The financial woes of hotels and malls during the pandemic has restrained CMBS conduit supply in 2021, in contrast with a resurgence in the single-asset, single-borrower and CRE CLO markets.

"The conduit market is the one that has not really recovered in terms of new issuance compared to 2020," Fred Perreten, senior director in CMBS at Kroll, said on Tuesday.

Perreten was moderating a panel on the CMBS market at the SFVegas 2021 conference in Las Vegas, organized by the Structured Finance Association. The four-day annual industry gathering ended on Wednesday.

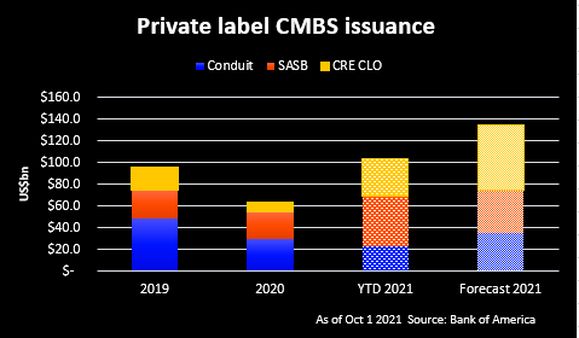

Conduit issuance totaled US$22.8bn in the first three quarters of 2021, roughly in line with the US$22.6bn over the same period last year. On the other hand, SASB supply has jumped to US$46.1bn from US$16.6bn, and CRE CLO issuance has increased to US$34.8bn from US$6.6bn, according to Bank of America.

For the full year, the bank projected conduit issuance to hit US$35bn, up from the US$29bn annual total in 2020; CRE CLO supply at US$40bn up from US$8.7bn and SASB issuance to US$60bn from US$25bn.

Prior to Covid, banks easily pooled hotel and mall mortgages with office, industrial and multifamily loans and sold debt securities based on their collective cash flows. Investors had been drawn to these CMBS conduits because they offer stable, long-term income and diversification across property types.

Since the virus outbreak, health and travel restrictions have hammered hotel demand and reduced shoppers at malls. A number of hotel and mall operators have sought debt relief to stay afloat. In this precarious climate, there have been few new hotel and mall loans to create conduit deals.

"It's (been) hard to originate enough hotel and retail loans to make a conduit pool diversified," said Barclays analyst Anuj Jain, another panelist.

Right now, most investors want little exposure to lodging and retail properties given the uncertainty about the delta variant on travel and consumer spending, according the panelists.

"Putting those assets into conduit pools just creates noise. It's almost a distraction most people don't want to deal with," said Bank of America managing director Leland Bunch.

To be sure, fund managers have been willing to finance top-tier hotels and shopping centers through SASBs due to their short-dated structure and low leverage, the CMBS panelists said. On Monday, Goldman Sachs and Bank of America arranged a US$1.8bn SASB, LUXE Trust 2021-TRIP, which refinanced nine luxury hotels in North America owned by Anbang's Strategic Hotels and Resorts.

Concerns about rising interest rates due to elevated inflation have also curbed demand for fixed-rate conduit paper, which typically has a 10-year maturity.

"No one wants to lock in prices at these levels. Investors also prefer floating-rate products in this environment where rates are expected to go higher," Barclays' Jain said.

On Wednesday, the benchmark 10-year Treasury yield touched 1.573%, the highest level since June 17, according to Refinitiv.