Coronavirus is greatest test yet of bond market liquidity

Regulators have long warned of the dangers the corporate bond market could pose to financial stability in times of market stress. So far, the risks have been largely theoretical rather than real. But the coronavirus-induced slump in credit markets will now provide a comprehensive test of how bond investors can navigate such storms in post-financial-crisis trading conditions.

Last week saw the sharpest sell-off in high-yield credit in nearly a decade, accompanied by record trading volumes, as investors reacted to the potential damage the novel coronavirus will do to the world economy.

There has been no indication so far of any self-reinforcing spiral of firesales, despite the billions of dollars that investors have pulled out of corporate bond funds.

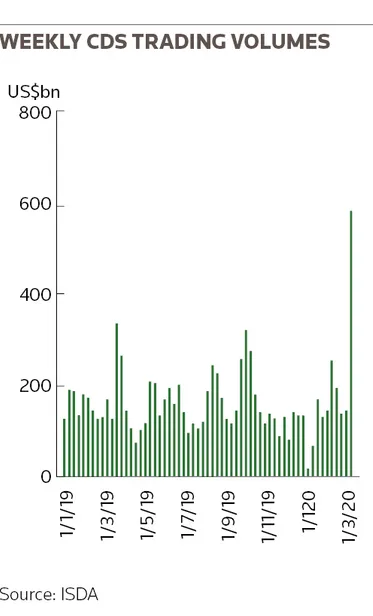

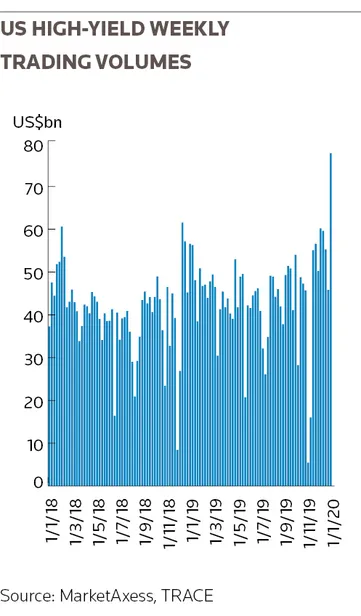

Instead, data show record trading volumes in US high-yield corporate bonds, credit default swaps and exchange-traded funds as debt markets have adjusted to the uncertain outlook.

Strategists warn it is likely that further large bond fund redemptions are imminent given recent poor performance and ongoing worries over the virus's impact. That would present perhaps the sternest test to date of the resilience of the multi-trillion dollar corporate bond market.

"The tail risk is if a large fund manager has to gate," said John Gousias, head of flow credit trading for EMEA at Nomura, referring to the process in which asset managers bar withdrawals from their funds. "If someone big gates, it'll be like when the first money market fund broke the buck. People are forced to sell, they don't care about the price."

"If everyone suddenly needs to raise cash levels, it creates a sell-off in risky assets that could compound itself. It's a snowball that turns into an avalanche.”

PRESSURE POINT

The US Federal Reserve and the Bank of England are among the regulators that have highlighted bond market liquidity - the ease of buying and selling securities in decent size - as a potential pressure point in financial markets. That is against the backdrop of the astronomical growth of asset managers and corporate bond markets over the past decade, coupled with the decline in risk appetite from bank trading desks.

The International Capital Market Association released a report this week that found liquidity in the roughly €3.6trn European investment-grade debt market has deteriorated since the trade body’s last study four years ago, and called on policymakers and the industry to act to arrest the decline.

Policymakers worry in particular about what would happen if asset managers offering investors daily access to their money have to gate funds because they are unable to sell corporate bonds fast enough to meet redemption requests.

There have already been notable outflows from bond funds and ETFs, which could explain the speed of recent price swings, analysts say. Global high-yield credit spreads widened by 123bp to just below 500bp last week, according to Federated Hermes and ICE bond indices - the biggest jump since 2011.

“This week, I expect we'll see some big redemptions on the back of last week's bad performance, and this is when you find out what the real value of these assets is,” said Mike Riddell, head of UK fixed income at Allianz Global Investors.

“We haven't seen yet signs of dislocations in markets until last Friday, when we maybe saw some signs of a liquidity crunch in places like [emerging markets].”

Investors pulled US$6.9bn out of high-yield debt funds in the week ended February 26, according to Bank of America, the third largest outflow ever. Meanwhile, almost US$2bn was pulled out of US high-yield ETFs on February 26 alone, according to Deutsche Bank - another record.

There was also a “steadily worsening picture” in Europe, where outflows have been lower so far, European credit strategists at JP Morgan said in a research note, with mutual funds starting to feel "the risk-off sentiment prevalent in the market".

“ETFs’ or mutual funds’ ownership of credit markets is high relative to history and you effectively become a forced buyer or forced seller if you get your inflows or outflows. That creates in itself more volatility,” said John Taylor, co-head of European fixed income at Alliance Bernstein.

“That passive risk-type portfolio is a source of volatility at what can be the worst time, as you tend to see investors use those products to hit the panic button and that exacerbates sell-offs.”

RECORD VOLUMES

One encouraging sign for investors was the bumper trading volumes that accompanied last week's sell-off, suggesting the market is holding up so far.

Last week was comfortably the busiest week in US high-yield trading volumes on record, with around US$78bn changing hands, according to market data going back to the start of 2009 provided by trading platform MarketAxess.

Trading data also showed how CDS and ETFs have become increasingly prominent in driving prices in the wider market.

It was by far the busiest week ever in CDS trading - with nearly US$600bn in volumes, according to data from the International Swaps and Derivatives Association going back to the start of 2013.

Elsewhere, BlackRock said gross flows in its European high-yield ETFs grew 251% last week. One European banker said the "ETF selling pressure was incredible”, with his bank receiving well over half a billion euros of sell enquiries one day last week.

Electronic bond-trading platforms also registered notable upticks, with MarketAxess and Tradeweb both reporting record credit trading volumes last week. Elsewhere, Liquidnet, a platform focused mainly on trading large blocks of bonds, said its volumes last week were double the average so far this year.

"There's a gap when it comes to liquidity provision from traditional sources, especially around blocks and less liquid securities,” said Constantinos Antoniades, Liquidnet’s global head of fixed income.

Even so, investors say trading bonds has still been challenging regardless of whether you are buying or selling.

“It’s tricky to buy, even on down days,” one high-yield investor said. “There’s dislocation, but also a lack of willingness to trade.”

That could be a positive sign that investors so far are not being overwhelmed by outflows. Many will be hoping that the market stabilises before large sales of corporate bonds materialise.

"The trader community in credit is smaller than it used to be. Now it's more of a real money, ETF product,” said Nomura’s Gousias. “The CIO has to give an edict to sell. It takes time. Every time the markets stabilise, the pressure to make big changes dissipates."

Additional reporting by Sudip Roy and Eleanor Duncan