Despite fears of greenwashing and looming regulation, the ESG bond market looks set to maintain its upward trajectory – particularly as stellar growth in sustainability-linked bonds continues – and 2022 will bring global green bond sales of US$1trn and total ESG-labelled bond volume of nearly US$2trn if last year’s record-breaking performance is replicated, Refinitiv data show.

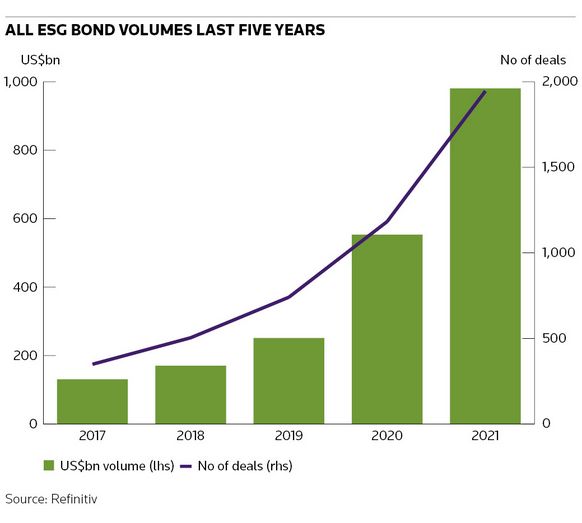

A 77% surge brought overall activity in green, social, sustainable and transition bonds, and SLBs, to just short of US$1trn in 2021. Global sales of US$986bn dwarfed 2020’s US$555bn, reflecting a combination of end-investor and regulatory demand on institutional buyers, corporate efforts to finance the transition to net zero and increasing government issuance of green bonds.

“The one trillion mark seemed unachievable still a couple of years ago,” said Julien Brune, head of DCM solutions and advisory at Societe Generale. “It is a landmark figure showing an extraordinary increase in investor and issuer awareness of the importance of ESG issues.”

The same level of growth this year will yield total volume of more than US$1.75trn. However, even if 2021’s 1,100% explosion in global SLB sales moderates somewhat, further success in attracting new corporate issuers among investment-grade and high-yield credits across an ever-wider range of sectors could push the total closer to US$2trn.

Alternatively, SLBs' success may be at the expense of other products' growth. For example, some green bond issuers could start shifting to SLBs due to limited availability of eligible green assets, said Brune.

Nonetheless, the bank sees further "strong growth potential" in green bonds due to the European Union's NextGenerationEU initiative (at €250bn, the world’s largest green bond programme) and increased reporting obligations on sustainable activities under the forthcoming EU Taxonomy, Brune added.

A further doubling in 2022 would take green bond volume to US$1trn. Bank forecasts are in similar territory, with BNP Paribas expecting US$880bn, for example.

“We are seeing extremely strong sustainable finance appetite from investors. The opportunity is there for 2022 to be a milestone year; over 40% of the world’s assets are onto net-zero trajectories and the evolution of the EU Taxonomy will increase the asset base eligible for green issuance,” said Constance Chalchat, global markets chief sustainability officer at BNPP. She expects “sovereign and corporate action on energy transition [to] foster the growth of new green assets”.

Green engine

Green bonds, the longest established ESG debt sector, were behind 2021’s boom. But while Italy, Spain and the UK, plus the EU, all entered the market with substantial sovereign benchmarks, the product’s doubling to US$509bn was a chiefly private sector development.

Government and agency green sales rose by US$85bn, according to Refinitiv data, but corporates and financials added just under US$175bn – two-thirds of total green bond growth in 2021.

The key energy and power, real estate and materials sectors all doubled, as did financials, though industrials lagged that performance. Among smaller sectors, the retail and consumer products areas grew especially strongly thanks to landmark deals such as Walmart’s US$2bn inaugural green bond. Telecoms, technology and consumer staples all outperformed the overall market as well, while new healthcare and media issuers provided diversification.

Asia ex-Japan was the most notable geographic source of green bond growth. Sales from the region boomed to US$116bn from 2020’s US$45bn, though Europe’s climb to US$303bn from US$146bn was the bedrock of the product’s overall gains. The Americas and Japan grew less, though each gained more than 30%.

SLB surge

The huge surge of SLBs was one of 2021’s most striking stories in ESG debt as the previous year’s marginal sales of some US$8bn soared to US$91bn. Moreover, the number of SLB transactions ramped up at almost the same extraordinary rate – from 15 to 151.

Led by the product’s pioneer, Italy’s Enel, European corporates drove this performance. The region accounted for nearly US$57bn of year-on-year growth and added just under 80 new deals to its 11 in 2020.

But companies in the Americas and Asia contributed a third of the growth. After 2020’s solitary deal from the Americas and none from Asia outside Japan, these two regions spawned US$29bn of activity from close to 60 SLBs.

Japan also scaled up from two transactions to 10, though deal sizes remained small.

While the energy and power sector remained the largest source of supply, industrial companies’ US$13bn of sales doubled their share of the SLB market (to 14%) even as it grew at such a notable pace. In contrast, healthcare SLB volumes tripled but the sector’s market share slumped from more than a quarter to just 6.5%.

Sustainable growth

Growth rates in sustainable and, especially, social bonds were more modest than those in green bonds and SLBs. All the same, the sustainable (or sustainability) bond product – which allows issuers to fund both environmental and social projects from the same offering – expanded by a notable 48%.

Moreover, social bonds managed a double-digit gain of 16% despite a falling away in the pandemic-related financings that propelled the product in 2020.

The transition bond area lost focus in 2021, meanwhile, as many high-emission corporate issuers appeared to adopt SLBs as their preferred instrument for financing the move to net zero. Even so, sales still rose to US$4.6bn from US$1.7bn and many ESG debt professionals expect new initiatives to help push the product forward in 2022.