Russia default swaps rally, but trigger concerns remain

Credit derivatives offering protection against a Russian debt default rallied sharply in the latter half of the week after Moscow said it would make US$117m of interest payments on two of its US dollar bonds and press reports suggested the payments were coming through to bondholder accounts.

Those encouraging signs were enough to ease concerns over an imminent trigger event for credit default swaps.

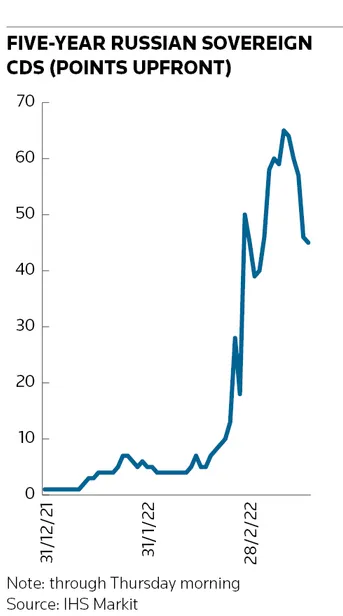

The upfront cost of insuring against a default on US$10m of Russian debt for five years dropped to US$3.9m on Friday morning, the lowest level since early March, from a high of US$6.5m the previous week, according to IHS Markit.

Russian CDS are still trading at distressed levels despite the relief rally, reflecting the considerable uncertainty hanging over a string of coupon payments the country owes on its external debt in the coming weeks – and the potential for Western sanctions to act as a roadblock in that process. That has left investors and analysts scrambling to understand how credit derivatives contracts will behave in a default scenario.

“The whole process with Russia CDS is more complex than normal: whether coupons are paid, whether the money reaches who it’s supposed to. I’m sure those questions will persist,” said Athanassios Diplas, a former senior Deutsche Bank trader and one of the architects of the auction process used to determine CDS payouts.

“Most of the effort we put in to designing the auction process focused on preventing manipulation of the final settlement price. If someone says you can’t trade bonds any more because of sanctions, you’re stuck,” he added.

The fate of the roughly US$6bn in Russia CDS exposure across the market has been an intriguing sideshow to the bigger question of whether Moscow will default on its external debt as a result of Western sanctions levied in response to Russia’s invasion of Ukraine in February.

Concerns that sanctions could prevent trading in Russian debt had previously led to a disconnect between CDS and bond markets, even though a widespread ban has yet to materialise. If Russia defaulted, Western financial institutions would need to be able to trade Russian hard-currency bonds in a CDS auction to establish a payout for credit derivatives holders that accurately reflects the scale of bondholder losses.

“There is a risk that if the CDS auction fails due to sanctions, this could adversely affect the perceived reliability and validity of the entire CDS market,” Bank of America strategists wrote in a recent note.

Cash call

Despite heightened expectations of a Russia default, there has been no CDS trigger so far. The Credit Derivatives Determinations Committee, a group of banks and investors that rules on CDS matters, confirmed on Thursday that a so-called repudiation or moratorium credit event had not occurred with respect to Russian CDS.

That means Moscow failing to honour its debt payments remains the most likely cause for a CDS trigger and ensures attention will remain fixed on whether bondholders receive their coupons in the coming days and weeks. Even if Russia clears this first coupon payment hurdle, it faces a string of cash calls in the run-up to May 25, the expiry date of an exemption US authorities have granted to US firms to process Russian sovereign coupon payments.

The next two coupons could be particularly problematic, coming on US dollar bonds with clauses allowing Moscow to pay in alternative currencies including roubles under certain circumstances. The Determinations Committee has already ruled such bonds can't be used in a CDS auction.

But will they work?

While uncertainty over a trigger event remains, there is growing confidence in some quarters that CDS will work properly if needed. Strategists at JP Morgan said in a note on Monday that CDS payouts should be substantial if Russia defaulted on its debt. They predicted a number of securities would be deliverable into a CDS auction, while a deluge of selling pressure on Russian bonds should produce a “very low” recovery rate – ensuring a meaty payout for protection holders.

The auction mechanism is complex, but essentially uses market forces to determine the level of CDS payouts needed to compensate for bondholder losses. Physical settlement of CDS positions plays a pivotal role in that process, Diplas argued, ensuring the integrity of the auction.

“It creates a balancing mechanism between CDS buyers and sellers, who have opposite desires for where the auction settles – high or low – and acts as an incentive to participate,” he said.

“It’s imperative for people that have not already hedged their CDS positions [through buying or selling bonds] to put in a physical settlement request. If they don’t, they effectively become a spectator. The only way to take care of your settlement risk is to trade bonds in the auction – otherwise you’re letting the other side determine where CDS will settle."