VinFast Auto has moved closer to launching Vietnam’s first US listing by starting investor education for a Nasdaq IPO of more than US$1bn with a target launch date in January.

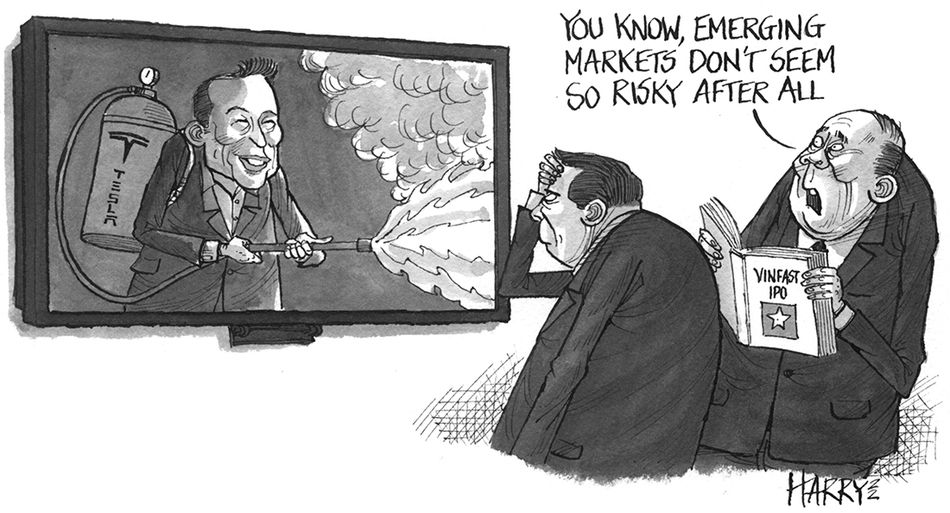

The electric vehicle manufacturer is in an industry that is popular with investors right now, but will need to win over fund managers who are reluctant to take exposure to emerging markets.

Although the deal size appears quite high at the end of a year during which the largest US IPO was that of Corebridge Financial at US$1.68bn in September, it is smaller than previous expectations of US$2bn–$3bn given the overall fall in stockmarket valuations, especially in previously hot sectors such as electric vehicles. Shares in Elon Musk’s Tesla have nearly halved in 2022.

The EV subsidiary of Vietnamese conglomerate Vingroup therefore took the market by surprise by filing a registration statement to the US Securities and Exchange Commission on Tuesday.

“Global stock valuations have not yet settled down and interest rates hikes are not out of the way. It is hard to believe that a Vietnamese company will reopen the US IPO market in the new year with a US$1bn deal,” a banker away from the transaction said.

Some analysts were also surprised that the company had chosen to pre-market the deal at the start of the holiday season in December.

“The company needs to have the support of anchor investors to get the deal to the finishing line,” another ECM banker said.

Market participants said that although electric vehicles have a bright future, the sharp correction in sector valuations and VinFast's huge early losses as it builds production capacity will keep investors cautious.

“Investors are no longer chasing future high growth, they also want to see profits within a decent period of time.” a Singapore-based analyst said.

VinFast's revenue in the nine months to September 30 was D10.5trn (US$438m), down 6.3% from D11.2trn in the same period of 2021. Its net loss rose 92% to D34.5trn from D18trn over the same period.

VinFast, which was founded in 2017, has chosen to list in the US as it sees the country as its main market in the future. It has a production facility in Vietnam, but is also building a factory in North Carolina with the capacity to produce 150,000 cars a year after it is commissioned in 2024. That earned it a US$1.2bn tax incentive package from the state, and assembling vehicles in the US is also expected to make American buyers of its EVs eligible for a US$7,500 federal tax credit.

“It will be easier to sell an IPO in the US when the business is known to the local investors,” the second ECM banker said.

However, international investors are already familiar with Vingroup, which is Vietnam’s largest conglomerate with interests in real estate, automobiles and retail. Vingroup and real estate unit Vinhomes are listed domestically.

In May and June this year, KKR, Qatar Investment Authority and a subsidiary of Singapore's Temasek Holdings subscribed to a combined US$625m of five-year exchangeable bonds from Vingroup which can be swapped for shares in VinFast, according to the IPO prospectus. Their investments were based on a company valuation of US$30bn, and if VinFast raises at least US$2bn from its IPO then the coupon on the EB will drop to 2% from 4% currently.

Citigroup, Credit Suisse, JP Morgan and Morgan Stanley are the lead bookrunning managers on the VinFast IPO. BNP Paribas, HSBC, Nomura, WR Securities and RBC Capital Markets are the bookrunning managers.

VinFast's first car shipment to the US last month comprised 999 vehicles – an auspicious number in Vietnamese culture. The shipment was the first batch of the 65,000 global orders it has received for its VF8 and VF9 sports utility vehicles. As well as individual customers, VinFast last month signed an order with Autonomy, the largest car subscription service firm in the US.

The company plans to develop its own battery design and production facilities, as well as an EV battery leasing service.