The primary bond markets reached a tipping point last week with three new issues pulled by London syndicate desks due to a lack of demand.

The casualty list could have been even longer, as a few other deals only just made it over the line as bankers struggle to devise appropriate pricing strategies against a highly volatile backdrop. "It's a tough market," said a banker.

The premium for smart execution has also increased after the ECB last week ended its net asset purchases. Although the central bank will remain an actor in both primary and secondary markets as it reinvests the proceeds of maturing bonds, its presence will be on a smaller scale and in a less predictable manner.

The primary market had seemed fragile the week before, with several covered bond and public sector deals just about getting done even with big concessions on offer. By Monday, the market finally came unstuck as two deals were pulled because of poor demand – one from French oil reserves manager Sagess in euros, the other from UK merchant bank Close Brothers in sterling.

Another deal was also postponed the same day, as Czech state-owned railway company Ceske drahy stopped its debut green bond mid-execution following a train crash in the country, adding to a sense of foreboding.

Then on Tuesday, CDP Financial, which is guaranteed by Caisse de depot et placement du Quebec, cancelled its long three-year US dollar benchmark after it was unable to build a strong enough book.

There were cancellations of liability management exercises too, one from French video gaming company Ubisoft Entertainment and another from the UK's AA, which is best known for its road recovery service.

Stuck in the middle

Each new issue had its own distinctive reason for failing. Sagess, for example, fell between two stools, being neither a pure agency nor a pure corporate. Leads were unable to move pricing from the initial 45bp area over OATs level for the €500m June 2029 note and eventually had to call off the deal.

"In this market you want to engage with as wide an investor base as possible," said a banker close to the deal. "For this you are ruling out some investors with the spread, because for those looking at it as a corporate this is off market in terms of how tight it is. So you alienate some of the investor base and the reality is that with the market at the moment, people prefer liquid and more frequent issuers."

But even relatively frequent and well-known issuers are struggling. African Development Bank managed to get a US$1bn July 2025 Global bond done on Tuesday but books were just US$900m (with the leads assumed to be making up the shortfall) and pricing did not move from the SOFR mid-swaps plus 25bp area starting point. In July 2021, when AfDB last issued in the US dollar market, it had books of more than US$4.2bn for a US$2.75bn five-year bond.

Even KfW played it safe, tightening pricing by just 1bp on a €4bn November 2029 green bond on Tuesday, even though the book was €13.6bn. The final spread of mid-swaps minus 16bp left a concession of around 4bp. "In recent large trades we were able to tighten the price by 2bp or more. But we have to consider that the market now is a different one, with the end of the net purchase programme by the ECB and the increased volatility in rates. Investors want to have more certainty about the value of their investment. That brings smaller adjustments during the marketing process and higher new issue concessions," said Jorg Graupner, vice president at KfW's capital market department, who added that the agency also wanted some flexibility over the deal's size.

Getting tougher

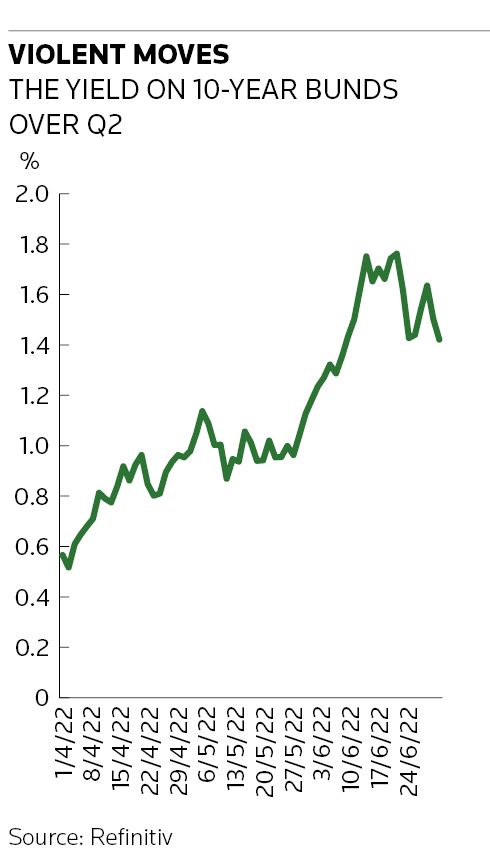

The first banker said that deal execution is incredibly tough because rates markets are moving so much intra-day, both higher and lower, as investors are unsure whether recession, inflation or both should be the biggest worry. "It's finding the point which offers relative value. Everyone looks at value from different angles – versus governments, versus swaps, or absolute yields. When swaps and rates are moving around in different directions it's difficult to find consensus on fair value. It's only with the benefit of hindsight that you realise something looks too tight."

That inability to pinpoint fair value was amply illustrated by CDP Financial, which was attempting to return to the US dollar market for the first time since January. The September 2025 deal struggled from the outset, with the price settling flat to initial price thoughts of mid-swaps plus 42bp area, before it was pulled. Bankers away from the deal judged that the new issue premium was somewhere between 5bp and 11bp

"The issue is if you are not a core or safe name, then investors don't have to buy since those names have widened so much they can be found at very attractive levels," said a syndicate banker.

"The key is all in the price. It's got to be cheap enough. And what was cheap yesterday may not be so cheap today."

(Additional reporting by Luke Acton and Robert Hogg)