Indian InvITs step up fundraising

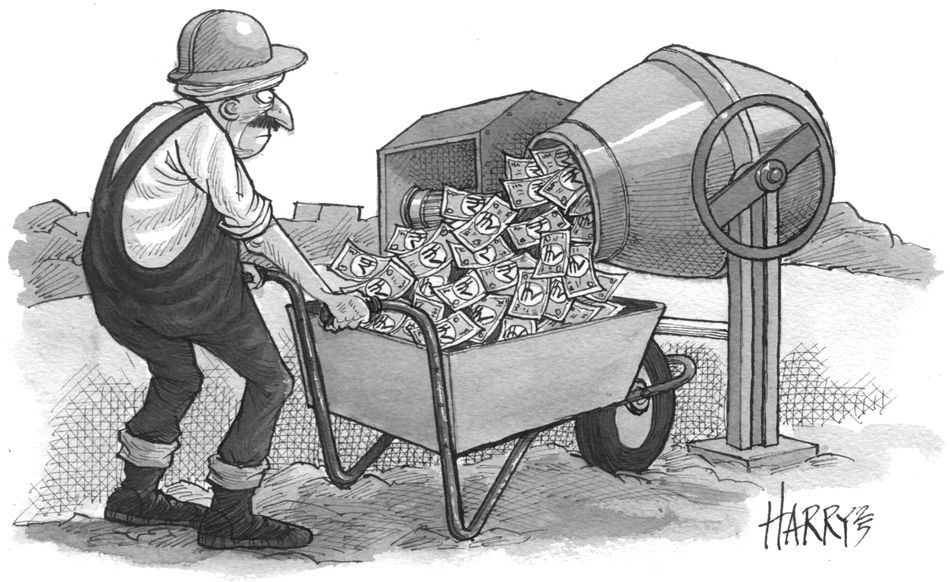

Equity and bond offerings by infrastructure investment trusts (InvITs) are gaining momentum in India, helping to derisk infrastructure investments and unlock capital for banks.

InvITs and real estate investment trust bond issuance has reached an all-time high of Rs243bn (US$2.8bn) this year, surpassing last year's record of Rs208bn, according to data provider Prime Database. Equity issuance by InvITs and REITs totals Rs122bn compared with Rs71.6bn in 2024.

The surge in fundraising is driven by the refinancing of loans InvITs used to build up assets. The Reserve Bank of India's larger-than-expected 50bp interest rate cut in June has also heightened investor interest in yield-based products such as InvITs and REITs.

The National Highways Authority of India has started work on its second InvIT but this time it plans to list it via a Rs100bn IPO, a change of approach from an earlier listing through a private placement.

ICICI Securities, SBI Capital Markets and Trust Investment are working on the listing, according to people with knowledge of the transaction.

The latest InvIT is expected to comprise road and power transmission assets.

"Indian ECM is very favourable and this is the best time to widen the investor base of REITs and InvITs," one of the people said.

NHAI listed National Highways Infra Trust in 2021 through a Rs50bn placement at Rs101 per share and sold a Rs14bn follow-on institutional placement in 2022 at Rs109. The shares ended on Wednesday at Rs136.

"Sponsors are transferring revenue-generating assets such as transmission lines, toll roads, and warehouses into InvITs and REIT structures. These platforms then tap equity and bond markets to raise low-cost capital, reducing reliance on traditional bank funding," said Pranav Haldea, managing director at Prime Database.

In the debt market, TVS Infrastructure Trust is mulling a debut bond offering of up to Rs10bn and Cube Highways Trust is planning to raise Rs4.5bn from three-year and six-month bonds. TVS Infrastructure listed in July through a Rs13bn private placement at Rs100 and its shares closed at Rs102.75 on Wednesday.

Icra and India Ratings have assigned AAA ratings to the notes of Cube Highways Trust. Icra has assigned a provisional AAA issuer rating to TVS Infrastructure Trust but is yet to rate the bonds.

InvITs can raise up to 49% of their capital through debt, or up to 70% if they maintain an onshore AAA rating. They can then turn to the equity market to cut leverage once their debt levels reach the regulatory caps.

Crisil predicts that assets under management of InvITs and REITs will increase to Rs10.5trn–Rs11trn by the end of March 2027 from Rs7.8trn at the end of March 2025.

"As InvITs become larger, they need to raise more capital, especially on the debt front," said Harsh Shah, managing director of IndiGrid, India's first publicly listed power sector InvIT.

“We could see InvITs from telecoms, warehouse, hospital and education institutions," he said.

Investor confidence is also strengthening, as the deals have been backed by strong sponsors and stable underlying assets.

"Most of the InvITs and REIT platforms are backed by pedigreed investors, which gives comfort both from an asset management as well as platform growth perspective," said Amit Tripathi, chief investment officer of fixed income at Nippon India Mutual Fund. "The underlying portfolio is one of stabilised assets with reasonably well-defined cashflows/revenue streams."

Deleveraging

There is a shift in infrastructure funding from traditional banking channels to nonbanking avenues as more InvITs and REITs access capital markets.

"Cash-generating infrastructure assets, previously held on corporate balance sheets, are being transferred to InvITs and REIT platforms. These platforms, in turn, are accessing capital markets for both equity and debt, helping the sponsor corporates deleverage," said Tripathi.

"As of the end of March, InvITs and REITs had estimated debt of Rs3.2trn–Rs3.3trn, of which nearly Rs700bn– Rs800bn has been placed using capital markets instruments, which is likely to gradually increase," said Anand Kulkarni, director of corporate and infrastructure ratings at Crisil.

The domestic bond markets are very liquid and provide attractive levels for long-term financing, which is important as InvITs and REITs typically have a life of 25–30 years.

"In current market conditions, they are getting fixed-rate funding for longer tenors from infrastructure financing institutions like NaBFID and pension funds, which suits their asset-liability management and helps with improving visibility on potential equity returns," Tripathi said.

National Bank for Financing Infrastructure and Development was the sole investor for IndiGrid's Rs19bn 22-year bond offering in July at 7.345%, rated AAA by Crisil and Icra.

For the upcoming Rs10bn bond sale, TVS Infrastructure Trust is eyeing Rs8bn from a 10-year amortising tranche that is expected to be placed with NaBFID at an estimated effective yield of 7.60%, while a Rs2bn five-year tranche will be placed with other investors.

TVS Infrastructure Trust did not reply to an email seeking confirmation of the plans. NaBFID declined to comment on the trade.