CPI pays a price to prove bond market access

CPI Property Group on Tuesday enticed bond investors with a new issue that priced at a big discount to par, offering a hefty yield in the process, as the under-fire commercial real estate investor strives to defend its investment-grade ratings.

The company, which primarily invests in Central and Eastern Europe, has had a torrid time of late, not only due to the higher interest rate environment, which has hurt the real estate sector at large, but also because of allegations levelled against it by short-seller Muddy Waters.

With its longer euro-denominated bonds trading at cash prices in the high 60s to low 70s and the company's ratings at Baa3 negative from Moody's and BBB– negative from S&P, it had to find a way to prove market access at a manageable cost. It did so by pricing the €500m five-year senior unsecured green bond at a cash price of 95.042, or yield of 8.25%. The 7% coupon that followed is still more than double the 3.12% average cost of CPI's debt in 2023 but the outcome means the company has got additional liquidity without overstretching its interest coverage.

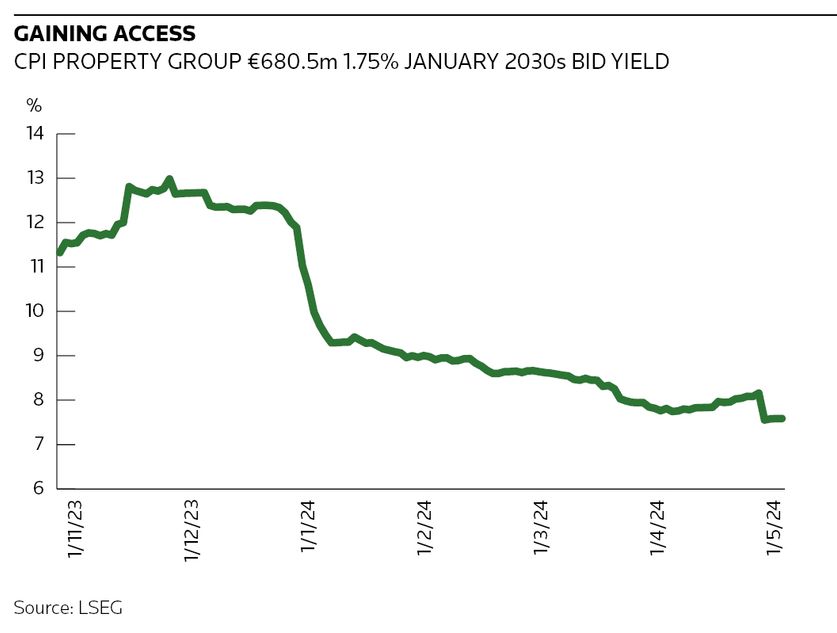

The final yield, which was 50bp inside initial price thoughts, was significantly higher than comparable bonds from other real estate issuers such as Balder, Citycon, CTP and Heimstaden Bostad, whose debt trades in a 4.50%–6.50% range. But given that CPI's €680.5m January 2030 bond was indicated at a yield close to 12.5% at the start of this year, according to LSEG data, it didn't have market access until recently. That bond is currently bid at 7.60%.

There was no shortage of demand for CPI's first bond issue since January 2022, with the final book exceeding €3.1bn. “Yes, the yield helped derisk the transaction,” said David Greenbaum, chief executive. But he highlighted CPI's loyal investor following too. "We also had an anchor commitment, which came through, and the other important thing is that we have worked very hard to maintain the relationship that we have with our fixed-income investors.”

To an extent, the deal's success could be put down to buoyant primary markets. One banker said it was a "bull market" trade. However, some other recent challenging deals, such as from Lithuania’s Avia Solutions and Germany’s BayWa, have failed to get over the line.

Demonstrating access

CPI's metrics have been hit by rising financing costs, a debt burden of almost €11.26bn-equivalent and a backdrop of declining real estate valuations. Compounding its problems, late last year the firm found itself under attack from Muddy Waters, which accused the company and its majority owner Radovan Vitek of inflating asset valuations. CPI denied the allegations and has published a detailed rebuttal.

Greenbaum said the market has moved past the allegations. “During the meetings [for the new bond] we did not have one question about Muddy Waters,” he said.

Even so, CPI's credit outlook is not straightforward. With liquidity of €1.4bn, €700m of proceeds from asset disposals, and only €1.1bn of debt maturing in 2024 and 2025, it was not under immediate pressure to issue. But the company is fighting hard to maintain its investment-grade ratings, and the agencies have started to turn their attention to CPI’s ability to deal with its close to €2.5bn of debt due in 2026.

“We don’t have large near-term maturities, but the rating agencies are starting to look at liquidity not just for the next 18 months but for the next two to three years and it was clear that they wanted to see bond market access,” said Greenbaum.

Proceeds from the bond issue will partially repay a bridge loan that CPI used to finance its 2022 acquisition of Austrian commercial real estate investors Immofinanz and S Immo. That bridge loan, of which €530m was outstanding as of March, forms part of the 2026 maturity wall.

Credit analysts welcomed the new issue. “For me they need to smooth [their] maturity peak of 2026, where I see €2.5bn of redemptions, so it is good to start sooner rather than later,” said one, who is becoming more bullish about CPI’s future and its bonds.

Others are more cautious, given the overall level of debt. “The company reports 52.3% net LTV, which seems quite high,” said an investor. “However, when considering companies' leverage, we usually also account for perpetual notes, which carry interest payments and have coupon adjustments. If these, around €1.5bn, are added, net leverage suddenly jumps to over 60%." He also pointed to an interest coverage ratio that declined to 2.5 times at the end of last year from 3.2 times in 2022.

Barclays, Goldman Sachs, Santander and Societe Generale were global coordinators on the new issue.