme in NGEU bonds later this year to encourage wider participation.

Trading pick-up

Tradeweb, which focuses on the dealer-to-client space (and is majority owned by LSEG, which also owns IFR), said it had been reaching out to the 39 primary dealers for NGEU debt, over half of which are now actively trading the bonds on its platform. It also plans to expand some of its trading protocols that would normally be used only for government bonds.

“The NGEU is a government bond in everything but name. We are definitely expecting more interest to materialise from this month as the issuance programme grows,” said Nicola Danese, head of European fixed income at Tradeweb.

Banks are already gearing up for an increase in NGEU trading, with reports of many looking to move NGEU debt from the SSA desk to the government bond trading desk to give it greater prominence.

Much of the first three NGEU bond sales went to investors such as official institutions and bank treasuries that don't tend to trade as regularly as other participants. Hedge funds and bank trading desks – which tend to switch positions more often – were only allocated about 4%. But Danese said there was growing interest from hedge funds, which should provide liquidity and support the development of the market.

The introduction of NGEU bond and T-Bill auctions this month should also encourage trading desks to get involved given banks will no longer earn underwriting fees as they did on the first three NGEU syndications. That should provide a shot in the arm for the repo market, as traders look to cover short positions on a more regular basis and hedge funds lever positions.

“The NGEU programme is still very young and traditional investors that are involved – mainly real-money accounts such as insurance companies – are not necessarily the most active users of the repo market. We believe that will change in September when the NGEU starts using the auction system too," said Jutta Frey-Hartenberger, an executive in fixed-income research and development at Eurex.

Repo and futures

BrokerTec and Eurex offer repo on NGEU bonds and have included them in EU “general collateral” baskets for financing purposes. Both firms believe repo volumes will pick up as the issuance programme grows.

"If we’re going to see some market development in terms of EU Next Generation cash bonds then we need a liquid and well-functioning repo market in those securities, otherwise you’ll see a reluctance in terms of people taking positions,” said Edwards.

The development of an active NGEU futures market would be a logical next step given the NGEU’s size. Frey-Hartenberger said Eurex, which runs government bond futures for German, French and Italian debt markets, is currently consulting market participants and is prepared to support NGEU debt with a new futures contract if there is sufficient demand.

Still, the most important ingredient for the development of a healthy bond market is certainty over the NGEU’s future – and that remains squarely out of the hands of investors and infrastructure firms alike. The programme has only been agreed under the EU’s budget until the end of 2027 and the willingness of Germany in particular to commit beyond then is unclear.

“For a futures contract to be successful, it does need a liquid and reliable underlying bond market. The market as a whole needs to develop some confidence that EU bonds will be there beyond 2027," said Frey-Hartenberger.