Out of this world: Mars bond attracts US$114bn book

Mars sold a US$26bn bond on Wednesday that gathered US$114.4bn of orders as the family-owned company behind confectionery brands Snickers and M&M's seeks to fund its US$36bn cash purchase of Pop-Tarts maker Kellanova.

The in-demand jumbo transaction was welcomed by investors, who have faced a scarcity of big-ticket bond offerings in the past two years, even as overall supply has been strong. No investment-grade bond has topped US$20bn since May 2023 when Pfizer printed a US$31bn trade to fund its purchase of Seagen.

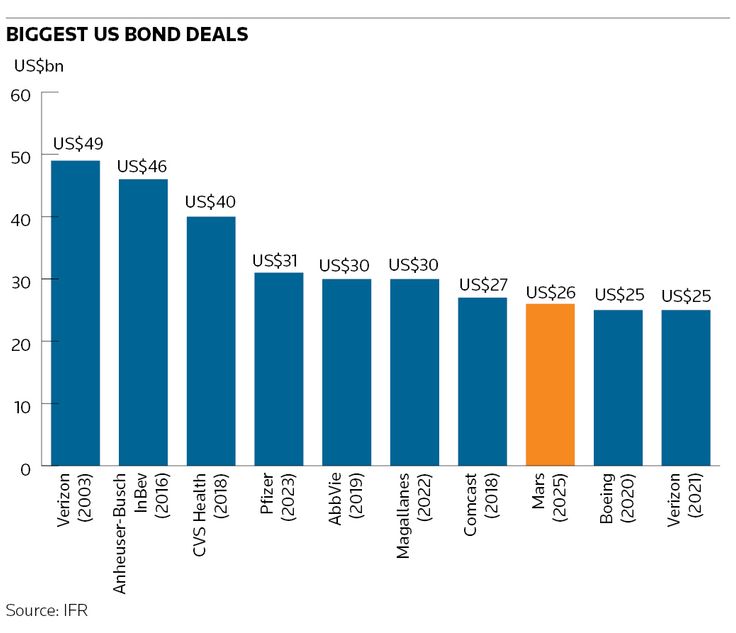

Wednesday's deal from Mars, an infrequent issuer, is the eighth-largest high-grade bond offering of all time, IFR data show.

“There’s always strong demand for jumbo sized M&A deal financings, especially if they’re names that have not been heavy regular issuers," said a senior portfolio manager.

As part of the financing package, Mars is also leaning on term loans and a private placement note. The acquisition was announced in August and is expected to close in the first half.

The 144A/Reg S bond offering, led by BNP Paribas, Citigroup, JP Morgan, Bank of America, Morgan Stanley and Rabobank, was split into eight parts. After holding investor calls on Tuesday, the company priced US$2bn of twos, US$3.25bn of threes, US$4.5bn of fives, US$2.75bn of sevens, US$5bn of 10s, US$2.75bn of 20s, US$4.75bn of 30s and US$1bn of 40s at spreads of Treasuries plus 50bp to 127bp, coming in from initial price thoughts of 75bp to 155bp area.

Mars achieved remarkable size and execution in a choppy market that had shown signs of indigestion only a day earlier, with Tuesday's offerings reporting weaker books and higher concessions than in past weeks.

"Double-digit spreads for a 144A deal from a private company is a great outcome," said a lead banker, referring to the 10-year note pricing at 95bp over.

Yet while investor concerns about a possible global trade war have pushed credit spreads wider, Mars is coming out ahead because Treasury yields have fallen steeply. The 10-year Treasury ended at 4.28% on Wednesday, down around 20bp from the start of the year.

“Maybe you’re paying 5bp–10bp extra in spread, but your rates have come down a ton," Ryan Jungk, senior managing director at Newfleet Asset Management, said on Tuesday. "The all-in yield you’re paying is still lower."

A private affair

Bankers said the large orders stood out given the offering's 144A/Reg S status. Such deals tend to trade slightly wider than generally more liquid SEC-registered securities, which require more disclosure.

That discrepancy was demonstrated by how Mars' spreads were wider than bonds of comparably rated food and beverage companies, such as Hershey, that prefer to issue SEC-registered debt, said the banker, noting that the additional yield was enticing to investors.

Though there have been large 144A/Reg S investment-grade offerings in the past, they have rarely come from private US companies like Mars with no publicly traded equity. Such borrowers, which include Cargill and Enterprise Holdings, are unusual in the high-grade universe.

To draw a wider appeal, Mars pledged to offer more information than when it previously raised funding.

"This deal was a lot more open kimono around pledging to give future financials," said the banker.

Moreover, the ubiquity of Mars' products helped offset the view that the company was opaque.

"People are familiar with the product," said another portfolio manager. "If the product was more esoteric, it would be more difficult."

Any concerns about the bond structure were also offset by the scarcity value of an event-driven offering from the sweet maker.

Not only has M&A issuance been sparse, but Mars is not a frequent borrower in public bond markets. Its two most recent high-grade issues were in 2023 and 2020, raising US$2.5bn each time in 144A/Reg S format, according to IFR data.

"They relied on the traditional private placement market for years and only kind of got their toes into the 144A market five or six years ago, and have never been a big [144A] issuer," said the banker. "144A investors don't have tons of exposure to Mars."

Opportunities to buy Mars bonds may also become scarce because investors expect it to reduce debt after adding significant leverage.

"The big issuance will be behind them, and they will need to be on good behaviour," said Jungk.

Moody's and S&P downgraded Mars bonds this year by a single notch to A2/A in anticipation of the increased leverage from the M&A debt. S&P forecast post-acquisition leverage would rise to four times from 1.2 times in the fiscal year to December 2024.