EDF's £4.5bn deal with Apollo poses questions for sterling bond market

Electricite de France closed the first part of an up to £4.5bn deal with Apollo on Thursday that poses questions about the state-owned company's funding strategy, the appeal of private credit for investment-grade borrowers and the outlook for the sterling public market, which has seen a dearth of issuance.

The deal is split across three £1.5bn senior unsecured tranches, which rank pari passu with EDF's other senior unsecured obligations, for a maximum maturity of up to 12 years, though the bonds are callable. With the first of those tranches now signed, EDF can borrow again in 2026 and 2027, though it has the option not to do so, under its €50bn EMTN programme.

EDF’s decision to turn to Apollo instead of doing a public deal has set the market abuzz, especially as it paid a premium to do so. One banker said he spent a 30-minute call with another client just discussing this deal.

EDF, one of the biggest issuers in the sterling public market, said its main objective was to secure the sizeable funding without damaging its secondary curves.

“We did not want to push the market, pay a high premium and disturb the curve and potentially impact on other [currency] curves,” Bernard Descreux, director of financing in group treasury at EDF, told IFR. “We have had to keep it separate and avoid this kind of problem.”

The deal with Apollo was facilitated through the investor's life insurance company Athene. As such, the debt is mostly expected to be kept in buy-and-hold funds, reducing contagion risk from the bonds potentially leaking into the market.

Proceeds are expected to finance EDF's investments in the UK, including the under-construction 3.2GW Hinkley Point C nuclear power project, which has a £5bn funding gap due to delays and cost overruns.

“We have now secured an important part of our needs on the [Hinkley Point C] project, which is one of EDF’s biggest projects and the one we have to finance naturally in sterling,” said Flore de La Hougue, investor relations manager at EDF.

Big premium

Although the terms of the deal are confidential, the banker estimated that EDF paid a yield of between high 6% and 7% for the £1.5bn tranche. The company said it was less than 7%.

Still, even something in the high 6s would imply a big premium over where some bankers reckon the company could raise debt in the public market. “EDF is one of the biggest issuers in the sterling market. They could have taken a lot of cash out of the market at a far lower rate,” said a second banker. “This a terrible trade for EDF.”

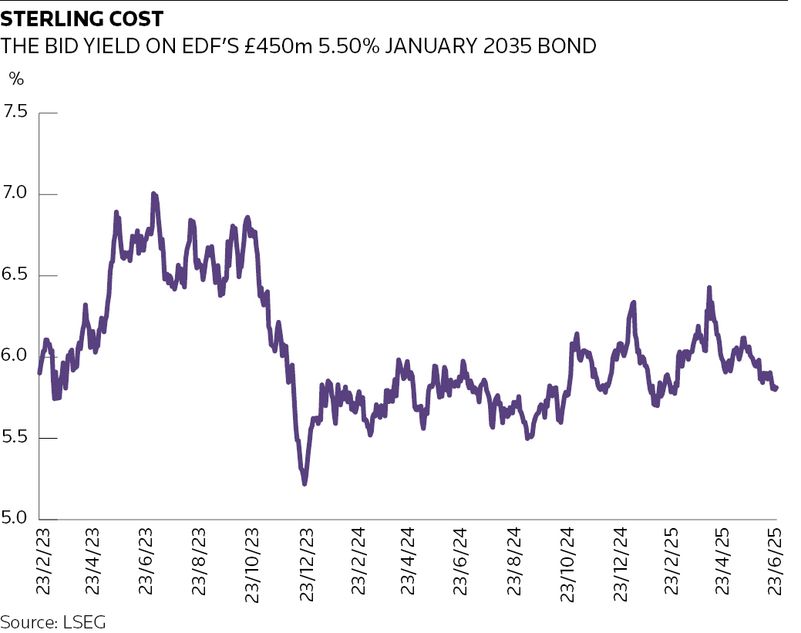

While it's difficult to be precise where a 12-year bond would price, bankers suggested it would be around 6.25%. EDF has a £450m 5.50% January 2035 bond, for example, bid at a yield of 5.80%, according to LSEG.

However, as that bond suggests, EDF wouldn't be able to raise £1.5bn through one tranche so would have to issue a number of tranches and ensure the blended cost made sense. To raise the full £4.5bn over three years would be an even more complicated exercise that would have to take into account market risk, the outlook for Gilts and the influence that UK investors have over the sterling market.

A third banker said EDF's call options, details of which have also not been disclosed, would also need to be considered in judging the merits of the Apollo deal.

“If they can call it on an annual basis then there is clear value to that from an issuer standpoint. If it’s just one call date there’s less value in that,” he said.

Flexibility

EDF (Baa1 stable /BBB positive/BBB+ negative) said it paid a premium compared to a standard bond because of its illiquidity – it's unlisted – the guarantee of accessing such a big amount and the structure's flexibility.

“It’s always too expensive,” joked Descreux on the pricing. “The deal made sense, it worked in our interest and helps us push our public yield curve south.”

In the short term, however, the company's sterling bonds haven't moved, said bankers, possibly reflecting the fact that investors are still trying to digest the news.

More coming?

There's also the question of whether more investment-grade issuers could turn to Apollo or other private credit investors rather than the public market.

Apollo has made clear its plans to strike new deals with investment-grade issuers, in addition to lower-rated ones. As well as EDF it has already provided financing to AB InBev, Vonovia and Air France through various structures.

For Apollo, bankers said the potential returns would need to at least cover the cost of Athene's annuities. Apollo did not respond to questions from IFR.

Other private credit investors are also hoping for opportunities. “A lot of other active private investors have rung and have expressed their interest in this kind of transaction,” said Descreux.

EDF's deal didn't go down well with some bankers who are fearful of further disintermediation, especially in the sterling market where supply is irregular at the best of times.

However, others are less concerned and say the pool of well-rated issuers likely to go down the private credit route is limited.

“EDF is a slightly different animal because their programme is very large,” said the third banker. “I don’t think it’s going to be widespread but, depending on the call structure, it could appeal to a lot of the utilities which have very large funding programmes.”

The first banker said he expected there to be more competition from private credit for similar project-based funding, but saw unlisted bonds as having “limited use cases because the bond and bank markets remain deep and very efficient".

Ironically, while emphasising its aim is not to disturb its listed funding programme, the Apollo transaction seemed to do just that for a €100m privately placed tap of its €1bn 4% May 2037 bond that EDF was attempting in mid-June.

That deal, via Credit Agricole, was cancelled because of “technical reasons”, according to an update to investors.

EDF officials said it could not have two live deals at the same time from a documentation perspective and described the timing of the Apollo agreement as “sudden”.

Additional reporting by Alex Chambers and Sudip Roy