Oracle makes new pledge on soaring debt in a bid to halt brutal selloff

Oracle has pledged to do everything it can to preserve its investment-grade rating, as the cloud computing provider seeks to assuage increasing nervousness over the gargantuan amounts of debt it is taking on to fulfil commitments made to hyperscaler clients such as OpenAI.

Douglas Kehring, the company’s finance chief, made the commitments in a meeting with analysts last week. Some of those present told IFR that the pledge marks a dramatic shift in policy for the company, which before the meeting had no formal debt or ratings policy in place.

“As a foundational principle, we expect and are committed to maintaining our investment-grade debt rating,” Kehring said, adding that Oracle would also seek other ways to reduce its financing needs – such as renting rather than buying chips, or asking customers to provide their own.

“Both of these options enable Oracle to synchronise our payments with our receipts and borrow substantially less than ... people are modelling,” he said. “There are a variety of [financing] sources available to us throughout our debt structure in public bond, bank and private debt markets.”

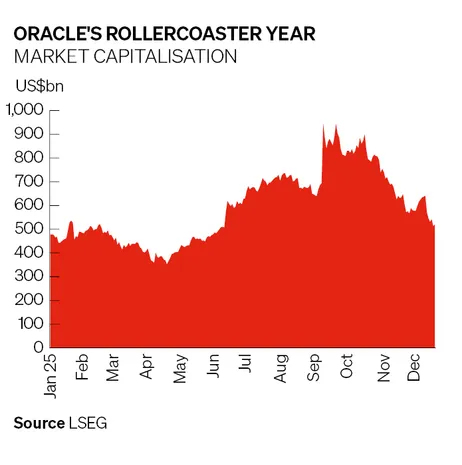

The abrupt shift in debt policy comes after a brutal few weeks for Oracle in equity and bond markets. After reaching a record high in September, when it was briefly valued at just below US$1trn, Oracle's shares have since fallen by almost half, wiping US$480bn off its market capitalisation.

Its fall from grace in bond markets has been just as dramatic. When the company sold US$18bn of bonds in September, investors almost fell over themselves to lend money to Oracle, with the deal more than four times subscribed. But investors in that deal are now sitting on US$1.3bn of paper losses.

Financial risk

Driving the selloff are concerns that Oracle is assuming too much financial risk to build data centres and buy chips to fulfil contracts with hyperscaler clients that won’t generate any revenue for years – assuming they are able to pay at all. Of those, one particular deal has come under scrutiny.

“Of their US$500bn backlog, at least US$300bn comes from OpenAI,” said Stefan Slowinski, global head of software research at BNP Paribas. “When OpenAI goes from perceived winner to perceived loser all of a sudden, then obviously Oracle feels the brunt of that.”

Oracle has been issuing debt since its early days in the 1970s and has been rated investment grade since the 1990s. It is rated BBB by S&P and Baa2 by Moody’s, placing it two notches above junk. Both agencies in July placed the company on negative watch for downgrade.

But that warning shot has done little to sate Oracle’s appetite for risk. Since then, it has done several deals, including the US$300bn agreement in September with OpenAI that could lead to a doubling of revenues by 2028 – but which will require huge capital expenditure to get there.

“Oracle … is fumbling to get past getting played by OpenAI,” said Gil Luria, head of technology research at DA Davidson. “It needs to fund the US$300bn of buildout for OpenAI even though the likelihood of OpenAI being able to pay for the capacity is very low.”

Unlike some other players riding the AI wave, Oracle came into the current boom period with a debt load that was already high. During the 2010s, the company borrowed heavily to fund a series of acquisitions – and an aggressive share buyback programme that doubled founder Larry Ellison’s stake.

Its borrowings stand at US$108bn, ranking it as one of the most indebted companies on the planet. But that debt load is expected to explode in coming years, with some analysts estimating that the company’s net debt could reach almost US$300bn over the next few years.

“There is concern that they could slip to junk,” said Slowinski.

He said the new debt policy brings Oracle into line with other similarly indebted companies. However, he said that – based on current spending patterns – there are questions about how it would meet that pledge.

“The company has now formally stated that it is committed to maintaining an investment-grade credit rating, but at the same time signalled it would be raising its capex guidance this year, adding to the concerns over the likely increase in debt despite the new investment-grade policy.”

Collapsed deal

Oracle is also facing pressure from other sources. The company has entered several outsourcing deals – effectively asking others to assume the immediate cost of building the cloud computing capacity it has committed to provide to its clients and then promising to rent those facilities.

But outside parties are beginning to balk at those deals. In recent days, private provider Blue Owl Capital – which has entered several deals with Oracle, Meta Platforms and other hyperscaler companies to build data centres – pulled out of talks to finance a new facility in Michigan.

Another player such as Blackstone could still step in, but the lack of an outside partner would leave Oracle on the hook, limiting its room for manoeuvre. “As it closes in on its debt capacity and investment-grade cutoff, Oracle will have to make some tough decisions,” said Luria.

While the company has about US$19bn of cash on hand, it will almost certainly need to come back to bond markets next year. Capital expenditure could be more than US$200bn over the next three years, and the company also needs to refinance about US$30bn of debt.

Bankers who deal directly with the company are confident that it will be able to raise what it needs. They believe that the selloff in markets in no way reflects the company’s financial stability – or the potential upside if many of its deals with the hyperscalers pay off.

“People aren’t concerned about Oracle – they are concerned about the wider AI complex,” said one San Francisco-based banker. “Most aren’t publicly traded so if you have any AI exposure then shorting Oracle is your only option. I haven’t heard a single concern about the company itself.”

Oracle has been here before. Its shares were so unloved in the 2010s that Ellison decided to buy back huge swathes of stock – a bet that has paid off handsomely. “There’s a lot of nervousness around Oracle right now – but it would be a mistake to count out Larry Ellison,” said Slowinski.

Oracle did not respond to a request for comment.