Derivatives users are having to plough more resources into the humdrum world of collateral management as stricter regulation and a steep rise in margin calls across the finance industry put unprecedented strain on the financial plumbing underpinning these markets.

Reducing counterparty risk by setting aside margin against derivatives exposures was one of the central planks of post-2008 reforms. But recent examples of huge margin calls amplifying market stress, such as last year's UK Gilt crisis, have highlighted other risks that arise if firms are unable to ship enough collateral to the right place at the right time to keep the broader system running smoothly.

The amount of collateral the largest dealers collected on uncleared derivatives trades increased 8% last year to US$1.4trn, according to the ISDA margin survey, amid a sharp rise in interest rates and market volatility. That also came as hundreds of smaller firms had to start posting margin for the first time after new regulations came into force in September.

Many are now turning to collateral specialists to identify and manage liquidity risks lurking in their portfolios. Their aim is to avoid repeats of the various "dash-for-cash" scenarios of recent years, where firms have had to resort to asset fire sales to meet daily margin calls.

"Liquidity risk has always existed within the market but today it's being accentuated by the perfect storm of regulation, interest rates, and market volatility," said Joe Midmore, chief commercial officer at collateral and software specialist OpenGamma. "It's a unique set of circumstances that has led to it becoming a key focus for most organisations."

A clear shift

Most derivatives market activity is now centrally cleared or subject to bilateral margining, a development that experts say has materially lowered systematic risk relative to pre-2008. That has helped reduce stress in the financial system at crucial moments – most recently when Credit Suisse teetered on the brink of collapse in March before its emergency rescue by UBS.

But a concerning byproduct of these reforms has come to the fore as volatility has picked up. That is liquidity risk, where derivatives users and other leveraged investors can suddenly find themselves facing eye-watering margin calls when markets move sharply, often forcing them to sell assets to raise money.

That dynamic can significantly exacerbate market turmoil. Euro area investment funds sold almost €300bn of securities in the first quarter of 2020 to meet margin calls in the choppy markets at the start of the pandemic, according to data from the European Central Bank.

More recently, the Bank of England had to intervene to calm Gilt markets in September after a sudden leap in bond yields created a self-fulfilling doom loop for UK pension funds with liability-driven investment strategies that had to keep selling more Gilts to meet ever-rising margin calls.

"[During the Gilt crisis] there was a lot of collateral that was just not reaching the right place at the right time and was stuck," Laide Majiyagbe, head of financing and liquidity at BNY Mellon, said during ISDA's annual general meeting in Chicago last month.

"A lot of fire selling of assets was a function of a need for margin and not having the right kind of collateral."

Admin headache

Such events have forced derivatives users to get a better grip on the liquidity risk they face from their trading and hedging activities – a risk that can quickly intensify during times of market stress as volatility picks up and margin calls balloon. That can involve reviewing whether they have enough of the right collateral on hand (often cash) to meet a steep rise in margin calls – and whether they're able to funnel it through the correct pipes to get it to their counterparty in time.

Jackie Bowie, head of EMEA at Chatham Financial, said the consultancy had expanded its collateral processing capacity recently due to heightened client demand. As well as ensuring clients have enough liquidity to meet margin calls, there are other challenges such as calculating the correct amount of interest to be paid on collateral – something that was barely considered when interest rates were near zero.

Posting collateral "is now a massive admin headache and really does matter because we're dealing with quite substantial sums of money", Bowie said. "Volumes are up 10 times because there's been so much movement in the market and with so much collateral going back and forth each day."

Wider scope

Last year's widening scope of regulations, meanwhile, has significantly increased the number of derivatives users having to post collateral. Rules that went live in September require any entity with an aggregated notional derivatives exposure of more than US$50m or €50m to start posting initial margin – the upfront collateral amount they must pledge against their trades.

Around 200 more firms are now posting margin as a result of these rules, according to OpenGamma, while an additional 800 counterparties are set to begin doing so in the coming months and years as more entities breach the threshold.

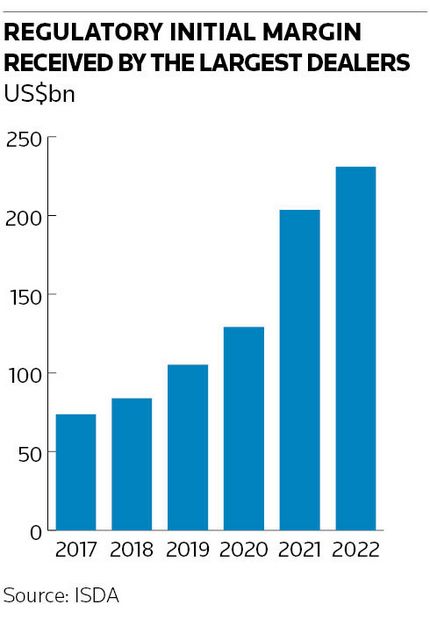

This continues the trend of greater collateralisation within the derivatives market over the past decade or so. Overall, the amount of regulatory initial margin the largest dealers in the market collect has more than tripled over the past five years – to US$231bn at the end of 2022, according to ISDA.

"We've seen an explosion of interest for margin analytics across multiple new client types – including corporates, pension funds, insurers and real-money managers who've had access to cheap financing for over a decade plus lower margin requirements in the bilateral OTC market," said Midmore at OpenGamma, which has seen its client base more than double over the past two years.

"That's now a rear-view memory as new regulation, persistent market volatility and rising interest rates have forced market participants to focus on capital efficiency and liquidity risk management," he said.

Baton Systems is another post-trade company that has seen increased demand from clients for its collateral services. Jerome Kemp, Baton's president, said that demand was primarily being driven by clients of futures commission merchants – the clearing broker arms of major dealers – which have also felt the strain of increased margin calls.

"The FCM space has been under exceptional pressure since the middle of last year, with a number of incidents significantly impacting the market – such as the US regional banking crisis ... and the LDI crisis," said Kemp.