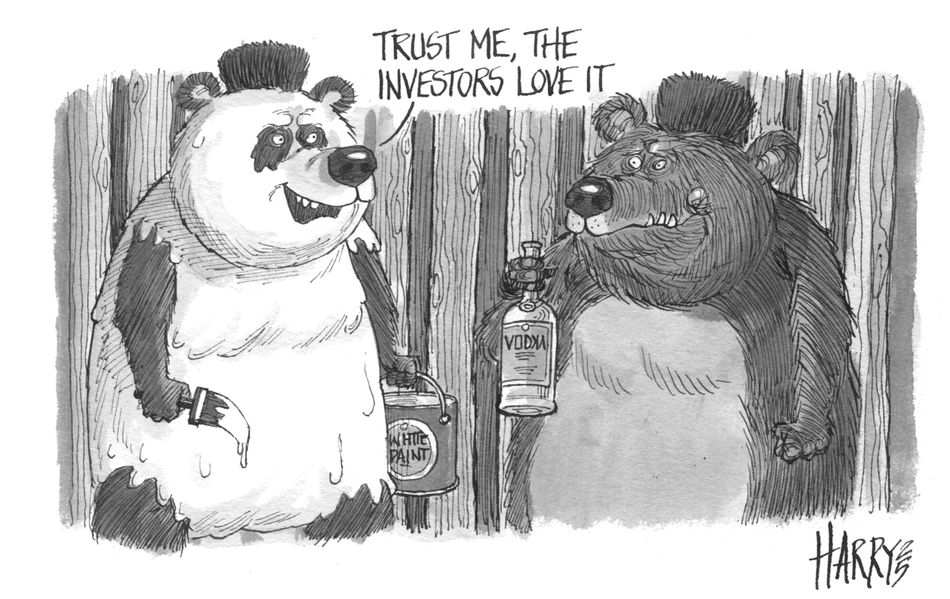

Russian issuers face Panda hurdles

Russian companies are eyeing China's bond market as a potential source of funding but US sanctions pose challenges for those issuers, whether or not they are on the sanctions list.

On September 7, the Financial Times, citing sources, reported that a number of Russian oil companies are considering issuing Panda bonds given their restricted access to G3 currency markets and have received support from Chinese regulators.

"A number of potential issuers have approached us; they are very interested in this market," a partner at a Chinese law firm told IFR.

But almost all Chinese banks active in underwriting Panda bonds have US branches, putting them at risk of breaching US sanctions if they help blacklisted companies, the partner said. Investors would also need to be aware of the restrictions and would be unable to participate if they have US connections.

"We do not see Russian Panda deals coming our way – yet," said a banker at the Hong Kong branch of a Chinese investment bank.

The US Department of the Treasury's Office of Foreign Assets Control has warned that foreign financial institutions that conduct transactions for sanctioned companies or individuals could themselves be sanctioned or have their correspondent accounts closed at US banks, which are banned from dealing in debt or equity of Russian sanctioned entities, including the sovereign.

In November, OFAC said it was "prepared to more aggressively target" foreign financial institutions that joined Russia's System for Transfer of Financial Messages, a financial payments system launched in 2014 as an alternative to the US-led Swift network following US sanctions imposed after Russia annexed Crimea. Some Chinese banks have joined the Russian network.

The country's biggest banks and oil companies, including Gazprom and Surgutneftegas, are among those subject to US sanctions, as the US says they help fund the war in Ukraine.

"Potential Panda bond issuers from Russia are those that are not on the sanctions list," the lawyer said.

Payments

The US and European Union's sanction policies against Russia began in 2014 and were expanded in 2022 and 2025. They continue to target certain sectors such as energy and financial services, without applying to all Russian entities.

Nevertheless, a majority of Chinese banks have ceased to accept payments from Russia. That means even Russian issuers exempt from sanctions would have to use their own Chinese subsidiaries to settle underwriting and legal fees, since they are able to make onshore payments in China.

The unfamiliarity of Russian accounting firms with Chinese audit requirements would be an additional challenge during the application process.

Prior to Russia's full-scale invasion of Ukraine in 2022, "Russian issuers would usually engage one of the Big Four audit firms, as those have branches in China and are familiar with this process, but since the Big Four no longer work in Russia, Russian issuers have to engage local auditors, which are not familiar with PRC requirements", the lawyer said.

"I don’t think we have seen a successful case of a Russian audit firm filing with the PRC," she said.

State-owned oil company Gazprom has obtained a domestic AAA rating from Chinese rating agency CSCI Pengyuan, the latter said on September 5.

The domestic rating is an indication the sanctioned company could be eyeing China's onshore capital market for fundraising. While a domestic rating is not a requirement, in practice companies rated below AA+ by an international agency would struggle to find demand among Chinese investors without an investment-grade Chinese rating.

International rating agencies withdrew their ratings on Gazprom following Russia's invasion of Ukraine.

A spokesperson for Russian nuclear power company Rosatom said it is preparing an onshore renminbi bond transaction, according to Reuters.

Unlike Gazprom, Rosatom is not on the sanctions list.

Relationship building

On September 2, Gazprom announced an agreement between China and Russia to build a gas pipeline through Mongolia, known as the Power of Siberia 2, after talks between presidents Xi Jinping and Vladimir Putin in Beijing the same day.

"China has a good relationship with Russia. Russian issuers may need to explore more funding channels and want to have more connection with Chinese regulators, [while for China it fosters] internationalisation of renminbi use, so it’s a win-win," the lawyer said.

Issuers of onshore renminbi bonds require government approval to remit the proceeds offshore, which is where good diplomatic relations with China come in handy.

Recent issuers of Panda bonds include Hungary, which in July sold the biggest sovereign Panda bond. Pakistan and other issuers with Belt and Road ties to China have also expressed interest in Panda bonds.

The lawyer does not expect a Russian company to access the market in the immediate future. "Not for at least a couple of months; it’s all in preliminary stages," she said.

The most recent Russian entity to issue Panda bonds was aluminium producer Rusal in 2017, according to LSEG data.

Reuters also reported on Monday that Russia's finance ministry had released a statement encouraging the issuance of renminbi bonds in Russia rather than in China.

In May, Kazakh brokerage Freedom Holding priced renminbi bonds that were listed on the Astana International Exchange and other "Falcon bonds" have been sold in Kazakhstan by domestic branches of Chinese banks to tap growing renminbi liquidity outside China.

Similarly, listing renminbi bonds in Moscow could allow Russian issuers to get around some of the complexities associated with Panda bonds and provide a way for Russian institutions to earn interest on their renminbi holdings, but there is generally lower liquidity in the offshore renminbi market and borrowing costs are higher than for Panda transactions.