Members of the family controlling Samsung Group have raised W2.7trn (US$2.05bn) from sell-downs in four group companies to fund hefty tax payments, contributing to a strong start to the year in Korea's equity capital market.

Former Samsung Group chairman Lee Kun-hee died in 2020, leaving his heirs an inheritance tax bill of more than W12trn. Last November, Lee's widow Hong Ra-hee and her daughters Lee Boo-jin and Lee Seo-hyun announced trust agreements with KEB Hana Bank to sell shares in the group's flaghsip, Samsung Electronics, to fund the tax dues. Additionally, Lee Boo-jin planned to sell shares in Samsung C&T Corp, Samsung Life Insurance and Samsung SDS.

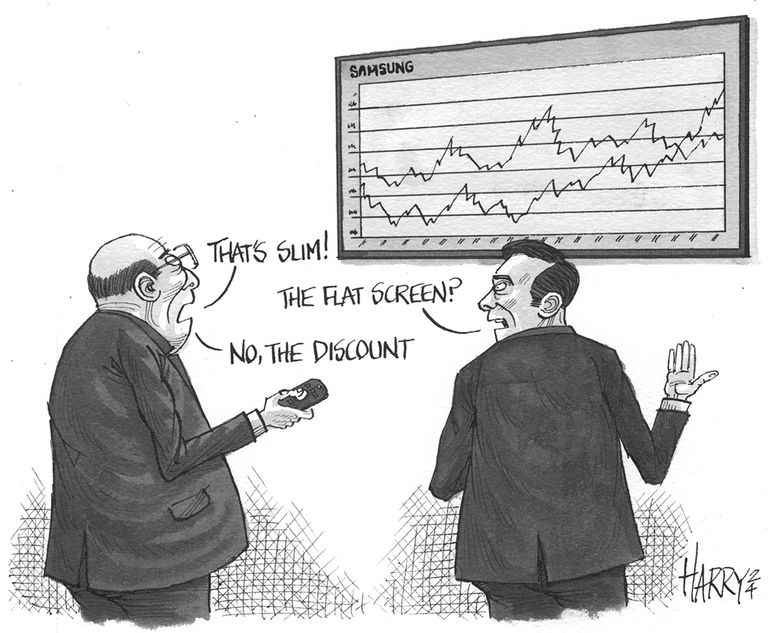

A block in Samsung Electronics comprising 29.83m shares, or 0.5% of outstanding, was launched after the market close on Wednesday and priced at W72,717, or a 1.2% discount to Wednesday's close of W73,600, to raise W2.17trn. The seller was KEB Hana Bank, acting on behalf of Hong and her daughters.

The offering was marketed at a very tight discount of 1.2%–2% to the pre-deal close because of the Samsung name, an ECM banker said. Shares in the tech giant have risen 21% in the past year.

The books were multiple times covered with around 100 lines participating, including sovereign wealth funds, long-only investors and hedge funds.

Concurrent with the Samsung Electronics block, the Lee family also raised about US$405m through the sale of shares in Samsung C&T Corp (US$110m), Samsung Life Insurance (US$108m) and Samsung SDS (US$187m) via club deals.

Citigroup, Goldman Sachs, JP Morgan and UBS were the joint bookrunners for Samsung Electronics. Citigroup and Goldman Sachs were the banks on the three club deals.

Lee Kun-hee is estimated to have bequeathed about W20trn and the Lee family, including his widow and three children, is liable for inheritance tax in six installments over five years, starting from April 2021.

The family had paid about W6trn of the tax as of last June, according to local media reports. Lee's only son, Lee Jae-yong, the current chairman of Samsung Electronics, has been paying the tax using loans and dividends.

Analysts say there is little chance of seeing further block deals in Samsung companies this year as the four deals have raised more than the required annual payment of about W2.5trn. However, concerns over further sell-downs will inevitably resurface ahead of next year's inheritance tax payment due in April 2025, Sanghyun Park, an analyst at Clepsydra Capital, said in a report published on research portal Smartkarma.

It is rare to see four blocks undergoing separate bookbuilds at the same time, a person familiar with the transactions said. "It just becomes more complicated, and the other three blocks were relatively smaller so we wanted to focus on the largest one."

The club deals attracted demand from hedge funds. The Samsung C&T deal was priced at W120,086 or a 3% discount to Wednesday's close of W123,800, while the Samsung Life Insurance trade was sold at W61,655 per share or a 5% discount to the close of W64,900. Samsung SDS's deal was cleared at W163,097 or a 4.9% discount to Wednesday's close of W171,500.

The three club deals were clean-up trades, another person familiar with the matter said.

More club deals

ECM bankers expect an increase in club deals in Korea this year as investors are more willing to accept a tighter discount on expectations of a solid aftermarket performance.

However, this is unlikely to become a long-term trend because large deals are difficult to execute with such small groups of investors, an ECM banker said.

On Tuesday, steelmaker Posco Holdings raised US$150m from the sale of shares in KB Financial Group via a club deal.

The transaction was priced at W50,566, or a 3.5% discount to Tuesday's closing price of W52,400. There were four buyers, people familiar with the matter said. The shares closed down 2.1% at W51,300 on Wednesday.

Citigroup and HSBC arranged the deal.