Investors are making space in their portfolios for US sub-prime auto loan-backed bonds, even though the best credit conditions for the sector may be in the rear-view mirror.

Softening used car prices and increasing sub-prime auto loan losses and delinquencies have emerged as risks for this part of the ABS market, while lower-tier borrowers in general are expected to feel more of a financial squeeze from 40-year high inflation and reduced Covid-related government aid than their higher-income counterparts.

However, wider spreads and adequate credit enhancement on sub-prime auto paper have for now enabled issuers to print new deals, market participants said.

On Tuesday, Exeter Finance, Pagaya Technologies, Consumer Portfolio Services and Lendbuzz Funding raised a combined US$2bn with new sub-prime auto ABS. Exeter, which is owned by private equity firm Warburg Pincus, enlarged its offering to US$1.1bn from US$850m.

"They all went really well," a senior ABS banker said. "I think there is still a decent loss buffer versus historical performance baked in, but the increases in delinquencies and losses are certainly a trend to watch."

Another sub-prime auto transaction is in the market, a US$400m debut from used car dealer America's Car-Mart which is expected to price next week.

Issuers are offering wider spreads to get deals done, in light of secondary market moves driven by the Russia-Ukraine war, concerns over rising interest rates, and deteriorating loan performance.

Exeter for example priced its second ABS of the year, Exeter Automobile Receivables Trust 2022-2, at wider spreads than the first one it completed on February 16. The biggest tranche, a US$234m Triple A rated A2 note which carried a weighted-average life of 0.54 year, priced at Treasuries plus 95bp for a 2.201% yield. This compared with a spread of EDSF plus 30bp and a 1.160% yield on the similar A2 tranche in the prior deal, Exeter Automobile Receivables Trust 2022-1.

Average secondary spreads on three-year Triple A rated sub-prime auto ABS have widened by 60bp to 110bp over Libor swaps since the beginning of the year, and those on five-year Single A rated unsecured consumer loan ABS gapped out by 70bp to 135bp over Libor swaps, according to Bank of America.

"We have seen spreads for both sectors, especially in the subordinate tranches, widen during the last month due to the potential for a slowing economy, inflation, and higher rates to negatively impact low-income borrowers," said Matt Corn, a trader at Breckinridge Capital Advisors.

Weakening trends

The average delinquency rate on securitized sub-prime auto loans which are 60 days past due was 4.20% in March, up from 3.60% a year ago but down from 4.68% in February. Average net loss rates on sub-prime auto ABS were 4.95% in March, up from 4.72% a year earlier but down from 5.95% in February, according to Barclays.

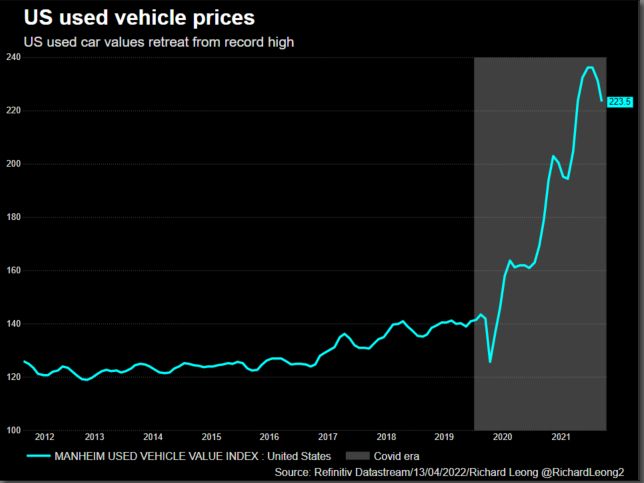

Another negative development for sub-prime auto ABS is the decline in used car values. The closely-watched Manheim used vehicle index fell to 223.5 in March, which was lower than an all-time high of 236.3 in January but it was still 24.8% higher than a year ago.

"We expect more noticeable deterioration in sub-prime performance because lower income households are more likely to be impacted by the pickup in inflation," Bank of America said in a research note on Friday.

Despite the increasing credit risks, some investors think these wider spreads represent a buying opportunity.

"Spreads have gotten wide relatively to where they had been. Now we have the opportunity to leg into sectors that we like," said Philip Armstrong, senior portfolio manager at Invesco. Softening used car prices have not weakened the credit protection on sub-prime ABS because rating agencies did not relax their loss assumptions in light of the historic high prices on used vehicles, he said.

"It hasn't put a lot of stress on the structure right now because rating agencies didn't change their underwriting criteria," Armstrong said.