Thames bursts into primary to keep its head above water

Heavily indebted Thames Water on Monday showed that it still enjoys full access to the bond market, though the big spreads it had to pay tell their own tale about its standing with investors.

The UK utility raised £850m through a dual-tranche offering comprising seven and 20-year bonds, with the deal upsized from its target of £650m–£750m thanks to strong demand, especially for the longer-dated tranche.

"For Thames it was important to establish there's ample liquidity for their funding needs," said a lead banker. "To show they have good ongoing demand was crucial."

Proceeds will be used to fund a tender offer on its June 2025s as well as for other general corporate purposes, including capital expenditure. The deal will help ease pressure on near-term refinancing risk, but questions remain about both Thames Water itself and holding company Kemble Water Finance.

"For a struggling company to get ahead of its debt maturities makes sense, but you still can't ignore everything else that's going on," said Johnathan Owen, a portfolio manager at TwentyFour Asset Management. "They need further equity funding."

Shareholders have indicated another £750m capital injection before March 2025 but that is dependent on certain conditions.

In the meantime, Thames Water bondholders were keen to put their cash into the two Class A secured notes, though it's debatable how much of that was down to any optimism about the credit outlook rather than the pricing on offer on ringfenced debt from a Triple B regulated entity.

Curve inversion

The spread on the £275m seven-year bond was set at 335bp over Gilts while the £575m 20-year note was at plus 320bp – the tranche sizes and curve inversion reflecting the scale of demand for long-dated assets from UK pension funds and insurers, though there were also orders from opportunistic buyers such as hedge funds and private banks.

Combined books, as the spreads were set, were more than £2.9bn, with more than £2bn of that for the 20-year tranche. Final orders for the longer tranche were even more impressive, at more than £2.5bn, while demand for the seven-year note stayed intact at more than £900m.

"If you want to take the positive, there's still a lot of demand for the company given what it's gone through over the past 12 months – more than £2bn for the 20-year is staggering," said Owen after the spreads were set. "However, it's not reflective of the company itself but the spreads and coupons on offer."

The coupon on the April 2031s was 7.125%, while the April 2044s was 7.75%. As a point of contrast, on January 3, National Grid Electricity Distribution (South Wales), rated Baa1/BBB+, priced a £300m July 2039 bond at a coupon of 5.35%, coming in at 120bp over Gilts in spread terms.

Initial price thoughts on both Thames Water tranches were plus 340bp–350bp, which was 40bp–50bp back of fair value. A second lead banker said that with "so much noise" around the credit, the syndicate was split between whether the curve would be upward sloping or downward and decided it was best left to the market to determine.

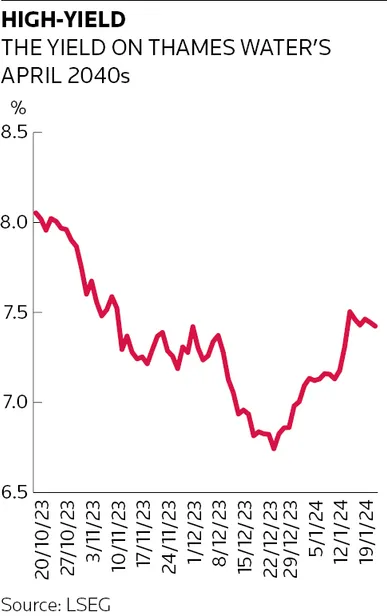

The best pricing reference point for the bookrunners was Thames' £300m 8.25% April 2040s that were issued in October and quoted at plus 313bp, according to LSEG data. In yield terms, it was bid just inside 7.50%.

Breathing space

While the deal provides Thames with some breathing space, the road to recovery will be arduous. Net debt at the opco level as of September 30 was £14.7bn, equivalent to 79.5% of the group's regulated capital value, and up 7% year on year. "It will be some time before we see Thames' spreads come down to anywhere near what they once were,” said Owen.

There's still plenty of uncertainty about the group's outlook, not least the fate of a £190m loan facility at Kemble Water Finance due in April. In the annual report for Kemble Water Holdings, which was signed off in July but not published until November, auditor PwC highlighted "uncertainties relating to the refinancing" of KWF's £190m loan facility "for which there is insufficient committed funds available, as at the date of this report, to repay".

KWF is an indirect subsidiary of KWH. KWF is also an unconditional and irrevocable guarantor of a £400m 4.625% May 2026 bond issued by Thames Water (Kemble) Finance.

While the auditor acknowledged that KWH's directors believe the loan will be refinanced ahead of the repayment date, PwC said at the time there is "currently no commitment from a finance provider and therefore no certainty this loan will be refinanced prior to April 2024".

Thames Water Utilities Finance (Baa1/BBB; stable/negative watch) is the issuer of the Class A notes, with Thames Water Utilities Ltd and Thames Water Utilities Holdings Ltd as guarantors. Lloyds, MUFG, NatWest and TD Securities were active bookrunners.