US bond primary markets see busiest September on record

The primary markets for US high-grade and junk-rated bonds saw their busiest September on record as issuers across the ratings spectrum continued to raise funding against an increasingly upbeat backdrop across capital markets.

It is certainly a borrower’s market. Spreads may be tight, but demand for credit remains robust as investors seek to put hefty inflows to work and lock in yields amid expectations that rates are on a downward path after the Federal Reserve eased monetary policy again in September.

“Despite record levels of supply, the demand is even stronger, particularly from the insurance community,” said John Sales, head of investment-grade debt syndicate at Goldman Sachs. “The yield buyers are trying to lock in coupons before the Fed moves lower.”

Dealmakers are reaping the benefits of this latest spurt of activity. Debt capital markets fees jumped 18% in the third quarter to take revenues in the first nine months of the year to above US$34bn, according to LSEG data.

DCM is now on track to surpass the Covid-era boom years of 2020 and 2021 for its best ever year. And a pickup in large M&A financings such as the recently announced US$55bn buyout of video game maker Electronic Arts is expected to generate more new issue volume this year and next.

"As yields come down, the math starts working better for LBOs and there is clearly demand [for these types of transactions]," said Mike Schueller, a senior portfolio manager at Allspring Global Investments.

Party like its 2021

Indeed, issuance levels in many cases are back to where they were in 2021, just before the Fed began hiking rates in March 2022 and dampening primary activity in the process.

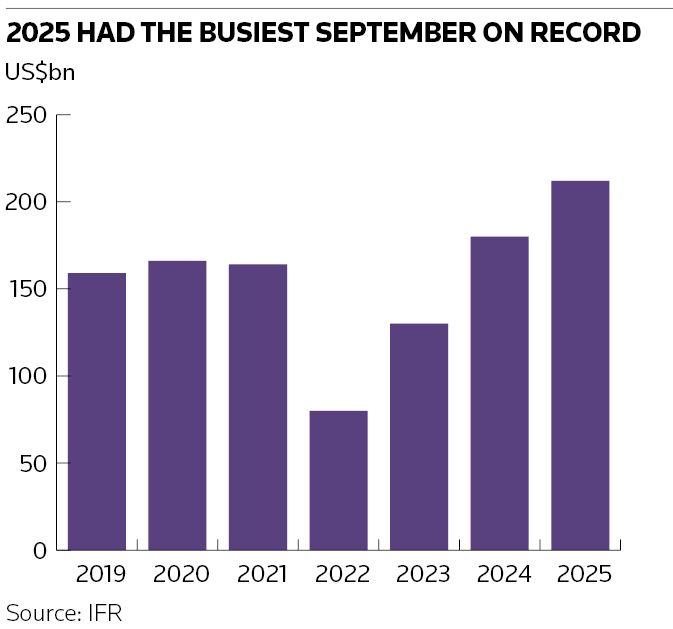

In September, total monthly issuance in the high-grade primary market reached US$212bn – a record high for the month – easily surpassing last year’s record September of US$179bn, according to IFR data.

That makes it high-grade’s fifth busiest month on record, the data show. The asset class saw its most active month ever in April 2020, when issuers priced US$288.6bn of deals amid the Covid pandemic.

It is a similar story for high-yield, where junk-rated borrowers raised US$52.05bn in September, also a record for that month. The asset class has only seen two months that have been busier: January and March of 2021, when primary volumes reached US$52.805bn and US$59.535bn, respectively, according to IFR data.

Yet, despite the flood of supply, credit spreads remain tight. The average spread for investment-grade bonds touched a post-financial crisis tight of 74bp earlier in September, according to ICE BofA data.

And while the average high-yield spread has widened a touch, it is still below 300bp – 281bp on October 1 – and not far from the post-financial crisis low of 259bp set in January this year.

“It’s very impressive that over US$200bn of supply [in the high-grade market] didn't produce any signs of investor fatigue by month-end, with strong deployment of cash,” said Jiyann Daemi, head of US corporate syndicate at TD Securities.

Strong technicals

Market resilience in large part is due to strong technicals in both the junk bond and high-grade markets. Consistent inflows into credit funds and ETFs – along with limited new money options in the form of acquisition financings – mean that demand continues to outstrip supply.

“The major theme has been strong US IG market technicals overriding episodic concerns around the Fed, general US macro and global geopolitics,” Daemi said.

Tight spreads and limited supply in the secondary market have the buyside seeking opportunities in the primary markets.

"Everyone is voraciously interested in the new issue calendar because they wanted to put some money to work in high-yield," said Brent Olson, a high-yield portfolio manager at Janus Henderson Investors.

"A lot of [portfolio managers] out there are thinking it is hard to engage the secondary at these levels, so let’s delve into these new issues and see where we want to be involved."

Against that backdrop, some buyside accounts have been more willing to take on risk in exchange for some yield, with names lower down the credit spectrum accessing funding.

During the week of September 29, for example, Single B names such as rig owner Transocean and oilfield products and services company Superior Energy tapped the junk bond market for the first time in several years.

The high-grade market has also seen several subordinated deals that were snapped up by investors on the hunt for higher yields in a declining rate environment.

Bank of Nova Scotia hit the market with a US$1bn 60-year junior AT1 capital note issue, while Dominion Energy also raised US$1.25bn through taps of two subordinated note offerings maturing in 2056.

Market participants expect October to be another active, albeit slower, supply month. Analysts at Bank of America are forecasting US$115bn in new supply for October, the largest amount for that month since 2021, thanks to low borrowing costs and a growing M&A pipeline, they say.

"Spreads are rich but there is plenty of demand," said Schueller. "And with the rally in rates and the tightening in spreads, we will probably see more supply."