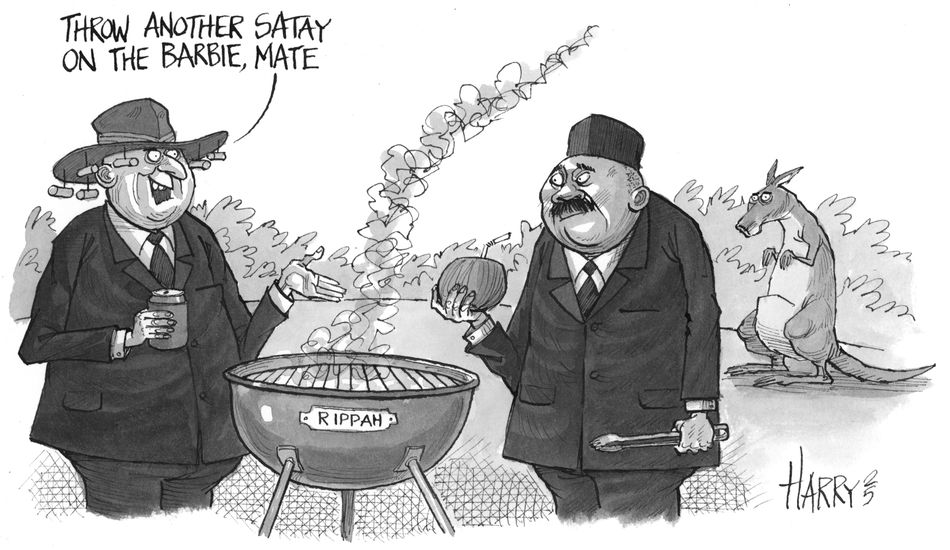

The Republic of Indonesia branched into a new market to sell a debut A$800m (US$522.5m) Kangaroo bond as it seeks to diversify its funding options.

Indonesia has become a well-established player in the G3 currency market, and this year has raised US$4.2bn from two Yankee transactions, €1.4bn via a dual-tranche Reg S trade, ¥103.2bn (US$700m) from a three, five, seven, 10 and 20-year Samurai issue and US$2.2bn from a two-part sukuk.

The sovereign had earlier expressed interest in breaking into two of Asia Pacific's most attractive local currency markets, Australian dollars and offshore renminbi, and took a plunge into the former last week.

Indonesia is just the second sovereign to sell a Kangaroo bond in the last two decades, following a debut A$450m five-year issue from South Korea in December. The previous national government Kangaroo was a 10-year Austrian note in 2004.

Bankers on the deal noted that while the pricing was attractive, the arbitrage Australian dollars offered was not the leading factor in Indonesia's decision to sell the notes. Instead, it was focused on diversifying its investor base and building on its ties with Australia.

"This is an extension of the republic's footprint in the international bond market," said a banker on the deal.

The transaction was heavily oversubscribed, with demand from international investors helping the final combined book reach A$7.97bn, of which A$3.76bn was for the five-year and A$4.21bn for the 10-year. But the issuer also attracted a good amount of Australian dollar-only buyers, with about 30% of the deal going to local investors, said a second banker.

While the book size would have allowed for a larger trade, the bankers said Indonesia wanted to be prudent in its debut deal. It divided the fundraising between a A$500m 4.4% five-year note priced at 99.88 to yield 4.427% and a A$300m 5.3% 10-year tranche sold at 99.387 to yield 5.38%.

The reoffer spreads were equivalent to asset swaps plus 90bp and 135bp, respectively.

Revised guidance of 105bp area and 150bp area was announced on Thursday morning, inside initial guidance of 115bp area and 165bp area.

Leads ANZ, Standard Chartered and UBS referenced as comparables Indonesia's US dollar January 2030 and January 2035 lines as well as its July 2029, January 2033 and January 2037 euro benchmarks.

In addition, the South Korea December 2029 Kangaroo, US dollar July 2029s and euro July 2032s were also referenced. But South Korea is rated Aa2/AA/AA–, compared to Indonesia's Baa2/BBB/BBB ratings.

Investors indicated that they wanted to see a premium compared to Indonesia's US dollar and euro curves, given this was a debut deal, but final pricing came flat to slightly inside the US dollar curve and inside the euro curve.

"The deal obviously surpassed expectations," said a third banker. "We do have quite a robust Kangaroo market, but also a robust SSA market. It was a natural fit for a lot of local and APAC investors."

Four Australian states also raised a combined A$5.5bn in the domestic bond market during the week.

Education

There was some education for Australian investors trying to figure out how to look at a Triple B SSA name, as it is lower rated than the typical Australian SSA borrower. The result was that orders came from a mix of rates and credit investors, said the third banker.

"We were pretty happy with the penetration in terms of the domestic investors, given the rating, given the spread and how it would sit in their portfolio," he said.

The second banker said he "wouldn't be surprised" if Indonesia returned to the Kangaroo market in the future. A Dim Sum is also still a possibility this year. "The sovereign has a larger funding plan versus previous years, so as part of their endeavour to raise more, Australian dollars was an option for them," he said.

Other sovereigns or quasi-sovereigns could also follow, the second banker said. "This opens up their eyes that Triple B issuers from emerging markets can access the market."

For the five-year, Australian investors took 34%, Asia 43% and EMEA 23%.

Asset managers received 35%, middle market investors 13%, banks and private banks 24%, official institutions 19% and hedge funds and securities houses 9%.

For the 10-year, Australian investors were allocated 33%, Asia 53% and EMEA 14%.

Asset managers bought 42%, middle market investors 22%, banks and private banks 22%, official institutions 8% and hedge funds and securities houses 5%, to the nearest percentage point.