E-trading revolution lifts fixed-income volumes to record heights

The rapid electronification of fixed income trading in recent years proved instrumental in sending volumes soaring to new heights at the peak of the US tariff-induced volatility earlier this month, traders and analysts say, as these once human-dominated markets continue to evolve to resemble the world of equities more closely.

Trading activity in Treasuries, US corporate bonds and US municipal bonds all smashed daily records earlier in April, according to data provider Coalition Greenwich, as a trade war between the US and China intensified following Donald Trump's announcement of sweeping tariffs.

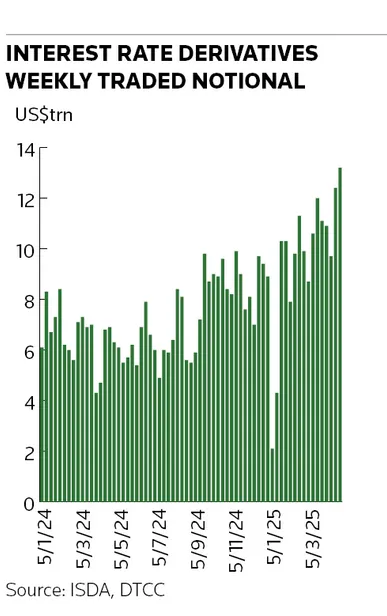

US Treasury yields spiked as traders reacted to the news. Interest rate derivatives volumes also hit fresh highs as investors moved to shield themselves from the volatility.

Many turned to electronic trading channels to get their orders done, traders and analysts say, in a sign of how growing automation is revolutionising bond markets.

“The electronic trading infrastructure that's further developed over the last few years has been important for facilitating these incredibly high levels of turnover without any major disruption,” said Kevin McPartland, head of market structure and technology research at Coalition Greenwich. “US$2.4trn of Treasuries trading in one day would not have been possible without a robust electronic marketplace. There's simply not enough traders in the world to answer enough phones to process that amount of flow manually.”

Bond and derivatives trading volumes have increased in recent years as the size of these markets has swelled. The amount of Treasury bonds outstanding has roughly doubled since 2017 to US$28.6trn, according to trade group SIFMA, as US government borrowing has risen sharply.

That has coincided with a rapid advancement in the electronification of bond markets, particularly in asset classes such as corporate credit that were once considered ill-suited to e-trading because of the sheer volume of different securities. About 58% of dealer-to-client Treasury bond trading volumes were handled electronically in March, according to Coalition Greenwich, up from 46% in 2019. The percentage of total US investment-grade corporate bond volumes traded electronically increased from 29% to 50% over the same period.

Pivotal

Traders said that e-trading has proved pivotal in the recent volatility, when Treasury yields jumped 50bp in the space of a week to 4.50% on April 11. An all-time high of US$2.4trn of Treasuries changed hands on April 9, Coalition Greenwich said, the third consecutive day of record volumes and nearly 25% greater than the previous day's total.

“We’ve seen this big change – this big equitisation – where price discovery is not as hard and volumes actually increase in the volatility,” said a senior e-trading specialist at a major bank.

McPartland said the above-average amount of dealer-to-dealer trading in on-the-run Treasury bonds suggested e-trading activity was robust during this period. These trades, which typically occur on electronic platforms, accounted for 59% of market volume on April 4 shortly after Trump's wide-ranging tariff announcement, compared with 46% on March 31.

“In these volatile market shock days, investors and traders rely on being able to get prices and execution on screen without having to get somebody on the phone,” McPartland said.

Strong performance

E-trading specialists appear to have performed particularly well over this period. Jane Street, which has leveraged its technological expertise to compete with banks in various asset classes, said last week that its current quarterly performance as of April 18 is generally in line with its record-breaking first quarter, when it estimated net trading revenues rose about 65% from a year earlier to around US$7.2bn.

Bank executives have already acknowledged the huge amount of client activity passing through markets as investors reshuffle positions in response to Washington’s shifting trade plans.

“We’re early in the quarter, but so far the business is performing very well and clients are very active,” Goldman Sachs chief executive David Solomon said on an April 14 earnings call.

JP Morgan chief executive Jamie Dimon painted a similar picture on the bank’s April 11 earnings call. “Volatility leads to bigger bid-ask spreads. That, all things being equal, is better [for a markets business],” Dimon said. “And it leads sometimes to higher volumes. So you’ve seen really high volumes in FX and interest rate swaps, a whole bunch of different things.”