Trading volumes across major credit default swap indices and debt exchange-traded funds have broken records in January, a sign of a significant reshuffling of investor exposure to corporate credit even as bond markets have shown remarkable resilience in the face of this year's downturn in equities.

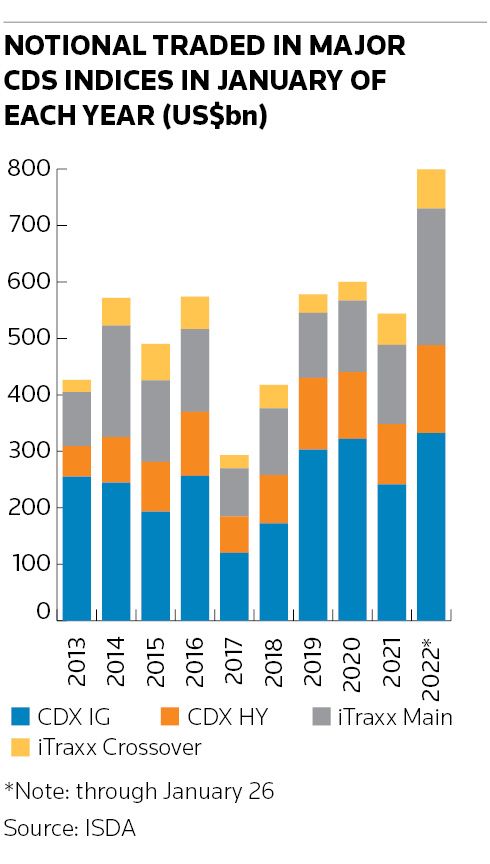

About US$800bn in volume has changed hands across the four main US and European CDS indices this year up to January 26, according to ISDA data, a third higher than the previous January record set in 2020. Volumes in the iShares iBoxx $ high-yield corporate bond ETF – the largest US junk bond ETF – have also surpassed January records with over 770m shares trading in the month through Thursday, according to Refinitiv data, while the iShares investment-grade equivalent "LQD" notched a high of about 323m shares for the month.

The jump in activity underlines how popular these macro credit products have become among investors looking for a fast and efficient way to rejig positions. It also belies a calm on the surface of corporate bond markets, where credit spreads have only widened modestly so far.

Many traders and investors are questioning how long corporate credit can continue to shrug off the volatility enveloping other markets as the US Federal Reserve moves to wind down its stimulus programmes and raise interest rates to tame inflation.

"This year has started off with what feels like a regime change due to higher interest rates percolating through the system. That is affecting equity markets because revenue multiples from a valuation standpoint are coming down,” said Benjamin Brodsky, chief investment officer at BlueCove, a London-based investment manager.

“We haven't seen that yet percolate through to credit, but we believe it's only a matter of time," he added.

The bumper volumes in macro credit products such as CDS indices and ETFs suggest many investors have been busy readjusting positions, even if they’re far from running for the exits just yet.

Trading volumes in US corporate bonds reached US$614bn this year through Thursday, according to bond platform MarketAxess, still some way off January 2021’s total of US$772bn. That contrasts with the height of the coronavirus pandemic in March 2020, when record volumes of nearly US$1trn passed through the US corporate bond markets as investors scrambled to overhaul their portfolios.

Hedge first, sell later

It has become increasingly common among investors and traders to use broad-based index products to switch their credit market exposure in recent years. January trading volumes in LQD, BlackRock's investment-grade ETF, have grown every year since 2014 and have more than doubled since 2018, Refinitiv data show. The demand for macro products – which allow fast execution in large size – often picks up when markets get rocky, allowing investors to reduce or increase their risk quickly, rather than reflexively buying or selling individual bonds that tend to be less liquid.

In one notable example of this type of behaviour, the volume of CDS index protection on European investment-grade credit that investors bought in the previous week amounted to their largest de-risking since February 2020, according to a note last Wednesday from Barclays' credit strategists.

“I’d argue the steadiness in credit markets makes them vulnerable from here,” said Yoni Gorelov, co-head of US credit trading at Barclays. “There could be more downside to come, though it might not happen immediately.”

He added: “I wouldn’t be surprised if some investors look at credit as a cheap hedge."

Some traders argue the middling response in corporate bonds is natural given the current economic outlook. Recessions are the greatest concern for credit markets, raising the prospect of investors failing to recoup all the money they have lent to companies if defaults pick up, and there is nothing to suggest that the US economy is headed in that direction. Instead, gyrations in equities look more like an adjustment period for large sections of a market dependent on ultra-low interest rates to justify heady valuations.

There are certainly some who remain cautiously optimistic about the outlook for corporate bonds, even as the Fed moves to unwind its extraordinary measures put in place to revive the economy following the outbreak of the pandemic. A more hawkish Fed means that investment-grade credit spreads should continue to have a widening bias, BofA credit strategists wrote in a note on Wednesday.

Still, “factors supportive of [high-grade] spreads remain intact, limiting the magnitude of potential widening”, the strategists added, including strong economic growth momentum in the US economy as well as the low-yield environment across the globe.