Units of Vietnamese conglomerate Vingroup are eyeing a return to the offshore loan market, joining a slew of other borrowers from the country that are paying up for foreign currency funding amid a credit crunch at home.

Despite the rise in borrowing costs, repeat Vietnamese borrowers continue to seek foreign currency loans.

Vietnam Technological and Commercial Joint Stock Bank (Techcombank) is another borrower likely to pay more on its latest US$200m new-money loan compared with its US$1bn multi-tranche borrowing completed last May. Masan Group and Vietnam Prosperity Joint Stock Commercial Bank (VPBank) have also launched financings carrying higher margins and fees than before.

“Vietnam is the most active market in South-East Asia by number of deals and there are loans from a cross-section of borrowers”, said a Singapore-based loan banker. “Everybody is looking for money in Vietnam because the local dong market is not easy to access, especially for the real estate sector.”

The surge in offshore borrowings is the result of regulatory tightening and government investigations into the bond and real estate markets that kicked off in the second half of 2022.

Last October, Truong My Lan, the chairwoman of real estate conglomerate Van Thinh Phat Holdings Group, was arrested on suspicion of financial fraud related to illegal bond issuances in 2018 and 2019. It followed the government’s introduction of Decree 65 in September, which removed an issuer’s ability to use corporate bonds to refinance debts of subsidiaries or affiliated companies and placed restrictions on the types of investors able to buy the bonds.

As a result, access to the domestic bond market has been constrained for most credits and is expected to take a while to recover. With GDP estimated to grow at 6.7% in 2023, according to the World Bank, market participants anticipate demand for debt from financial institutions wanting to fund growth, real estate developers in need of capital to complete projects, and the manufacturing sector.

That explains the rush to borrow offshore, even at higher cost. Vietnamese issuers are rare in the G3 currency bond market – the sovereign, rated Ba2/BB+/BB, has not issued offshore bonds since 2014, meaning other borrowers lack a benchmark.

Since then, only three Vietnamese credits have raised US$1.2bn combined from widely marketed offshore bonds with developer Bim Land’s US$200m offering in April 2021 being the most recent deal, according to IFR data.

Returning for more

By contrast, the offshore loan market has been a viable funding option for Vietnamese borrowers, which have raised US$30.85bn from 136 loans since the beginning of 2015, according to LPC data.

Banks willing to take exposure to the country face an embarrassment of riches this year. For instance, Masan, a top-tier conglomerate, has launched a five-year loan of up to US$650m paying top level all-in pricing of 373.95bp based on an interest margin of 350bp over SOFR.

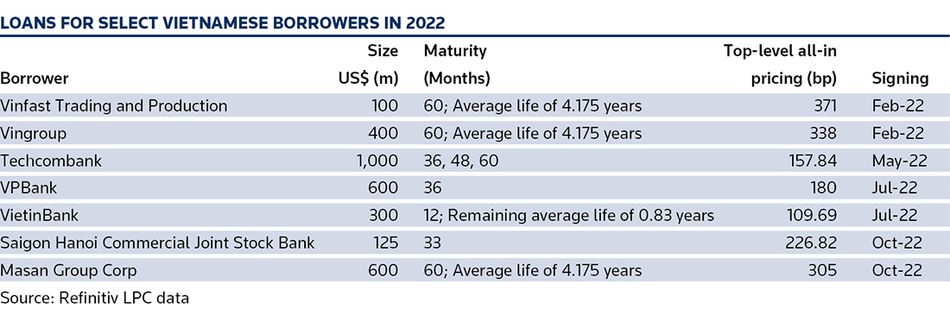

If Masan manages to raise that size, it will beat its largest loan so far – a US$600m five-year facility that closed last October paying a top-level all-in of 305bp via a margin of 290bp over SOFR. That deal was a blowout, attracting 37 lenders in general syndication, with Taiwanese lenders accounting for the bulk of the retail liquidity.

VPBank’s US$300m three-year social loan launched in January pays a top-level all-in of 198bp based on a margin of 170bp over term SOFR and a remaining average life of 2.75 years. Last July, the bank raised US$600m through a three-year bullet loan paying a top-level all-in of 180bp via a margin of 155bp over SOFR.

Market participants feel the increased pricing is justified as rising global interest rates raise funding costs for offshore banks, in contrast to last year when foreign lenders competed for mandates with aggressive terms.

“We think the pricing now is reasonable in terms of Vietnam’s country rating, and we need higher pricing to compensate for the higher rate risks we are taking due to the rising interest rates and global market volatility,” said a senior loan banker from a Taiwanese bank. “The pricing on those Vietnamese loans from 2021 and 2022 was a bit too tight because of intense competition among lenders for assets amid a dearth of deals from Indonesia and India due to the coronavirus pandemic.”

Some borrowers unwilling to meet the pricing expectations of foreign lenders are struggling to attract liquidity. Two such examples are the Vietnamese unit of South Korean display panel maker LG Display and state-owned Military Bank.

Both borrowers launched three-year loans last October offering top-level all-ins respectively of 148bp via an interest margin of 140bp over SOFR and 154bp via an interest margin of 135bp over term SOFR. Those levels were tighter than those on loans for other Vietnamese borrowers last year. (See Table.)

LG Display’s unit has scrapped its syndicated green loan of up to US$500m with a guarantee from the parent and is seeking bilateral loans instead from offshore lenders because of tight liquidity in the domestic market in Vietnam. Military Bank’s borrowing has still not closed, while it is not clear if other loans for Vietnam Maritime Commercial Joint Stock Bank and Saigon Hanoi Commercial Joint Stock Bank – also launched in the second half of 2022 – have closed.

“Although the parent might enhance the borrower’s credit profile, the pricing is a bit too tight compared with the other Vietnamese loans in the market,” said a Hong Kong-based loan banker who declined the LG Display deal. “In addition, the global demand for televisions and smartphones has taken a hit due to soaring inflation and a gloomy economic outlook."