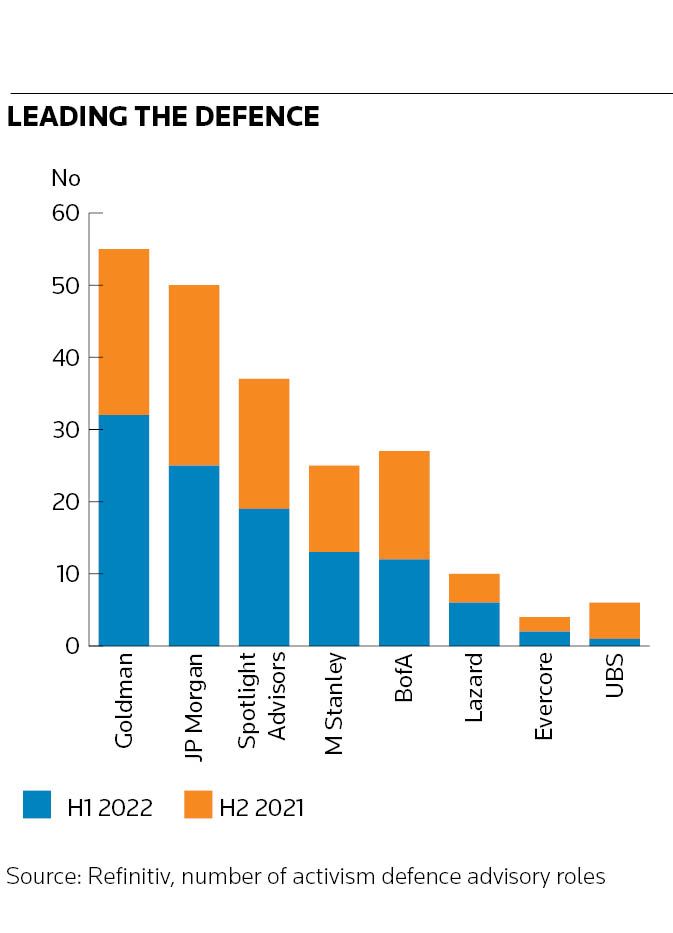

Who you gonna call? When companies are facing hostile shareholder actions – from demands to sell the company to requests for board seats – the first call still goes to Goldman Sachs, according to Refinitiv data.

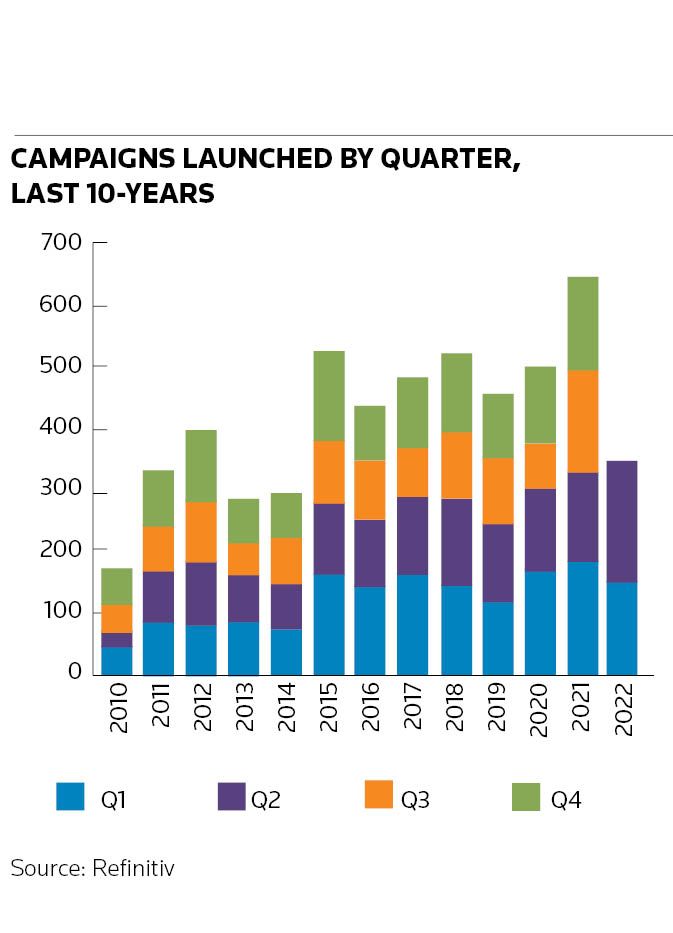

Nearly 350 activist campaigns were launched in the first half of 2022, up 6% compared with the same period last year, Refinitiv data showed. It was the most active first half in more than a decade, signalling that activists are fully engaged after a brief period of calm, and bankers expect the rest of the year to remain lively. Activists took a breather following the pandemic, but have come back with a vengeance this year, launching campaigns for shareholder rights, board seats, demands to sell companies, demands to resist a buyout, say on pay and demands to split companies up.

"It’s been a record-setting year so far through July and August," said Ryan Nebel, partner in the activist group at Olshan Frome Wolosky. "Its certainly been the busiest year I’ve had and I expect a busy second half."

Olshan Frome Wolosky was the top law firm in the first half of this year, working on 37 activist campaigns; the New York firm works primarily for activists whereas banks work primarily for companies. Sidley Austin, Vinson & Elkins and Schulte Roth & Zabel followed with 19, 17 and 15 assignments, respectively.

"The volatility we’ve seen this year has created quite a bit of opportunity similar to 2020," Nebel said. Volatility creates opportunity for activists and many are sitting on war chests ready to be deployed. And unlike the brief period following the pandemic when companies and activists quietly settled campaigns without much of a fight, both sides are now prepared to slog it out.

For companies, that means engaging financial advisers and Goldman remains the leading bank for defence work. The bank was tapped for 32 defence assignments, according to Refinitiv, keeping the top rank it held last year. JP Morgan was second in the first half with 25 assignments, followed by activist defence boutique Spotlight Advisers, which had 19 assignments. Morgan Stanley and Bank of America followed with 13 and 12 assignments, respectively.

Despite poaching Goldman’s head of activism in 2015 to build its practice, Evercore had a modest two assignments in the first half, Refinitiv data showed. Rival Lazard had six assignments.

Repeat activists

Main street investor and corporate gadfly John Chevedden was the leading activist with 16 campaigns in the first six months of the year. Chevedden is a former Hughes Aircraft employee who is known to take public transportation to shareholder meetings. He has spent years challenging big US companies such as JP Morgan, General Motors and Netflix on issues ranging from executive bonuses to voting bylaws, and has had some success.

Retail investor Kenneth Steiner was second on the list with six active campaigns, followed by the New York State Common Retirement Fund with five and National Legal & Policy Center and Carl Icahn and GAMCO Investors with four each.

Elliot Investment Management ranked ninth for campaigns launched in the first half, but in the past 12 months the powerhouse investor ranked second with 14 campaigns.

Technology was the most targeted sector with 61 campaigns launched in the first half, up from 36 a year earlier. Targets included Apple, Microsoft, Alphabet and Amazon. The financial sector is catching a slight break – it faced 54 campaigns in the first six months of this year, down from 89 in the first half of 2021.

While this year has been one of the busiest ever and encompassed a variety of campaigns, changes to proxy rules will make it harder to win full change of control battles, but could lead to more contested seats.

At the end of August, new proxy rules approved by the Securities and Exchange Commission take effect. The new rules usher in a universal proxy card that will allow shareholders to split their votes for board directors instead of being bound by a slate. That will allow them to “mix and match” nominees from the company’s and activist’s slates of nominees to a board.