US-Europe divergence upends popular equity bets

This year’s sharp divergence in fortunes between US and European stock markets has upended some of the most popular and profitable investment strategies of recent times, forcing a drastic rethink among equity investors as they struggle to get to grips with a murkier outlook for the US economy.

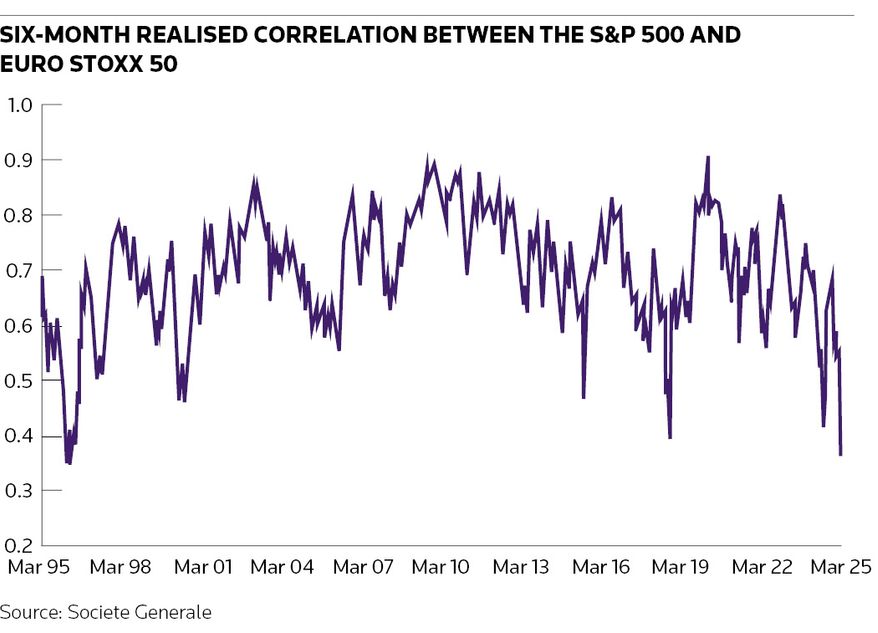

Correlation between US and European stock markets recently hit a 29-year low, according to Societe Generale, as concerns over US growth and Washington’s tariff policies have weighed on the S&P 500 this year. That contrasts with a rise in European shares on the back of growing optimism over increased fiscal spending on the continent.

Several prominent hedge funds reportedly suffered heavy losses as US markets reversed and volatility rose, while crowded bets on technology stocks have also come under pressure. Investors now face the dilemma over whether to dial back wagers on US equities that – until recently at least – have delivered hefty profits, while shifting money into European markets that have consistently underwhelmed over the past decade.

Many are turning to derivatives to hedge their bets in this uncertain environment and protect themselves from further pain, while casting around for strategies that can profit from the sea-change in global markets.

“We’ve seen a shift towards defensive strategies,” said Julien Turc, head of the quantitative investment strategies lab at BNP Paribas. “Investors are looking at ways to hedge or benefit from the market turmoil induced by US policy and the geopolitical environment. We’ve seen interest in trend-following strategies, which makes sense if you expect new macro trends to emerge.”

Tariff uncertainty

The pan-European Stoxx Europe 600 index is up about 8% so far in 2025 as investors have cheered Germany dropping its historical opposition to higher fiscal spending with the announcement of a nearly €1trn defence and infrastructure package. The S&P 500, by contrast, is down over 8% from its February highs as investors have struggled to digest the news of the Trump administration’s start-stop tariff policies and concerns have mounted over a slowing US economy.

That has threatened to reverse a long-held dynamic in global equity markets, where US shares have powered ahead over the past decade – in large part because of heady gains from technology companies like Apple, Google and Nvidia. Those erstwhile leaders have fast become laggards this year, though, as the emergence of China’s DeepSeek AI model has raised questions about the dominance of US tech companies.

Bank of America’s closely watched global fund manager survey showed the biggest drop ever in US equity allocations in March – and the highest allocation to eurozone stocks since mid-2021.

Investors who were previously happy to double down on US exceptionalism bets have turned more cautious, while appearing reluctant to dial back exposures too much given the S&P 500's consistent outperformance over the years.

“Clients are still cautious about selling the S&P,” said Michele Cancelli, global head of structuring for the multi-asset group at Citigroup.

Cancelli said clients have been increasingly using “shallow” hedging structures like so-called volatility knockouts, which provide protection against US equities falling as long as volatility stays below a certain level.

“These products are perfect for a grind lower in the market,” he said.

Trading opportunities

As well as the unravelling of the tech trade, this year’s market reversal has derailed other popular investment strategies. Bloomberg News reported earlier this month that investment giants Citadel and Millennium Management both lost money in February and early March as multi-strategy hedge funds stumbled during the market volatility.

Despite these struggles – and the considerable uncertainty that remains over tariffs and the US economy – bankers say investors have been identifying new ways to capitalise on the shifting outlook across markets.

“The sharp underperformance of the US compared to the rest of the world has created some profitable trading opportunities,” said Herve Guyon, head of flow strategy and solutions for Europe at Societe Generale.

Guyon said the “massive decorrelation” of US and European stocks has stoked investor interest in betting whether those markets will drift further apart or not. One popular trade has involved buying put options on both the Euro Stoxx 50 and the S&P 500 while selling a put option on an equal-weighted basket of shares from those two indices – a strategy that profits from the two markets heading in opposite directions.

“Hedge funds have been very active on both sides of that trade. Some people think Europe and US markets will continue to decorrelate. Others think it will mean revert massively," Guyon said. "Some clients are also looking at directional trades: buying put options on S&P or Nasdaq and selling puts on Euro Stoxx to finance it.”

Put options offer protection against stock markets falling.

The market selloff has generated "big wins" for dispersion strategies, Turc said, where investors bet on individual stocks within an index heading in different directions rather than the market moving in lockstep. There's been growing interest in European dispersion as US tariff policies have hurt autos and drink makers, while increased fiscal spending has boosted local banks and defence contractors.

"We’ve seen some upside structures on European defence baskets and some interest in European dispersion because there are going to be some winners and losers in Europe as inflows into the region persist,” said Cancelli.