PharmEasy finds high-yield cure

Indian digital healthcare company API Holdings has refinanced a high-cost loan at an attractive rate through unrated and unlisted bonds, underscoring the growing importance of the private credit market as an alternative to bank or equity funding.

The parent of telehealth and diagnostics companies PharmEasy, Thyrocare Technologies and DoCon raised Rs16.9bn (US$190m) from two-tranche high-yield bonds that were sold to corporate treasuries, according to market sources.

The deal allowed API Holdings to replace an expensive high double-digit loan from Goldman Sachs, which was due by June 2026, at a blended effective yield of 12.81% for three years.

The company seems to have saved close to five percentage points in interest costs, according to sources.

The new structure also came with more favourable covenants, including a reduced pledge on listed Thyrocare shares of just over 60% compared with 100% under the Goldman facility.

The lower collateral requirement was supported by a sharp rise in Thyrocare’s stock, which has surged by more than two-thirds in the past six months.

While one of API’s units, PharmEasy, reportedly breached covenants under the Goldman loan last year, API continued servicing the debt and avoided default, sources said.

360 One was the sole arranger.

The improved borrowing terms are expected to strengthen API Holdings credit profile, boost Ebitda, and support a potential public listing within the next two to three years, a source said.

API Holdings did not reply to a request for comment.

API Holdings' positive experience in the Indian high-yield bond market stands in contrast with the unsuccessful attempt by another Indian new economy company, construction materials marketplace Hella Infra Market, to sell high-yield bonds in the US dollar market earlier this year.

Hella Infra had announced a mandate in July for 144A/Reg S bonds with a 3.25-year tenor and expected ratings of Ba3/B+ (Moody's/Fitch) but had to give up on the deal last month after a pricing deadlock with investors.

Eager investors

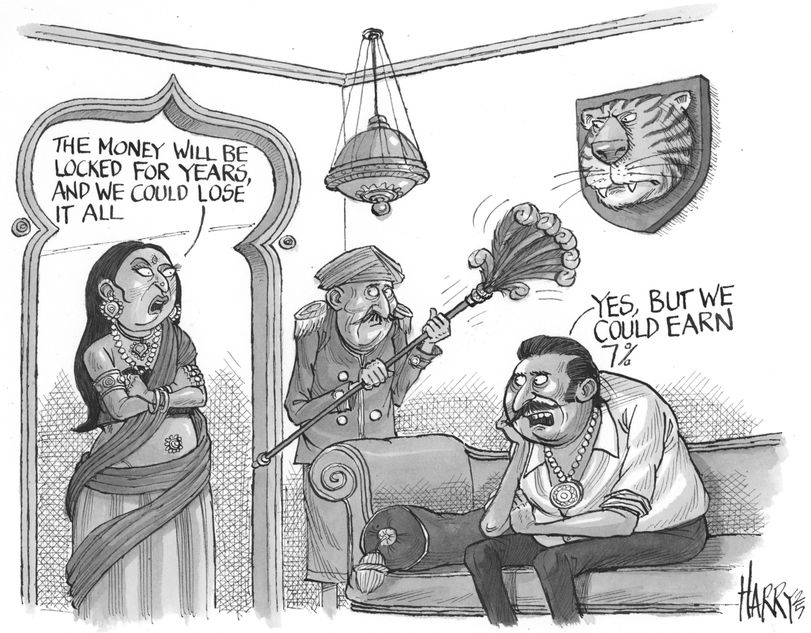

Unlike the stiff competition and high disclosure requirements in the offshore bond market, India's private credit market offers a large pool of eager corporate treasuries, high-net-worth investors and family offices that are prepared to invest in illiquid securities in exchange for double-digit yields.

API Holdings' bonds were placed with the corporate treasuries of Micro Labs, MVS Ventures, Bennett Coleman, Alkram Ventures, Kyrush Investments, Medley Pharmaceuticals and Mahalaxmi Trust, among others, according to sources familiar with the trade.

The unrated and unlisted bonds are expected to be sold in the secondary market to non-institutional investors, including high-net-worth individuals, sources said.

The bonds have exclusive appeal with a minimum investment set at Rs51m (US$575,000) and an investor pool capped at 200 accounts. The 11.1% and 14.5% coupons on the two tranches also offer HNWIs a rare chance to secure a return of around 7%–8% after tax.

In May, conglomerate Shapoorji Pallonji Group raised close to US$3.5bn in a private credit offering of unlisted and unrated three-year zero-coupon bonds to reduce the compliance burden of disclosures to exchanges and rating agencies every time there is a covenant trigger.

Private credit deals surged to US$9bn in India in the first half of 2025, up by more than 50% year on year in large part due to the Shapoorji trade, according to an EY report.

Despite the popularity of bespoke high-paying deals, some investors have concerns over the quality and transparency of such trades.

"The issuers do not have to adhere to the stringent disclosure and reporting norms that apply to listed debt securities," said the head of a private credit fund. "The lack of external credit ratings shifts the entire burden of credit risk evaluation onto investors themselves. Since the products are often highly bespoke and technically structured, it is challenging for a non-specialist investor to fully understand the embedded risks or cashflow mechanics."

While double-digit returns and exclusivity appeal to HNWIs, the private credit fund manager warned that "the underlying risk disclosures and safeguards are often inadequate, leaving investors exposed to opaque structures with limited recourse".

Part of the problem is excessive private credit liquidity.

"For several quarters now, private credit fundraising activity is much higher than the number and value of deals in India," said Bharat Gupta, founder of research firm Au-RRange Ventures and former strategy and transactions partner at EY India. "When more money is chasing fewer deals, mistakes are bound to happen and risk can get mispriced, especially for cashflow-based lending secured by equity."

IPO plans

Investors in the API Holdings bonds may enjoy some derisking if the company's renewed IPO plans come to fruition after it withdrew a planned IPO of Rs62.5bn in 2022 because market conditions were not favourable for tech names.

ECM sources said the company is planning to revive a smaller IPO with a new syndicate. Bank of America, Citigroup, Kotak, JM Financial and Morgan Stanley were the banks in the 2022 transaction.

Two banks from the 2022 syndicate said they were not interested in pitching for a new mandate. “These transactions are hard to execute as investors know the company is cash-strapped and will only buy an issue at very attractive valuations,” a Mumbai-based ECM banker said.

Another banker though said the company has managed to get a lifeline through debt and that improves the chances of a listing, adding: “Any investor on board is a good sign.”

API Holdings reported a net loss of Rs15.72bn for the financial year ending March 2025, narrowing from Rs25.34bn in FY24.

Meanwhile, Hella Infra plans to file confidentially in October for a US$500m–$800m IPO after recently raising capital from a group of investors including Tiger Global, Accel India, Nexus Ventures V, NKSquared and Evolvence India at a US$2.8bn valuation, just half of its peak valuation of US$5.6bn in 2021.

Goldman Sachs, HSBC, ICICI Securities, IIFL Capital, Jefferies and Kotak are working on the IPO.